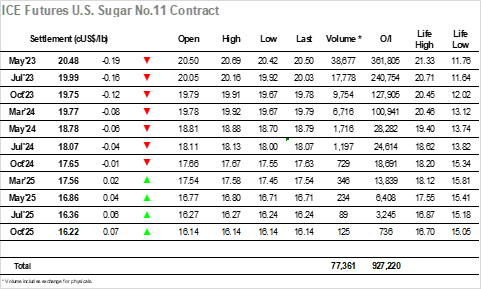

With concerns still rumbling around the banking world there was already pressure upon equities and the macro commodity picture overnight, and this held some sway over our opening with any buyers retreating and the market quickly printing down through 20.50. Some consumer interest did then emerge at these lower levels which held the price in the vicinity of 20.50 moving through the morning, though volumes were light with no sign of producer pricing and the funds still content to sit on their longs. We still do not have an up-to-date COT picture as had been expected on Friday with the CFTC delaying publication of the most recent report due to further ION issues, although hopefully these will not hinder the situation for long and we can receive a “current” view as this week progresses. Lows were seen at 20.42 ahead of the US morning, though some smaller specs then stepped in to bring the price quickly back up into the 20.60’s, filling the overnight gap from the intra-day charts in conjunction with a pick-up from equities and some loss limitation in the energy sector. The recent lack of momentum has been due to the funds standing back and that situation has not changed, and so having reached 20.69 the market proceeded to chug along within the range, sitting quietly either side of 20.60 until some day trader liquidation sent prices back towards the lows late on. This weakened the spreads with May/Jul’23 trading back to 0.49 points, and while the flat price ended lower at 20.48 this remains within last weeks parameters leaving a continuation of the range bound picture the likely way forward.

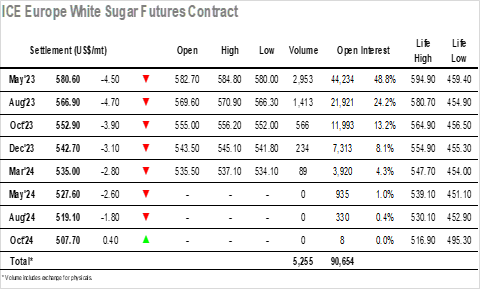

The macro environment was setting the tone as the new week got underway, leading May’23 to fall by around $4 on the opening A burst of buying for the opening on low volume as buyers stood back. The situation soon settled and for the next couple of hours there was little to report as trading became restricted to an increasingly narrow band around $581.50, only moving from it in a muted way as a small amount of selling sent the price down to $580.00 as the Americas day was getting underway. Initially this changed little however it was not too long before some buying started to emerge, its motives likely driven by the overnight gap on the intra-day chart as May’23 was driven back to $584.80 to fill said gap before pausing. With the specs/funds still not showing from the long side it is providing difficult to rebuild the upward momentum, and so a calm afternoon played out within the range. The only brief threat to breakout came during the later stages as prices were pushed back toward the lows, though the consumer buying held things sufficiently leaving the market to conclude an uneventful day lower at $580.60 but with the broad picture unchanged.