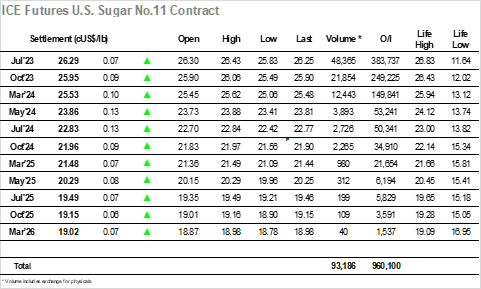

The new week starts with little change to underlying market factors, with bullishness still resonating from most traders despite the rapid upward progress having stalled recently. Friday’s COT report showed that the funds continue to participate only lightly at present, a small weekly increase of 9,414 lots bringing their holding back up to 218,290 lots long, still within the same 200/220,000 lot range that has held for several weeks. The day began with some positive movement and the early stages saw Jul’23 reach 26.43, though it was likely driven by hedge lifting with prices returning to unchanged levels once the initial cover had been taken. The remainder of the morning proved to be slow, and it was not until the early afternoon and its increased volumes that the market started to move again with moderate selling appearing to send prices down through 26c and test the size of the underlying consumer scale buying. The fall to 25.83 was rapid but once the selling eased things soon calmed down with short covering bringing the price away from the lows though the market remained in the red. With little likelihood of the fund or trade longs selling out at the present time the move showed how the downside will likely only see “dips to buy” at the current time, the lack of further selling eventually allowing prices to return to overnight levels with an hour of the session remaining. The final stages played out a small way above unchanged, and the day ended with single digit gains as Jul’23 settled at 26.29.

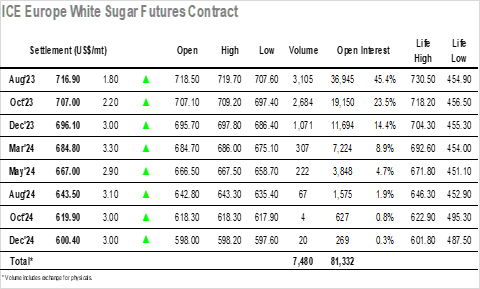

After the significant volatility seen during April, the market has now calmed somewhat with the past week seeing a tighter range establish either side of $710.00 that has allowed the technical indicators to unwind while still maintaining the positive trend. The new week got off to a positive start with light early buying immediately pushing Aug’23 to $719.70 before easing back to the mid-teens with the buying concluded. Volumes have been light over recent sessions and that remained the case today with only limited spread volumes being seen as Aug/Oct’23 sat little changed at $10.50, while the outright saw low interest while continuing to tread last weeks range. An early afternoon push down to $707.60 saw the lower end of the band also tested, but here too the move lacked substance and so amongst a wave of disinterest the losses were reduced, and the sideways trading continued. The price did push back up into positive ground later in the afternoon, remaining here to close showing moderate gains at $716.90 and bring down the curtin on a slow but ultimately steady day.