Mar 21 – Sugar No.11

There was some continuation selling from the off this morning as last night’s decline brought out more long liquidation which sent March’21 down to 14.27. The rest of the morning then proved to be an incredibly mundane affair with nearby values slowly edging their way back towards last night’s closing levels but with very little volume changing hands either on an outright basis or in the spreads. The arrival of US based traders brought with it a little more buying interest and we nudged through to new highs before lighting up the board as prices accelerated sharply ahead, though this was as much to do with a lack of selling within the recent range as any sudden surge of buying. This quickly brought the 15c mark back into view for March’21 and though there was some slightly better selling ahead of this level it was not as huge as one might expect, maybe in part to the latest steady showing from the BRL with the USDBRL today reaching 5.44. Still it proved sufficient to stem the rise with specs clearly lacking the volume and/or appetite to push through, instead content to try and hold the gains on lesser volume. The surge did lead to a widening of the March’21 spreads which have been under recent pressure and March/May’21widened back to an intra-day high at 0.94 points before slipping back to an unchanged 0.83 points later in the afternoon as selling emerged despite the flat price March’21 holding most of the gains in the 14.90 area. This continued into the close to ensure that a volatile week concluded with prices back towards the upper end of the range, though whether it encourages another assault upon the highs remains to be seen. Estimates for the fund long in tonight’s COT vary between 250,000 lots and 290,000 lots, a wider than usual range given the varying views of the choppy movement over the reporting period.

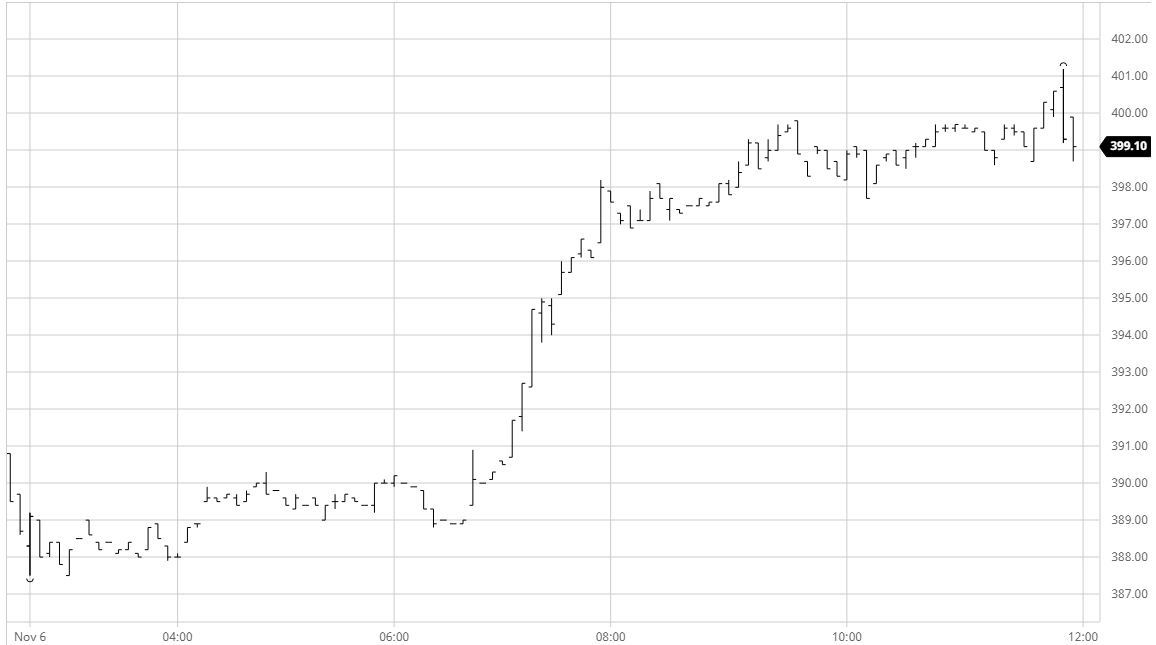

Dec 20 – Sugar No. 5

Initial losses led the way in to a very quiet morning with nearby values holding at the lower end of the day’s range in particularly low volume. It was not until the early afternoon that we broke from this tight trading band and when we did the move was more boisterous than anticipated as initial gains led in to a short and sharp spike upwards with March’21 gaining almost $10 over the course of an hour. Selling picked up a little with the market above $400 though it coincided with the buyers easing back in to consolidation mode leaving the market trading a fresh narrow band which lasted throughout the afternoon. Throughout all of this movement there was a far more stable showing from the white premiums with the rally mirroring the No.11 in contrast to recent days, while for the spreads we saw Dec’20/March’21 holding between -$4 and -$3 for the most part as the Dec’20 contract approaches its final week of trading. A mixed close ensured that March’21 settled firmly at 403.40, maintaining positivity for the weekly chart and something which will be considered a job well done by the longs.

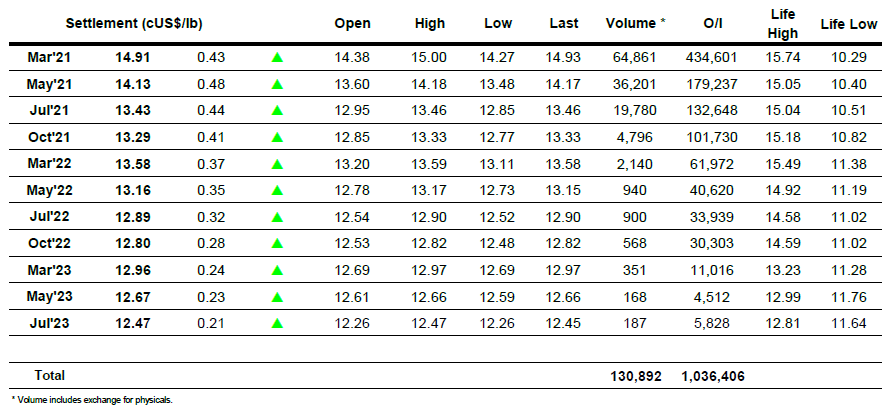

ICE Futures U.S. Sugar No.11 Contract

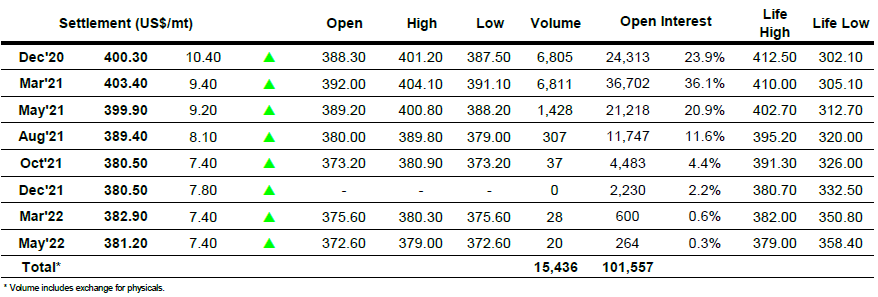

ICE Europe White Sugar Futures Contract