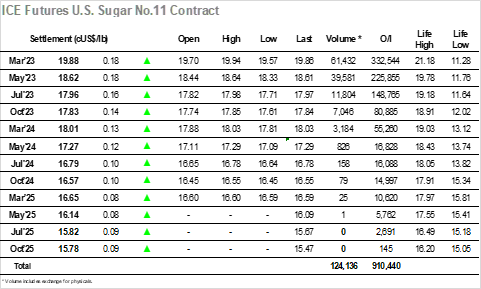

It was very much a case of as you were with morning trading seeing March’23 soften a touch to 19.57 on light volume but still showing no intent to mount a break of the current 19.50/20.00 trading band. Some light consumer interest then emerged to pull values back towards overnight levels by late morning however for most traders it was very much a watching brief with little happening to inspire them to participate. Early afternoon saw specs then make their latest effort to force the upper end of the band, easily moving through the thin conditions to the mid 18.80’s and then drawing in some slightly higher volume buying from the US as the price moved into the start of the producer scales, reaching 19.94 amid news of higher Brazilian gasoline prices. The highs were seen only briefly with prices quickly slipping back down to unchanged levels once again before digging in as the day trader interest picked from the long side again. This set the pattern for the rest of the session with several hours of slow and tedious trading as the price edged back towards the highs, eventually faltering in the low 19.90’s again with the producer selling unmoved and continuing to provide resistance. The closing stages played out just shy of the highs to leave March’23 settling at 19.88, leaving the range unchanged for yet another day.

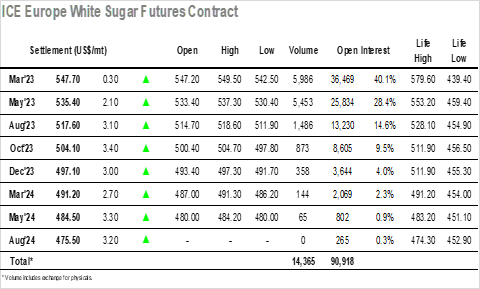

Following a slow start some selling arrived into the March’23 contract to send the price lower, initially pausing in the mid $540’s before slipping to a low at $542.50. This was still ahead of last Fridays low mark and changes nothing of the recent range, though the movement was inflicting some damage to the nearby white premiums with March/March’23 trading beneath $110.00. Spreads too were under a great deal of pressure and March/May’23 slipped back to $11.60, its lowest level since 12th December, a sign that the structure is weakening to a degree even though the flat price continues to hold the range. Of course, there has been no shortage of support for the market from the spec sector who remain keen to play / defend the long side, and again we saw some buying emerge as the Americas came online to send March’23 up to $549.50 before returning to the range at a similar pace. A quiet afternoon then played out with a gradual push back towards the earlier highs, though the flat price activity was limited as most of the traded volume centred around the March/May’23 spread. With March’23 just three weeks from expiry this spread continued at around $12, the start of some fund rolling keeping in under pressure, and with plenty more rolling to follow in the coming days this will likely confine us to recent parameters for a while yet. March’23 ended a couple of dollars shy of the highs at $547.70. concluding yet another slow day with no sign of change on the horizon.