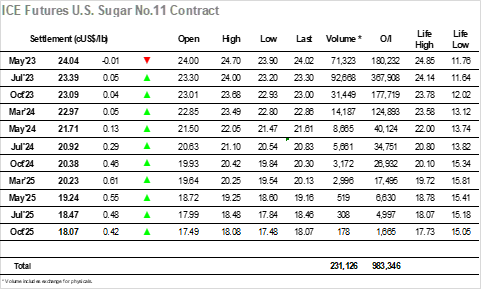

Over the last couple of weeks, the market has shown no sign of breaking the upward cycle, and despite yesterdays fall from 24.85 the market was soon back on the front foot as prices slowly edged upwards to sit in the 24.30 area. These are the highest prices seen for No.11 since 2012 and with the longs holding all the cards as they continue to squeeze the producers/trade house shorts there was no sign of them letting up in the efforts to work higher still and try to look beyond 25.00. There was a small hiccup in the rally as the US day got underway though this was soon gathered and by mid-afternoon, we had seen the price back to 24.70 to be well poised once more. Spreads were also steady with May/Jul’23 seeing a daily high at 0.73 points, though as has been the case for some time it is content to sit steadily with the flat price working much more strongly, something that is likely to continue with many of the longs now rolled into the July’23 and more following by the day. With no bearish news on the horizon all seemed set to remain firm as late afternoon consolidation pointed towards a positive inside day, however there was a final twist when some late long liquidation served to send prices tumbling back down, knocking the spread back to 0.65 points as May;23 ended the day at 24.04. The selling continued until the last with lows at 23.90 ending the prospect of a technical inside day, and while no major harm has been done to the structure it will raise questions as to whether we have seen the top for the near-term at least.

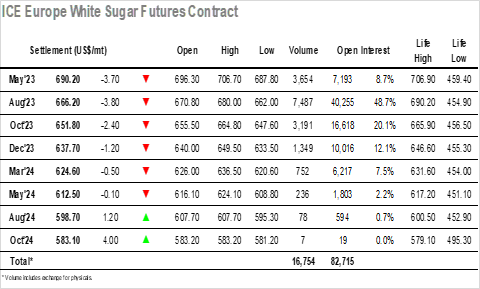

Having experienced an inside day yesterday to consolidate following the rise to $690.20 on Tuesday, the day began relatively calmly with early trading seeing the price move across the lower $670’s to maintain the same pattern. May’23 meanwhile was performing slightly better as the spread attracted a steady flow of buying, bringing May/Aug’23 through into the upper $20’s where a little more selling started to be encountered. By early afternoon, a little more buying started to emerge though this was likely in reaction to No.11 gains, though it did serve to limit the losses for the white premium as the price first rose towards $678.00 before then pushing on to $680.00. This of course was still more than $10 beneath Tuesdays high, and for the first time this month the market then started to show a modicum of fatigue by easing back into the morning range, that drive which has proved so relentless in the last couple of weeks now lacking. Until the closing stages it seemed that this would lead to another “sideways” showing, however there was a late twist when a move to new daily lows led to some modest long liquidation that against a lack of consumer interest saw the price plunge to $662.00 on the post close. Settlement was some way above at $666.20, such was the late movement, and while this represented a weak close it does not yet hinder the technical picture as presently it serves to unwind some indicators but little more. With just one day remaining until May’23 expires the open interest at 7,193 lots suggests we will see a moderate sized delivery given the tightness, though volume at more than 3,600 lots today may well see that cut. The May/Aug’23 spread remains firm and ended today at $24.00 having touched to $30.00 during the afternoon.