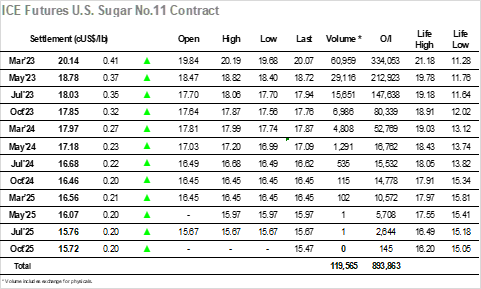

Returning from the long weekend there was a higher call being made against yesterday’s gains for London whites, and while the market failed to completely match this mark it was a positive start nonetheless with the price rising to 19.94 before pausing. Against mixed macro activity and with expectation that the higher levels may draw some increased producer activity the market fell back to 19.68 by late morning, though it was not long before buyers returned to pick the price back up and leave us at session highs as the US morning got underway. Activity remained mixed for a few more hours however with last weeks COT having shown a larger than anticipated drop in the net fund long to just below 160.000 lots there was some fund buying capacity which started to reappear. Reaching to 20.00 the market found some buy stops to spike the price to 20.17 and having maintained a 20c handle there was to be another burst on the close which further extended the range to 20.19. Settlement was recorded only just beneath this level at 20.14 to leave the market situated positively and bring the 20.50 area back into view, though with the fund/index roll now just 3 weeks away this may still prove to be a short-term move with questions as to the long-term sustainability of rallies.

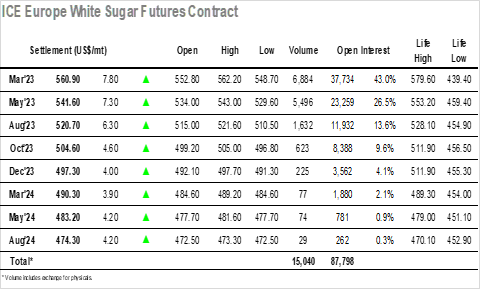

There were some moderate losses recorded through morning trading as a proportion of yesterday’s gains were given back, however the trend was generally well maintained with March’23 bottoming out in the $549.00 area and clawing back to unchanged levels by midday. This resilience, particularly given the lack of significant macro gains, was welcomed by spec longs, and following a period of stability in the lower $550’s as we moved into the afternoon a fresh wave of buying was inspired. March’23 drew the brunt of the volume with the price surging up to $560.30 in quick time, though the rest of the board kept far better pace than many recent moves, to firm up white premium values down the board. By late afternoon we were seeing March/March’23 above $117.00, May/May’23 at $127.50, Aug/Jul’23 at $123.50 and Oct/Oct’23 above $111.50, remarkable strength once more which may reinvigorate the upside. The final stages saw the gains comfortably maintained before a late spike to new highs ensured a March’23 settlement at $560.90, a positive conclusion which will renew activities between specs and producers.