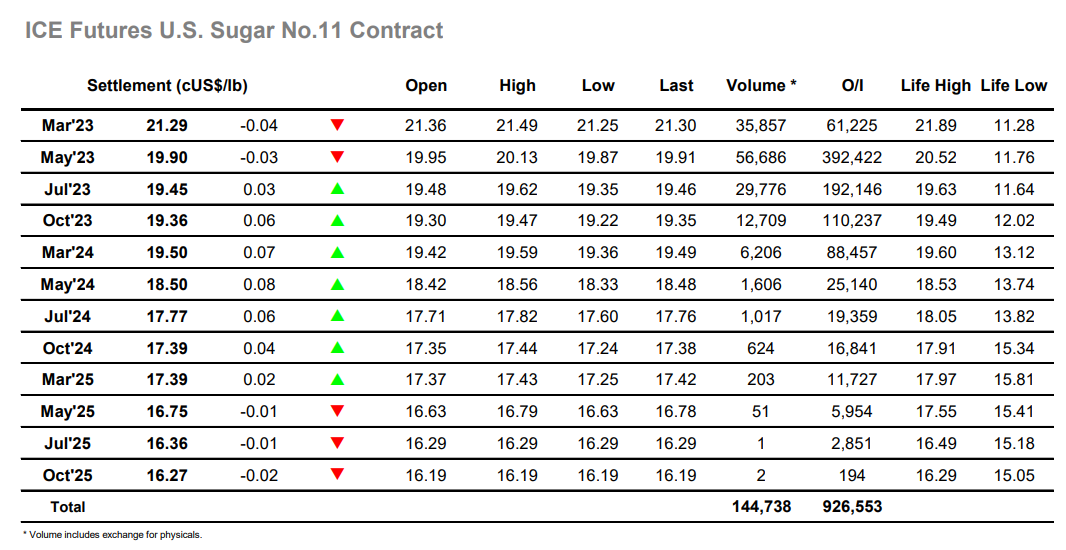

There was very little movement seen this morning as the rangebound conditions limit interest with the first couple of hours seeing May’23 confined to a 10-point range. There was almost as much movement for the spread as March/May’23 was sold down to 1.32 points before digging in, possibly some late spec rolling the cause of the recent retreat from its highs. Late morning did see a little more buying into May’23 which took the price up to 20.03, but progress remains tricky above 20.00 and seems set to continue to do so while we have no COT data to guide us by limiting the visibility as to the fund positioning. The only sector who plough ahead undeterred are the day traders as they pushed May’23 briefly to 20.13 before selling back out as the lack of follow up buying became apparent, ironically leaving the market in a worse position for their efforts as it levelled back out in the lower 19.90’s. All remained calm through the rest of the afternoon with a non-descript session concluding very marginally lower, May’23 settling at 19.90 and March/May’23 at 1.39 points.

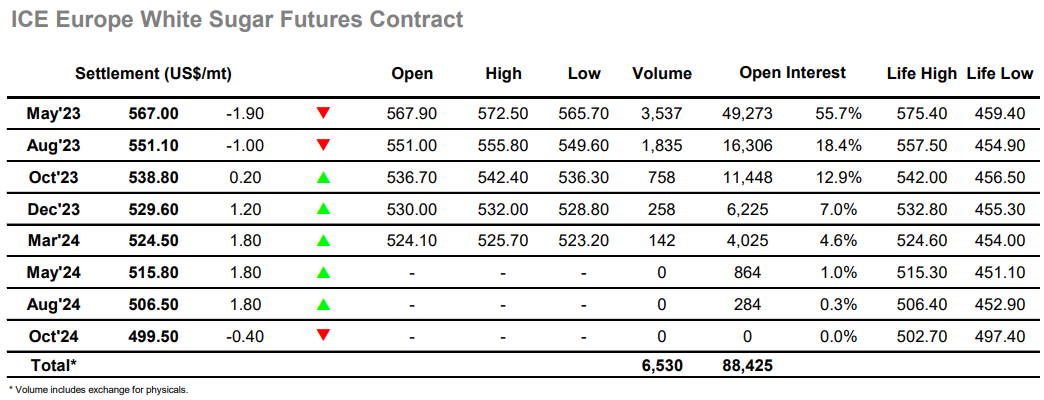

The morning was spent trading lower with May’23 printing down to $565.70 but again there was no sign that we would break from the range leading values to recover to unchanged ahead of the Americas day. Volumes were paltry even by recent standards, illustrating how the market needs an injection of fresh news to generate a break from the current stalemate if we are to see some increased activity generated. There was a mid-afternoon push to $572.50 which failed to draw additional interest and so quickly failed, and with that so ended any slim hope of a breakout today as values quickly slipped back down into the range. May/Aug’23 was trading a touch lower through the day and sat either side of $16.00 during the afternoon, while the flat price levelled out in the upper $560’s to be little changed and render the day rather irrelevant. By the close May’23 was trading back towards the lows, resulting in a settlement at $567.00 with continuing rangebound trading anticipated for the near term.