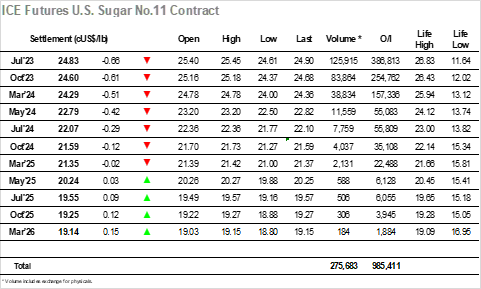

Yesterday’s fall opened the way for another look towards 25c and the market was immediately falling today in continuation of this action with the rumoured high Unica number for the first half May still driving the movement. As expected, there were specs at the forefront of the action and their efforts soon had Jul’23 trading down into the teens, where things began to level out with the consumer buying interest picking up in from of 25.00. For almost four hours the price remained confined to a tight band, and it was only with arrival of US traders that some fresh movement was generated, once again to the downside as more spec/algo selling emerged. There was a sharp push lower to 24.61 ahead of the Unica announcement, which arrived to show cane at 43.976mmt / Sugar 2.526mmt / Mix 48.40% / ATR 124.56, above even the highest estimates and significantly higher that the same period last year. Given that the expectation of this has sent the market tumbling by more than a cent there was no great reaction, and in fact price proceeded to stabilise marginally across the remainder of the session. An orderly close saw Jul’23 end at 24.83, by far the weakest showing for some time and one that may lead to further near-term technical selling from weaker longs.

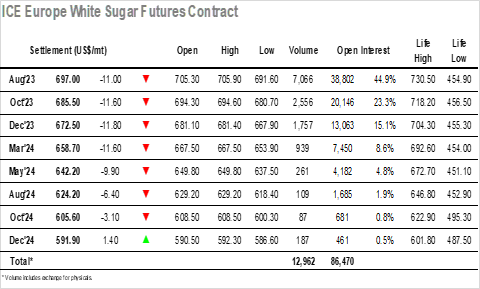

Lower No.11 values led prices to step lower on the opening, with Aug’23 dropping to 3-week lows as it looked to consolidate ahead of consumer buying in the $700 area. Volumes were light as an extended period of consolidation took place, and it was not until the early afternoon that our friends in the Americas drew some fresh interest into the market to enliven proceedings. Initially their selling simply nudged the price beneath $700, however this in turn led to some sell stops being triggered that resulted in a sharp decline to lows at $691.60. The movements came at no cost to the white premiums which were enjoying another stellar showing, Aug/Jul’23 working beyond $150 during the afternoon as No.11 values took a beasting. Though there was plenty of red on the board the market became comfortable within the lower half of the range through the rest of the afternoon, and with the early May low at $685.00 not being threatened there was no hint of any significant technical panic. The final few hours saw the market attempt to stabilise ahead of the lows and ensure that there was no further breakdown of the structure, and we ended the day with Aug’23 at $697.00, a weak showing though one which could have been considerably poorer.