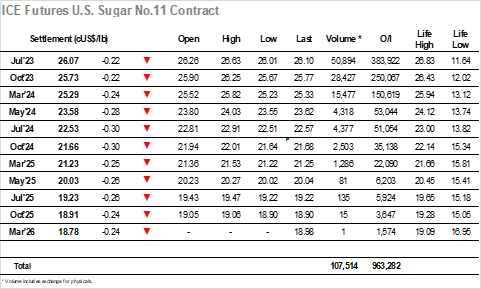

Opening lows at 26.17 were quickly forgotten as early buying helped Jul’23 to rally up to 26.42, though having come within a point of yesterdays highs the momentum waned and prices eased back int the range. The remainder of the morning proved to be quiet, and it was only the arrival of US traders that drew an increase in activity with prices pushing back up due to specs again pursuing the long side in the hope that the contract highs could be challenged. The move gathered some decent momentum, particularly above yesterdays highs in reaching 26.63, though the move faltered ahead of last week’s 26.74 mark and some rapid long liquidation soon followed. The move lower proved more dramatic than the rally with prices finding no traction until they had reached 26.10, and even then, there was more to follow with the latter stages seeing a session low recorded at 26.01. This was still well above yesterdays 25.83 low, and with settlement made at 26.07 but no sign that the trade/fund longs will liquidate it seems that a continuation of this current range is the path to follow for the near term.

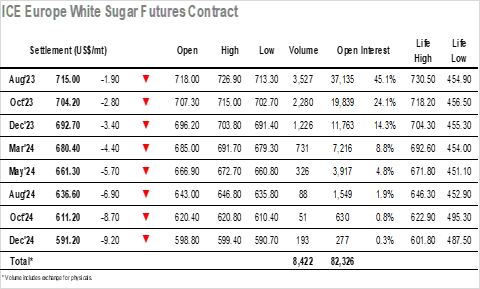

The day began in similar fashion to yesterday with early gains being erased by mid-morning, and Aug’23 slipping back to $714.80 before looking to stabilise. The one difference to yesterday was that the Aug’23 contract was finding greater support than seen for No.11, which in turn was strengthening the Aug/Jul’23 white premium towards $140.00, though volumes for both markets suggested that very little was actually changing hands. With the arrival of the afternoon things started to pick up once again, and as so often it appeared to be driven by small specs/day traders/algo’s looking to exploit the lack of selling to strengthen the technical picture. Having paused around the morning highs there was a second push that saw Aug’23 reach $726.90, the highest levels seen since contract highs were recorded on 27th April, though with consumers not chasing higher at the current time the move ended and long liquidation followed. The resultant fall saw the price slump all the way back to $715.50 before pausing, though prices remained at the lower end of the range heading into the last hour. There were more new lows seen during the final hour as Aug’23 touched $713.30, and with settlement made at $715.00 the market remains entrenched in its recent range.