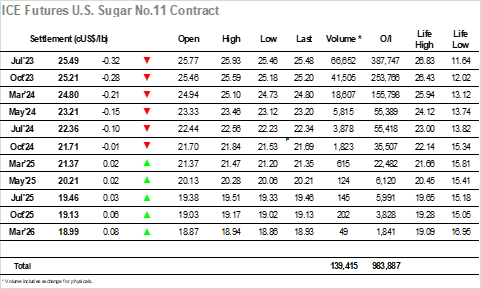

Having failed to sustain above 26c earlier this week the day started with buyers somewhat more reluctant, and this allowed for some early losses with Jul’23 falling back into the 25.50’s. The lower levels began to draw out some consumer buying interest with traders looking to lock in some buying ahead of last Thursday’s 25.46 low, and this led to an extended period sat in the 25’50’s through the rest of the morning. There was a small pick up as Americas based participants came on board, but the market remained muted until mid afternoon when from nowhere some spec buying appeared to send the price driving higher to 25.93. Clearly, they were attempting to see a 26c handle in the hope of encouraging others to chase the move, but in fact their efforts proved unsuccessful with a more rapid fall back to the 25.50’s following as they chased back out of their longs. Suggestion is that expectations of solid UNICA numbers are behind the move back to recent lows, though given this news is well anticipated it seems more likely that the action is simply a factor of the ongoing apathy until we move nearer to the Jul’23 expiry. Selling appeared for the closing stages to send the price down and match the recent 25.46 mark, and while settlement at 25.49 suggests there could be some more weakness to come, the prospect of falling beneath the early month 24.88 low mark continues to feel unlikely.

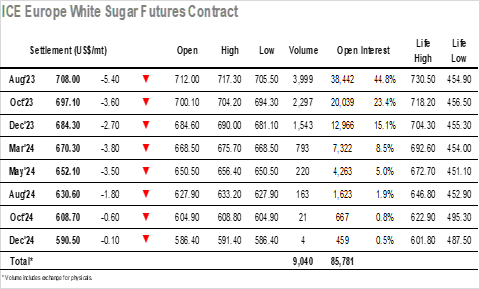

Following on from the dynamic market movements seen throughout April this month has proved to be incredibly calm with various efforts to escape the current range having failed. Yesterday provided one such example with Aug’23 unable to sustain its move above $720 and so this morning it came as no surprise to see the market immediately pushed downward to once again be looking beneath $710 and towards the underlying support. Through the rest of the morning / early afternoon there was very little happening, with the picture only changing with the arrival of some spec/day trader activity that moved the price rapidly between $705.50 and $717.30. While interesting to watch from the side lines this movement just reiterated the thin nature of the market within the range and having no challenged to either end the market proceeded to calm down again in the $710 region for the closing stages. White premiums did trade a little lower during the morning but had regained their recent strength later in the afternoon with Aug/Jul’23 valued around $146.00, the spot whites still showing resilience relative to other markets/products. Selling ahead of the close did send prices back down towards the lows and resulted in a Aug’23 settlement level at $708.00 to conclude another day of rangebound trading.