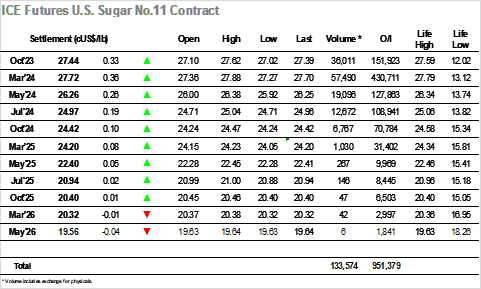

It was another slow start for the market this morning with prices initially holding near to unchanged, and despite a brief push to 27.57 a large part of the morning was spent holding onto modest gains. This did leave the picture well set for the US specs to maintain the recent strength though initially they did not show a great deal of interest with March’24 slipping back to unchanged having rejected another look above 27.50. It takes more than this to deter the wider speculative community at present though and another effort was soon mounted to press towards the highs, forcing the market up to new daily highs and drawing in some algo volume. Spreads were quiet with Oct’23/March’24 seeing a lower volume as we move nearer to expiry, the value remaining in the -0.20’s for another day on the interest that did change hands. Having positioned Marchh’24 just beneath last weeks highs there was a sharp push to a new lifetime high as we entered the final hour, reaching to 27.88 before encountering the usual profit taking. There was to be no further pushing from the specs today and the closing stages played out within the range, leaving March’24 to conclude another strong showing at 27.72.

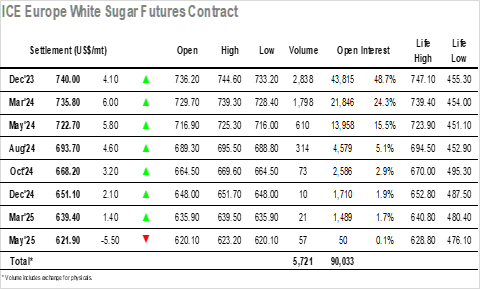

It was a lively start for the nearby positions as Dec ’23 pushed quickly up to $742.60 before making a similarly rapid retreat to $734.00 as soon as the initial buying dried up. Trading then went rather quiet for the rest of the morning, and though there remained some interest in trying to re-generate the upside momentum it was failing to attract the necessary volumes to succeed. The market only began to find some sustainable buying to bring the picture back to the positive as we moved through the afternoon, seemingly holding onto the coattails of No.11 where specs were setting the pace, and moving back to the upper $730’s. White premium values were struggling to regain momentum and March/March’24 was trading down towards $124.00, the lack of willing buyers a possible consequence of mostly UAE sugars being tendered against the Oct’23 expiry. Despite this the market did find sufficient buying to push up to an afternoon high at $744.60, just $2.50 shy of last weeks lifetime high, before falling back against long liquidation. The final hour proved calm, playing out in the range to leave Dec’23 settling at $740.00.