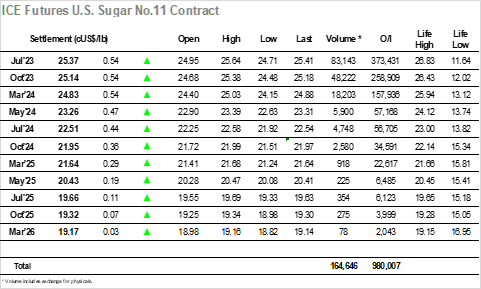

Today No.11 market opened at 24.95, 12pts above yesterday’s settlement. Bullish pressure did not last for long in the morning and until 9am, little volumes and selling pressure brought No.11 to its daily low at 24.71. At 1pm, bigger volumes rapidly pushed the market and daily high until that point was achieved at 25.05. Half an hour later, all gains were lost, and market almost touched its daily low. Buyers started to push again and around 2pm market reached 25.17 and from that time onwards, buyers strongly acted in the market and daily high registered 25.64. In the last two trading hours before settlement, sellers profiting from higher levels started pressuring the market down. Settlement was 25.37, +54pts from previous settlement (2.17% change). Volume was 83k lots. NV spread closed at 23pts premium.

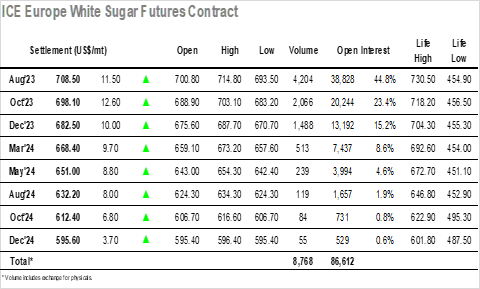

Today Whites Aug’23 opened at $700.8, almost $4/mt above yesterday’s settlement. Just after the opening, buying force was lost until 11am, when market touched the daily low at $693.50. At that time onwards, market just saw an uptrend, touching $701.5 near 1pm, $704 at 2 pm, consolidating consecutive tops. At 3pm, the biggest push was seen, and market touched its high near 16h25pm, trading at $714.8. Approaching the market closing, market lost a bit of power and settled at 708.5, +11.5 from yesterday’s settlement and a +1.65% change from the previous session. Aug’ 23 registered 4K lots of volume, and the Q23/V23 spread closed at +10.4.