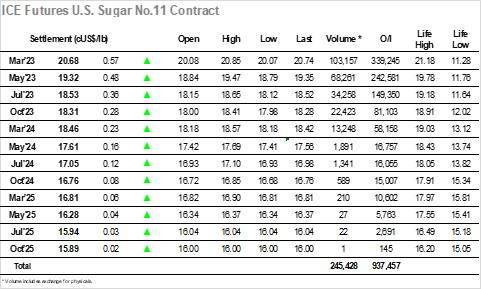

There was a continuation of yesterday’s buying from the start to ensure that the market commenced on the front foot, quickly moving to work through initial 20.19/20.25 resistance. While there were no buy stops or fireworks on this move there was clearly a desire from longs to continue pushing with the rest of the morning seeing a steady push through the scale selling which reached 20.53, placing the short term technical into a very healthy position. A brief pause in the rally was merely a prelude to a more aggressive push upward once the US specs joined the fray, the extra impetus taking Match’23 all the way to 20.78 before some inevitable ay trader profit taking kicked in. Spreads were buoyant on the move with March/May’23 reaching 1.44 points, its highest level since 11th January, even though a reasonable amount of the new buying has been directed to the May’23 to negate the need to roll in the coming weeks. This was further illustrated by the reduction in the spread to 1.38 points later in the afternoon despite the market making another move to new daily high’s, the increasing nature of the May’23 buying being borne out as March’23 attracted mostly day trader / algo noise. Topping out at 20.85 for March’23 and 19.47 for May’23 we saw some more position squaring during the closing stages, ensuring a close form March’23 at 20.68. Whether the movement is motivated by the macro strength, by pure spec opportunism or by a belief that India will cap exports leading to greater tightness this year it was certainly an impressive showing today. Overhead the December highs at 21.03 (March23) and 19.55 (May’23) are in close view as we await to see just what more the specs/funds have in reserve over the coming days.

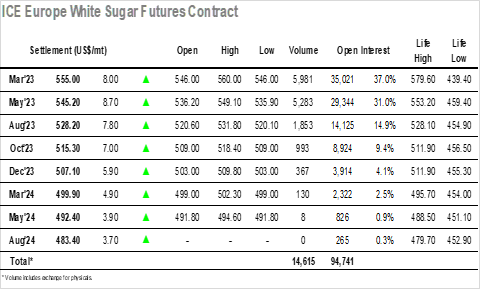

From an unchanged start the market quickly punched higher to break off some of the recent shackles, with March’23 moving up towards the mid $550’s over the first hour and in the process bringing the March/March’23 white premium value back out to $107.00. This was by no means the end of the positive movement although progress did stall having reached to $555.90, our failure to continue highs leading white premium values to narrow again as No.11 values punched ahead. There was little movement for the flat price until the afternoon when the scale of gains being made for the raws made the whites appear cheap in comparison, the March/<March’23 white premium by now having fallen to $102.00 as interest returned to send the flat price onward to $560.00. Funds were again rolling March’23 longs down the board and ensured the March/May’23 spread remained around $10, while the impact of this sent March’23 back down through a vacuum to $553.00 and placed the spot white premium beneath $100.00. The sheer strength of No.11 and a positive macro helped to pick things back up during the later afternoon, but the earlier highs were not threatened as the day petered out rather quietly. March’23 settlement was made at 555.00 with plenty of work still do if we are to break above this month’s highs at $562.20.