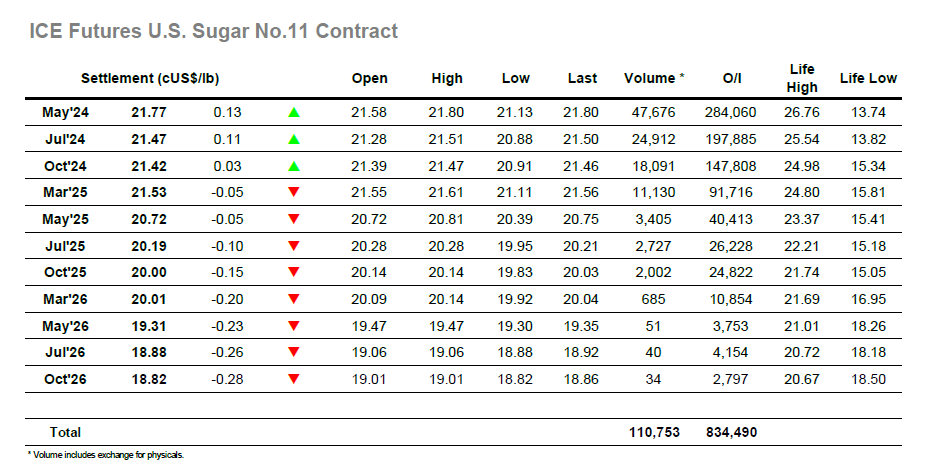

Following yesterday’s unconvincing showing the market found immediate selling which plunged the price down to 21.35 before a period of calmer trading allowed for a degree of consolidation. The trading direction of the specs has clearly changed in the last 24 hours and so as the buyers were filled on their requirements so the market continued to be pushed lower in the hope that any stops / fresh liquidation could build downward momentum. The waves of selling meant that by early afternoon May’24 had fallen to 21.13, though from this point it was all change as a sharp short covering rally brought the price quickly back upward to the 21.50 area. This likely inflicted some punishment on those who had been pushing the short side, and it was testament to the value of bullish sentiment that from this point onward the market looked to continue as if to shrug away the morning activity as an anomaly. Over the final couple of hours, the price worked back up into the 21.70’s to be showing a credit, with the gains being maintained through into the close ahead of session highs at 21.80 on the post close. This left May’24 settling positively at 21.77 with May/Jul’24 valued more firmly at 0.30 points and may be used by the specs as reason to again look beyond 22c to the upper end of the current range in the near term.

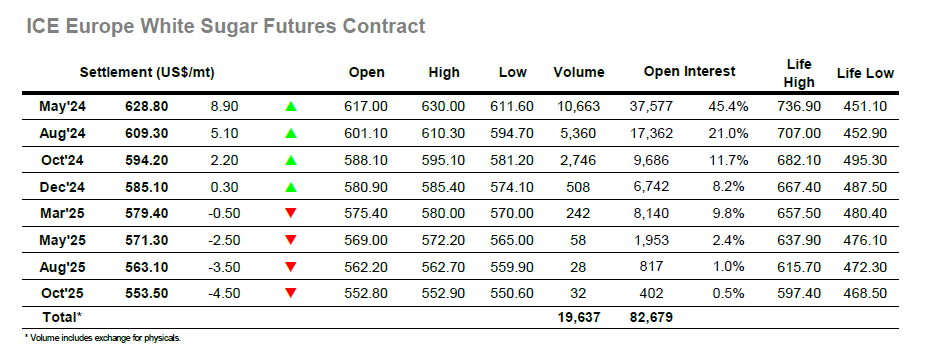

The market was a little softer as we resumed with the effects of yesterday’s pullback deterring buyers, though with values remaining near to overnight levels the relative performance compared to No.11 was good and nearby white premiums were strengthening. Despite this, the drag effect of lower No.11 vales did cause prices to slip further during the later morning before another aggressive move dragged our price down to a low at $611.60 early in the afternoon. Despite this weaker pull the May/May’24 had strengthened towards $148.00, a contradictory signal for a falling market and suggesting that a further collapse would be resisted. In fact, there was no time to even consider one as a short covering rally pulled May’24 quickly back up to overnight levels, where consolidation followed to suggest a more comfortable setting had been found. This in turn provided the basis for additional gains to be made later in the session where the price worked through to the mid’620’s before an aggressive late push arrived and set it even higher to $630.00, remarkably representing a new high for the month. Settlement was made at $628.80 with May/May’24 valued around $149.00, strong gains for both which the specs will no doubt look to maintain in the coming days.