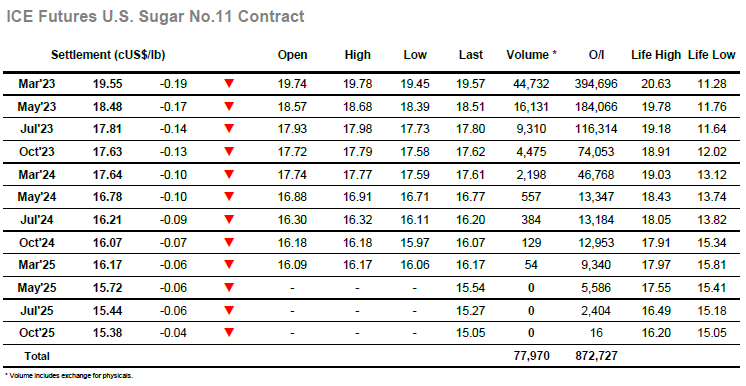

Early trading was subdued as the market edged either side of unchanged, continuing to lack direction now that the momentum from the first half of the month has been lost. It has often been said that directionless markets will tend to drift lower and so it proved over the rest of the morning with the lack of resting orders allowing some fairly ordinary selling / liquidation to send March’23 back to 19.45. The arrival of US specs drew some light defensive buying to the market which led prices back away from the lows, however it merely served as a defensive block with March’23 proceeding to drift along aimlessly for the duration of the afternoon. Though the flat price remained in debit there was little damage to the March’23 spreads which continue to perform well, March/May’23 holding at 1.08 points still during the latter stages. There was no fresh movement until the close, at which stage some light MOC selling emerged (pre-Thanksgiving position tidying) leaving the market heading into tomorrow’s holiday at 19.55 and likely to continue within the broad range for the near term.

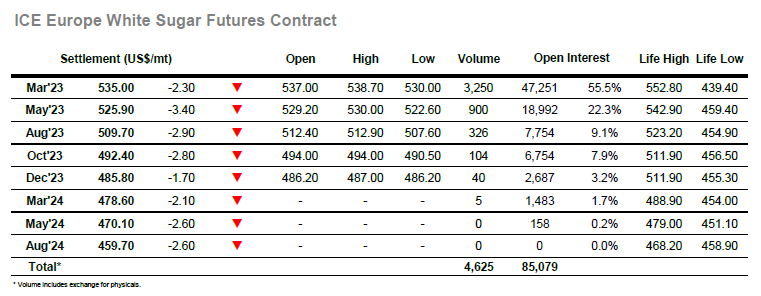

Following a couple of days in which the market has calmed, we saw very little price change during the early part of the session though as the morning wore on, so the lack of spec impetus led prices to drift downward. Though the move lower did not see any noteworthy spec liquidation (as illustrated by the low volumes), it did serve to show how vulnerable the market may be without an influx of trade support should the recent lows break down and any sizable liquidation take place. The slide extended to $530.00 to mark a new low for this week, but importantly dug in and remained above last weeks $528.50 mark. This enabled some defensive buying to emerge and pull prices back to the mid $530’s, though progress then halted once more with consolidation again the order of the day. The afternoon saw this consolidation pattern maintain for the final few hours, never quite able to pull prices back into positive ground however with the 2023 positions holding broadly a couple of dollars lower with spreads showing little change. A little MOC selling appeared to send March’23 out at $535.00 though white premium values ended positively despite the flat price loss with Marc/March’23 at $104.00.