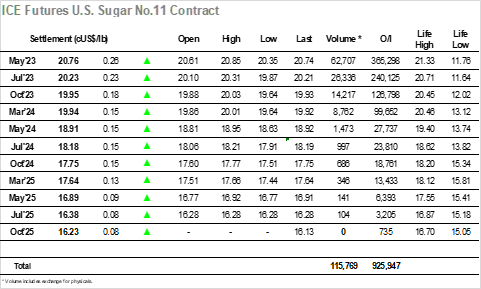

Some offtake related buying saw May’23 trade as high as 20.64 on the opening, but it was soon concluded and so the market eased back to sit right around overnight levels. With the wider macro having performed poorly in recent days as some de-risking takes place considering global banking concerns there seem few reasons to enthuse about the upside currently and so a gradual slide down to 20.35 as a little more spec long liquidation takes place was probably to be expected. More surprising was the sharp turnaround in fortunes as the US morning got into full swing with prices pushed sharply up into the 20.70’s (albeit through only very limited selling) before pulling back as the buyers attempted to lock in some profits. The see-saw action continued with an almost immediate push back upward that saw trade and spec buyers carry the market to new daily highs at 20.82, which was an impressive effort in the context of the wider macro which was by now slipping back again. With the leg work done we saw the specs go into consolidation mode through the final two hours, holding prices up within proximity of the highs to try and ensure a strong close. To this end they were successful with this platform used to push the market again ahead of the close, recording another new high at 20.85 before dropping back on position squaring as we hit the call. This left May’23 settling at 20.76, a good effort which stems the decline, though maybe just brings the market back to play a 20.50/21c range for the near term while macro concerns persist.

There was light opening buying around as some hedge lifting took place against overnight business, though once concluded the market set back to sit in the upper $570.00’s and be showing modest losses. The morning then saw calm trading maintained as prices continued along in the upper $570’s, with lows recorded at $577.10 ahead of the US day starting. The appearance of US based specs pulled prices quickly back into the green as they looked to ward off the possibility that the decline continues to grow, and though there was a drop as some long liquidation/profit taking occurred, this too was soon picked up. The rest of the session then saw the market move positively with defensive buying continuing and taking the price up to new daily highs at $586.70, albeit in quiet fashion with volume remaining moderate at best. This buying also ensured that the premiums remained firm with May/May’23 sat comfortably in the $128/$129 area, though the May/Aug’23 gave back a small amount of ground to sit at $13.50. Holding the upper end of the range there flowed one final late push by the specs which extended the days range to $589.00, though having made their effort a touch early there may be disappointment that settlement was made at $585.60 due to end of day position squaring.