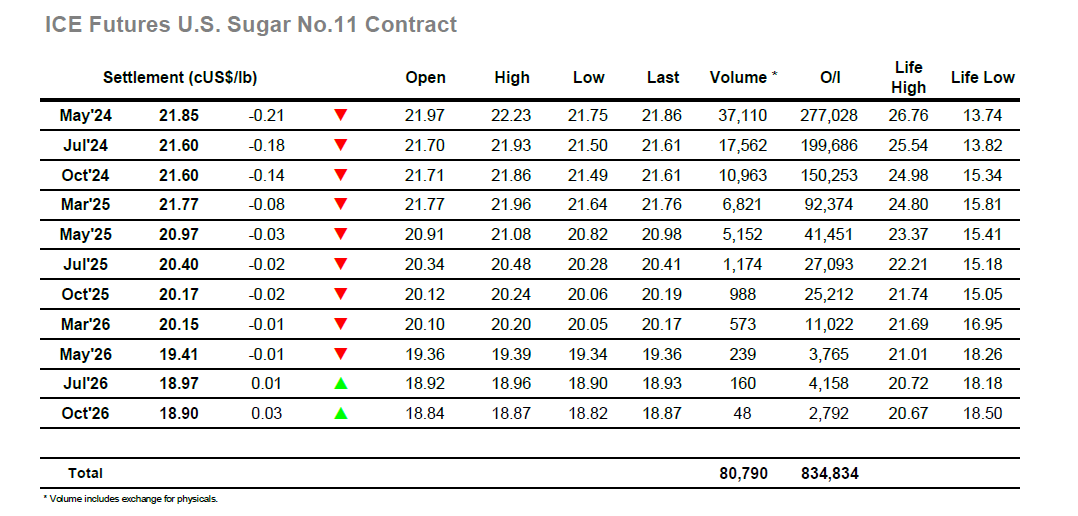

Despite settling above 22c last night there was no continuation buying to be found as we opened and instead the opening minutes saw March’24 fall backwards to a low at 21.82. Though prices then held in front of the lows there was little spec activity and so it took a while to generate any fresh momentum, though by the later morning some new buying had started to emerge and taken the market back to unchanged levels. The arrival of US based specs brought a fresh injection of buying to the market however resistance was again met above 22.20 and having reached only to 22.23 the market saw a retreat against long liquidation and returned to the range. Having seen daily highs between 22.15 and 22.35 across 7 of the past 8 sessions the market is building quiet a resistance area overhead and ahead of the weekend it seemed that the specs had lost heart with continued buying efforts failing in the same area as further selling / liquidation emerged and sent the price back to 21.75. Through the later stages the price held a narrow band ahead of the lows, finally settling at 21.85 for May’24 to send us quietly into the weekend and still no nearer to finding a way out of the current range.

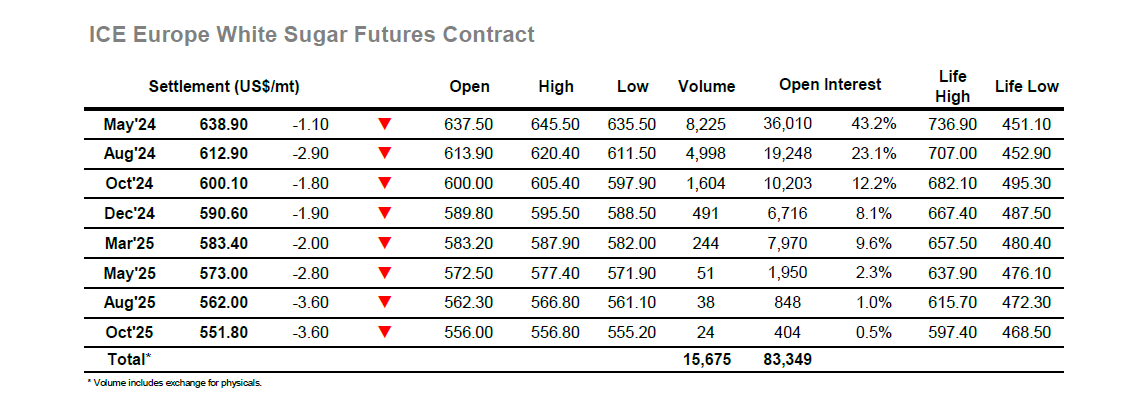

There was a gap lower for the intra-day chart as May’24 followed the weaker No.11 market and traded down to the $636.00 area on the call. For a period, the market remained near to these lows, though as the morning progressed so the price picked back upwards to be showing a small credit as noon approached. The feature of this week has been the ongoing surge in the May/May’24 white premium value and despite the market not making upward progress there was continuing strength being seen for the arb as it worked up beyond $155.00. Moving into the afternoon there was some outright buying from specs which moved the market through to another new monthly high at $645.50 before falling back into the range on long liquidation. Despite the flat price refusing to hit the earlier heights during the final few hours (and making a new low at $635.50) there was no weakening for either the spreads or premium with May/Aug’24 seeing a high at $26.90 while the May’24 premium was approaching $158 late in the afternoon. Closing trades were near to unchanged which left May’24 showing only a minor loss at $638.90, while the rest of the board headed into the weekend with slightly larger losses.