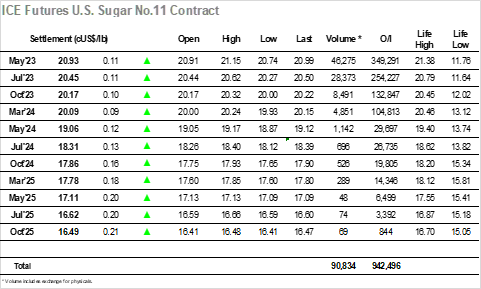

An inauspicious start to the week saw May’23 initially sitting marginally lower however it was not long before the specs reacted to the rising values for energy products and a general recovery in equities to once more play from the long side. With the COT reports having finally caught up to date, we saw on Friday that the spec/fund long stands at 174,409 lots, a small week on week reduction and as had been gradually apparent as the reports arrived somewhat lower than many had anticipated. The spec efforts saw the price hovering either side of 20.00 through the rest of the morning, though without the funds on board to add to their holding the moves continue to feel rather flimsy. There was an additional effort made to generate some interest as the US morning go underway with a spike to 21.14 however this was a brief move and with no other significant interest emerging the price returned to continue edging along wither side of 21.00. Clearly some longs remained and a late afternoon di back to 20.84 saw these cleaned out before efforts were made to return the market back upward to boost sentiment if nothing more. Prices remained beneath 21.00 through the final stages, reaching the close at 20.93 to show moderate gains though still appearing confined to the broad recent parameters.

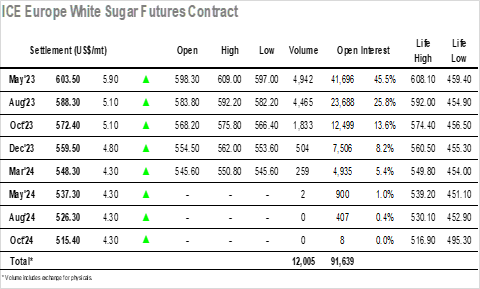

Following a slow start the white’s market soon found its footing again with a sharp push upwards on limited volume as the lack of selling interest within the recent range allows for some free movement. Moving quickly to $606.00 and pulling the rest of the board along for the ride there was another noteworthy widening of white sugar premium values that saw May/May’23 to $143.00, Aug/Jul’23 to $138.00 and Oct/Oct’23 to $128.00, marking around a week now that whites have instigated the movements. With the contract high at $608.10 now nearby progress became trickier though keen to maintain technical progress the buyers looked to hold the gains and test this area. It arrived during the early afternoon with a push to a new mark at $609.00, though there was no fanfare or follow up interest with the market soon returning to the $604/$605 area where it remained through most of the afternoon. A dip back to $602.00 was the only divergence from this sideways dirge, with the market finally closing at $603.50. Overall, the move to another contract high was positive as was the May/Aug’23 spread close at $15.20, though without the US funds and No.11 market joining the move one feels the efforts may ultimately prove fruitless.