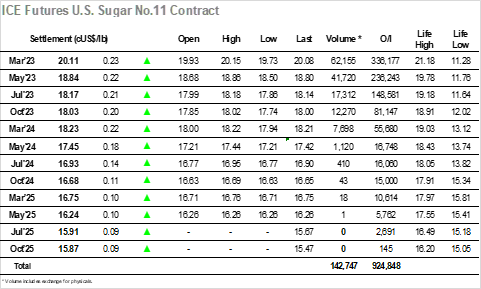

The market slipped back a little during early trading and spent another quiet morning holding in the 19.70’s to be well ahead of the lows seen in recent sessions. In keeping with the pattern of recent days the market began to pick up as the US morning got underway to push into the 19.90’s, this time reaching to 19.99 and filling in a little more of the scale selling before slipping back. Open interest for yesterday showed significant increase to suggest a rise for both spec longs and commercial shorts, and it would be likely that we see something similar tomorrow as the afternoon brought a second wave of buying which this time pierced through 20c and filled more of the producer scale selling. Progress was orderly with highs recorded at 20.15 on a couple of occasions, the buyers ensuring that prices did not fall back before the end of the day to maintain the technical positivity which they had strived hard to achieve. Settlement was made for March’23 at 20.11 in amongst some later position squaring and this will now bring last weeks highs at 20.19/20.25 into view, and area that the specs will surely look to challenge tomorrow as they try and reinvigorate the long side despite questions remaining as to the sustainability of such a move.

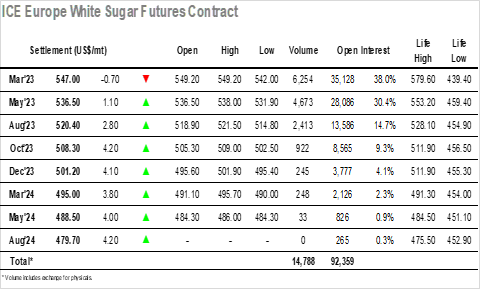

There was early selling around once more for March’23 sending the price back down to the lower $540’s during the first couple of hours as we continue to tread familiar ground. The movement was still being influenced by spread activity with the ongoing fund roll of their longs to May’23 seeing the March/May’23 differential narrow to $10 and continue to trade only just ahead of this mark. Session lows were recorded early in the afternoon at $542.00 with a rally then pulling process up by around $4, inspired by US specs pushing the No.11 market. The spot white premium was suffering throughout the day and eventually dropped to lows around $104.00 during the afternoon, the weakness both here and in the spread not abating despite the flat price being pulled back to overnight levels against the No.11 strength. Elsewhere on the board performance was much more in keeping with No.11 with steady gains by now recorded, higher refining costs and relative tightness for whites ensuring the premiums remain firm. March’23 recorded highs at $549.20 during the latter part of the day though eased back on the call to settle marginally lower at $547.00, the present parameters likely to continue for a little longer yet.