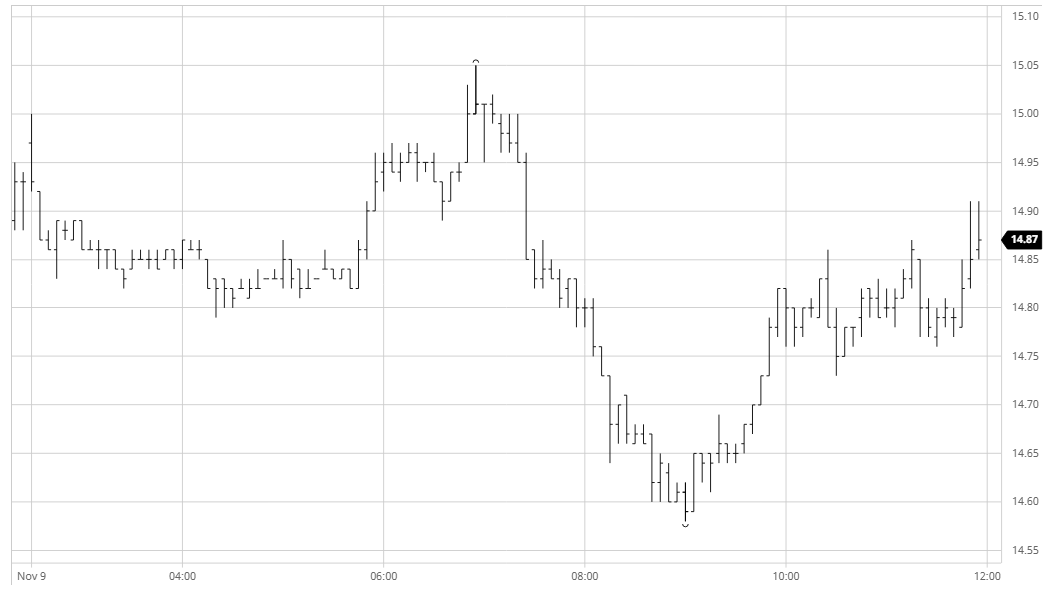

Mar 21 – Sugar No.11

The new week commenced with a burst of opening buying which took March’21 immediately to 15.00 though prices soon eased back a little as this was concluded. Friday evenings COT report showed that as at cob 3rd November the net spec long had reduced to 245,373 lots placing it at lower end of estimates, though action over the second half of last week may well have increased this position back above 250,000 lots. The general malaise of morning trading was broken by some macro generated buying upon news that Pfizer has produced a Covid-19 vaccine to prevent 90% of infections, bringing hope that a return to less restricted activities may be moving closer, however somewhat disappointingly the market only reached 15.05 before falling back as it failed to follow the wider commodity sector and instead continued recent contrarian intra-day action. Slipping back from the highs had clearly undermined confidence and having moved beneath morning lows we continued to slide steadily until finding some support around 14.60. The nearby spreads had also continued to struggle on this move and the March/May’21 gave back yet more of its recent gains to record a daily low at 0.68 points while the March/Jul’21 came back to 1.31 points. Recent sessions have shown a resilience within the market to remain firm and today proved to be no different with prices recovering from the lows to consolidate mid-range, lending a platform from which March’21 could be pushed back upwards on the close. This ensured a settlement level at 14.88, neutral in the wider scheme of things but maintaining the bulls belief that further gains can be achieved.

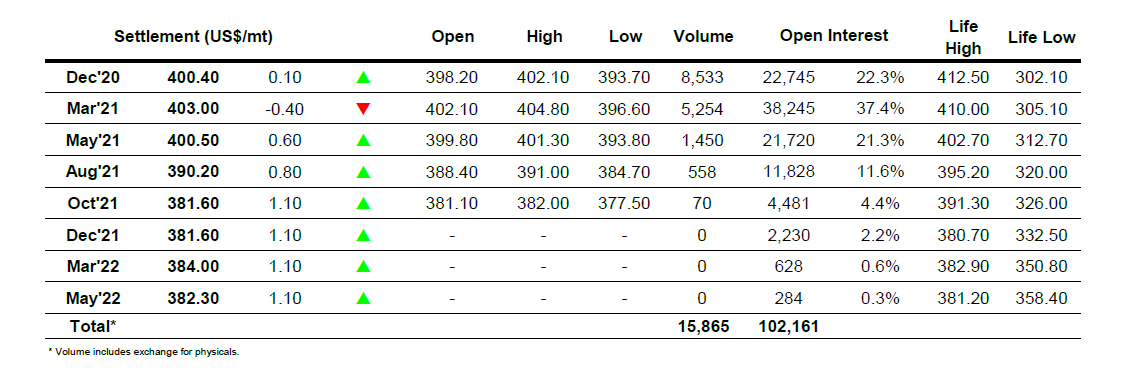

Dec 20 – Sugar No. 5

Early buying took nearby values briefly up into positive ground however it soon petered out and in very quiet volume we eased back down into the range. This Friday will see the Dec’20 contract expire and it is being keenly watched with the current open interest figure of 22,745 lots suggesting that there remains plenty of action to come. A slow morning was enlivened with a macro surge on the back of news that Pfizer has produced a Covid-19 vaccine to prevent 90% of infections, bringing hope that a return to less restricted activities may be moving closer however to the disappointment of many the pull upon sugar was limited and the market soon topped out. A sharp decline then followed as the failure to pull higher encouraged some light selling which exaggerated the price lower in the ongoing thin environment bringing the March’21 contract to the $397 area before finding some support. With so few resting orders it then proved similarly easy to pull prices back upward with nearby values soon back to mid-range and the March’21 contract above $400 once more. Throughout these moves we saw another stable showing from the Dec’20/March’21 spread between -$3 and -$2 for most of the day, while white premiums slipped a little on some mid-afternoon selling before clawing back later in the day. Defensive buying for the close ensured a choppy day concluded as neutral to positive, once again towards the upper end of the broader recent range.

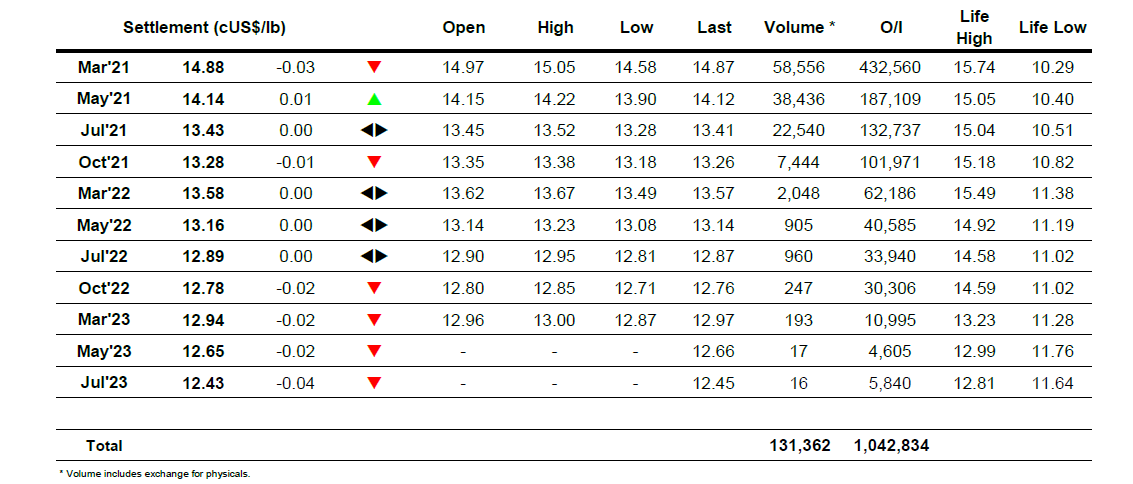

ICE Futures U.S. Sugar No.11 Contract

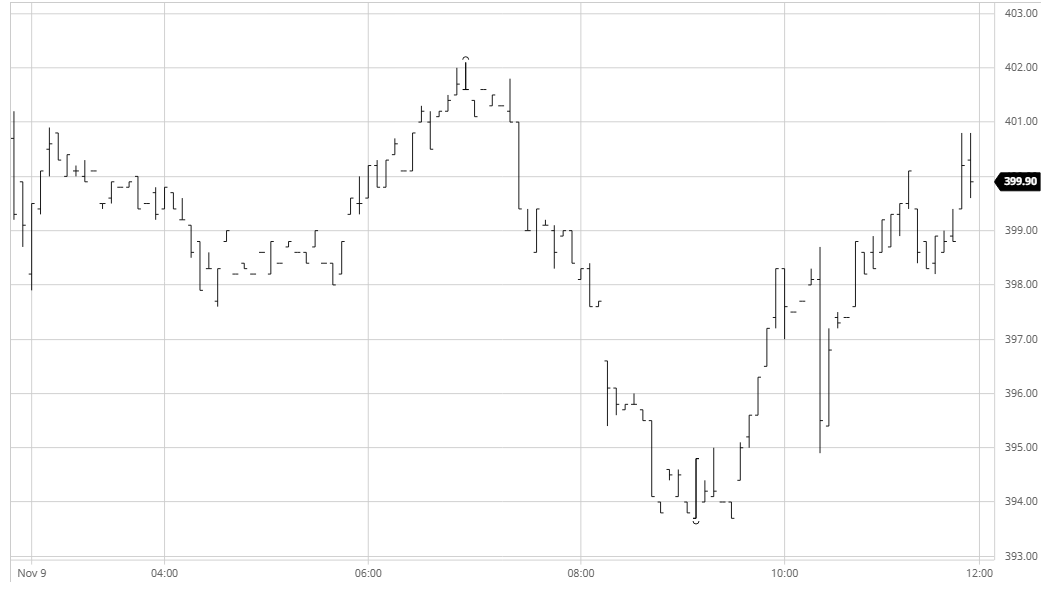

ICE Europe White Sugar Futures Contract