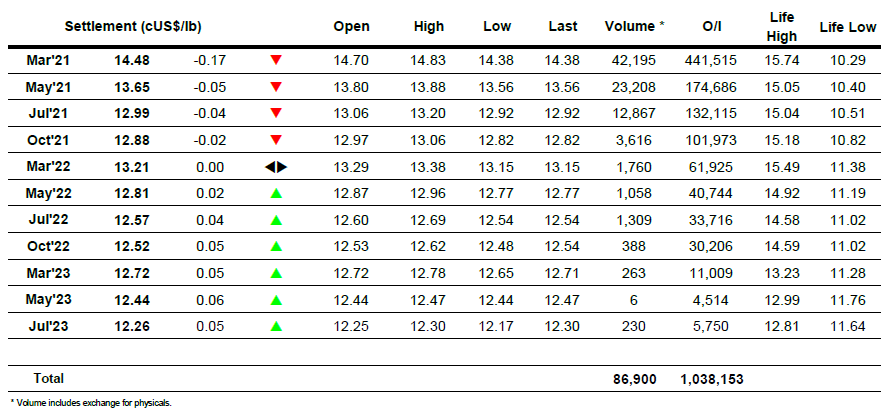

Mar 21 – Sugar No.11

After the recent volatility today saw a return to calmer and rather mundane trading. The pullback from 15c has brought in a small amount of consumer interest and initial buying helped March’21 up to 14.83 however with no follow on buying we then entered a period of slow, laborious decline which led the spot month down to 14.56 over a four hour period. Specs seemed to be absent throughout this period while the only other noteworthy activity came in the March/May’21 spread which was again weakening by a few points. Light buying sent prices back up through the range during the afternoon but stalled just shy of the morning highs, while a recovery in the BRL taking the USDBRL back to 5.55 ensured that the already quiet producer sector only retreated further. The failure to climb seemed to unnerve some of the weaker spec longs with some fresh selling emerging during the final hour, none more so that on the close when an aggressive burst of selling sent March’21 down to 14.38 and the March/May’21 to 0.82. With settlement values at the lower end of the range some fresh news may be required if we are not to see further corrective action towards 14.00.

Dec 20 – Sugar No. 5

Recent volatility seemed like a distant memory as the market today endured a slow session within a far narrower range. March’21 spent the morning holding quietly in positive ground with the only losses being seen for the Dec’20 with some steady selling pushing the Dec’20/March’21 spread down to -$3.50. This pattern continued into the afternoon with the spread losing more ground and reaching a widest discount of -$4.40 despite some very light buying bringing the outright value up a little further towards $400, and were it not for the spread volume changing hands as the rate increases ahead of the upcoming expiry there would have been very little volume changing hands. White premium values recovered some of yesterday’s lost ground, placing March/March’21 back around $74 though this had more to do with the lack of selling than any discernible buying activity. The latter part of the afternoon saw some fresh selling emerge to force values down to new session lows, widening the March/March’21 to touch $75 in the process with No.11 falling at a greater pace, and though it made little difference to a quiet day in itself the nature of ending both the nearby spreads and outrights at their lows may encourage further near term corrective action.

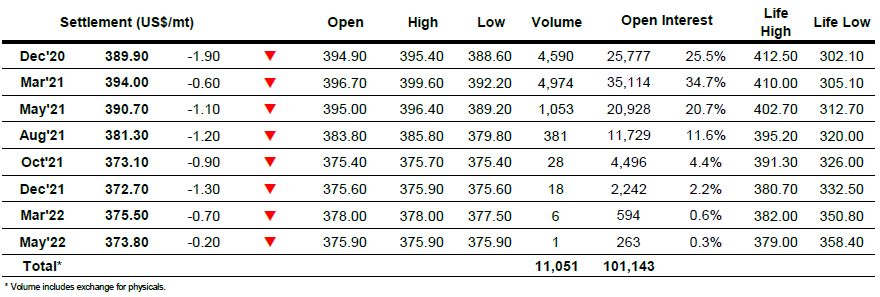

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract