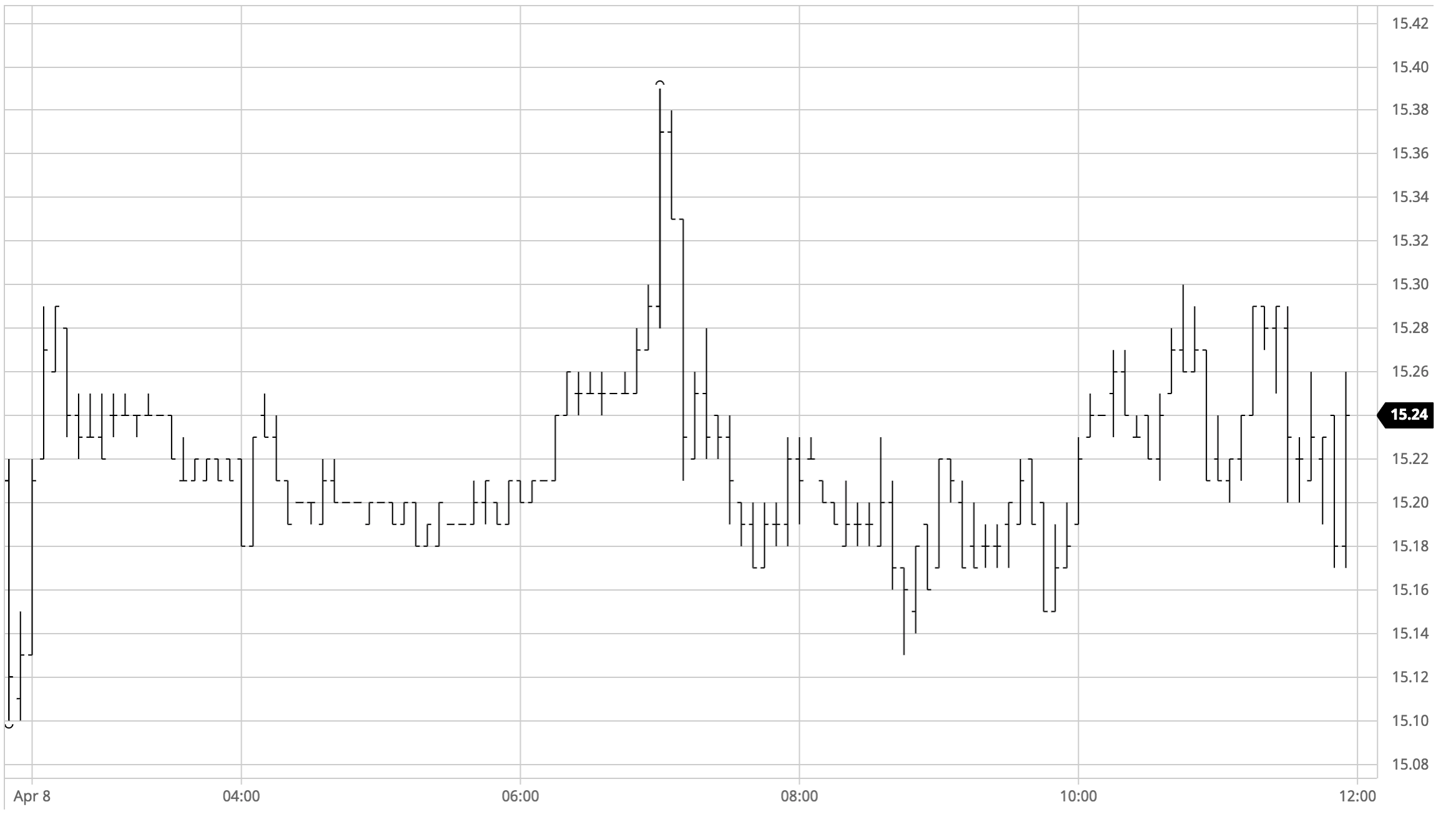

Sugar #11 May’21

A flurry of early buying which took May’21 up to 15.29 quickly petered out and the market soon settled into another morning of slow rangebound action with May’21 struggling to break far from 15.20. The start of the US morning brought with it a touch more buying interest however it was still a shock as a sudden burst of spec buying sent the price spiking to 15.39 only to be all the way back to 15.21 just 10 minutes later as selling short straight back in. Odd as this movement had been it seemed to kill off any momentum that had been being built with prices being constrained to the lower end of the range for the next three hours, touching the morning low at 15.13 but not trading below despite some heavy pressure being applied to the May/Jul’21 spread. The first day of the index-fund roll was brining the expected increased volume to this spread and though some of the larger quantities would be reserved until nearer the close we were already seeing the differential as low as 0.01 point by mid-afternoon. Outright values pulled up closer to mid-range during the final couple of hours however with the pressure from the index roll sending the spread in a touch further to parity we could not build any momentum. Closing action saw some position squaring to leave May’21 settling at 15.18 to conclude a steady but unspectacular day, while May/July’21 at flat and Jul/Oct’21 at -0.01 point leaves the front three prompts separated by just a single point.

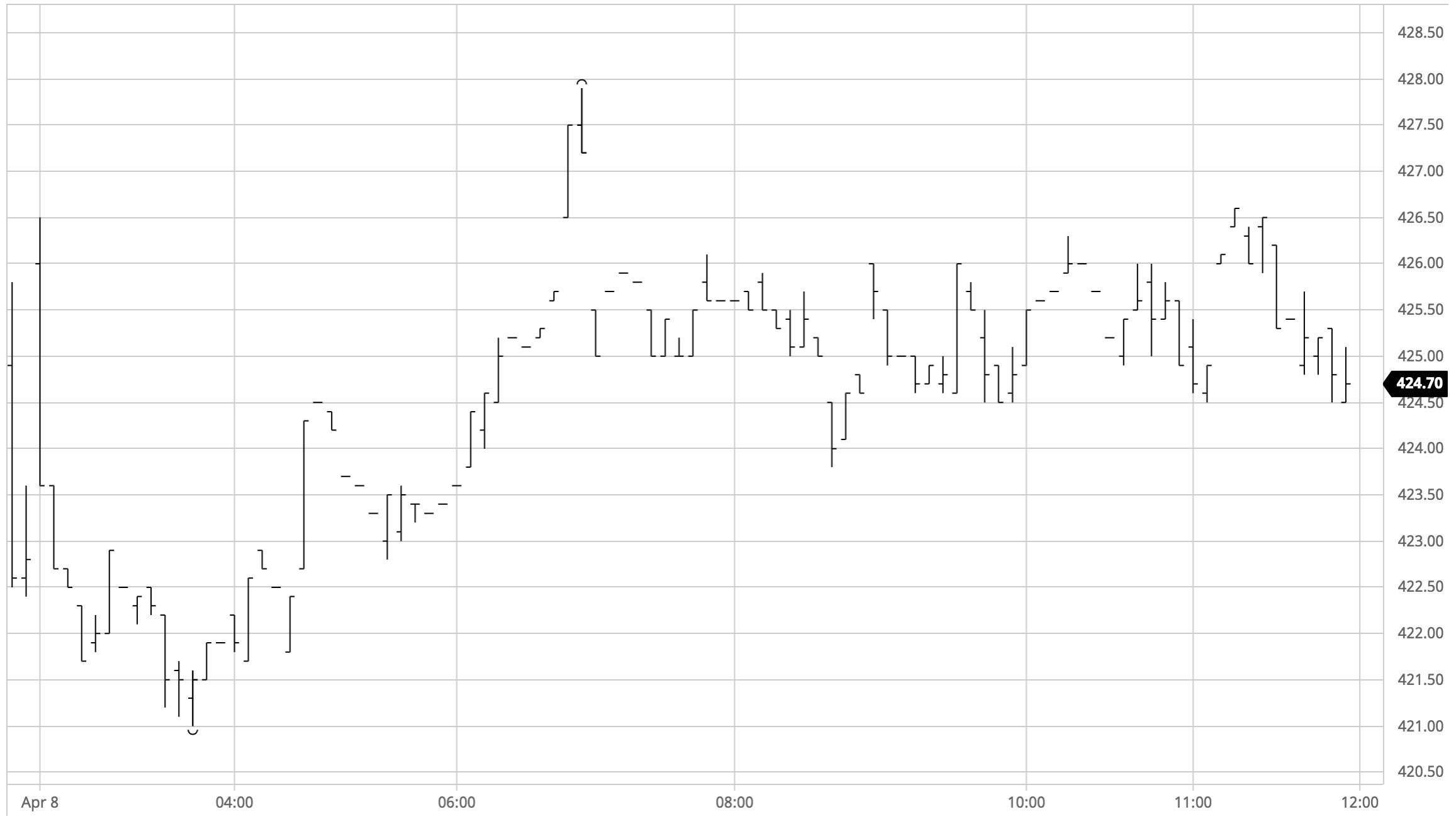

Sugar #5 May’21

A very choppy start to today’s session saw Aug’21 between $427.50 and $422.90 during the initial stages before settling into this range and enjoying a somewhat calmer morning. While the lack of progress during the morning was not unusual we were seeing a good deal of pressure continue on the whites through the May/Aug’21 spread which struggled once again with trades out to -$3 discount early on before making an attempt to halt the decline with buyers bringing the differential back to -$1. A mid-session spike to $429against No.11 activity proved to be very short-lived and the market soon returned to the range though as with recent efforts we were seeing an upward bias to the movement once more. Despite a fresh wave of spread selling that sent May/Aug’21 down to -$4.50 during the final couple of hours the Aug’21 contract showed good resilience to push ahead into fresh daily ground reaching a session high mark at $430.00. Moving into the close we continued within near proximity of the highs, ending the day positively at $428.60.

May/May’21 continued its recent struggles to trade into $86 intra-day though recovered ground late on to end at $90.00. Aug/Jul’21 meanwhile closed a touch firmer at $94.00 while Oct/Oct’21 ended the day unchanged at $89.50.

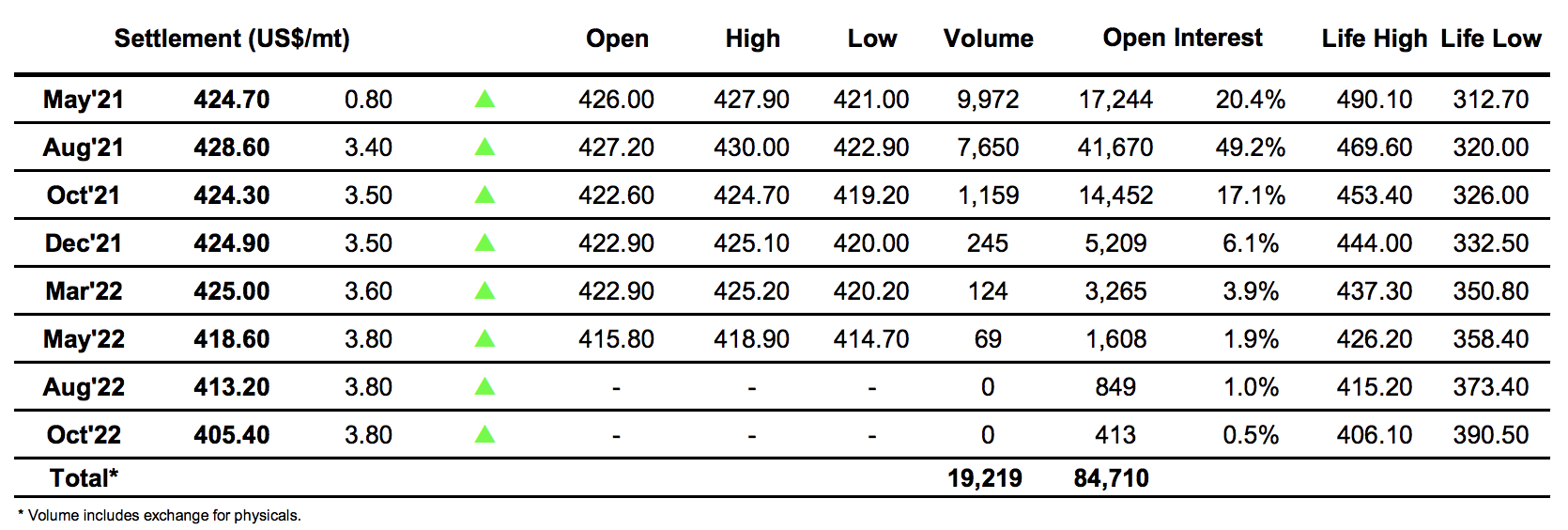

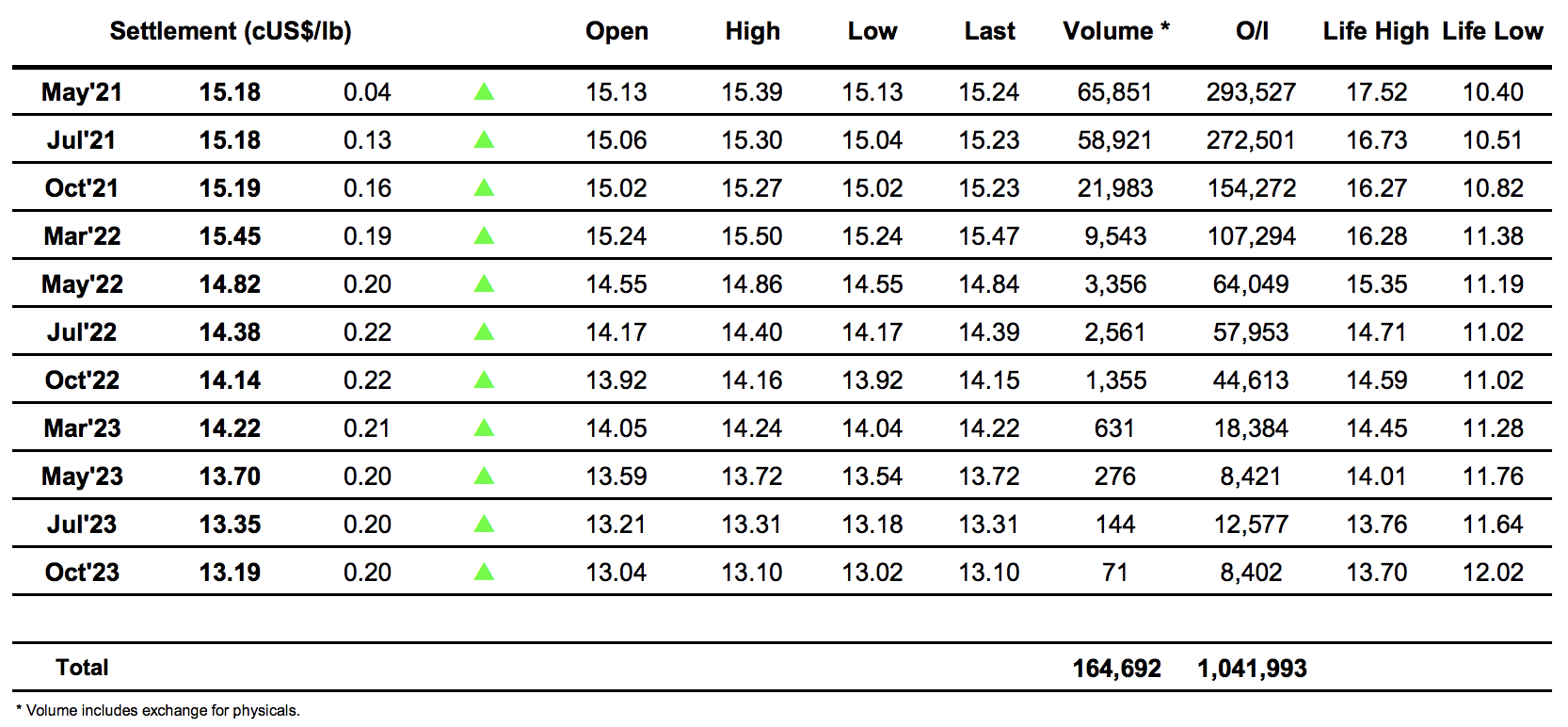

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract