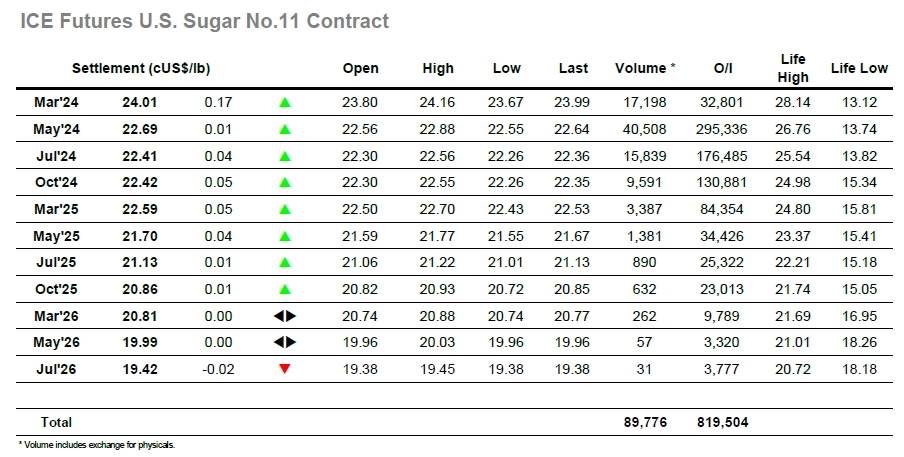

Resuming after last night’s eventful closing period there was a remarkable lack of interest in proceedings and so a quiet opening period ensued as May’24 sat calmly wither side of the 22.68 settlement value. There looked to be a mild effort to get the upside moving which fall short, but otherwise the market was calm throughout the morning and remained sideways. Any hopes that this situation may change with the arrival of the US specs were simply that, and as the range continued into the afternoon the only area of focus became March’24 ahead of tomorrow evening’s expiry. Here the March/May’24 spread was once again proving stronger with a recovery from prints at 1.04 points this morning to be trading into the 1.20’s, showing no sign of reversing the trend over the last couple of weeks. March’24 open interest meanwhile fell by more that 14.000 lots to stand at 32,801 lots and suggests we should see an orderly (if firm) expiry. The prevailing range was only extended during the second part of the afternoon with a push up to 22.84, and once again it seemed that the specs were trying to force gains / strength without using too much volume by holding back their resources as much as possible. A corrective dip was brief and moving into the final hour the market was well poised in the low 22.80’s however this move too was destined to fail and from a high at 22.88 there was a late retreat to settle a mere point higher at 22.69. March/May’24 meanwhile showed no sign of weakening as the final day of trading loom sand end the day at 1.32 points.

It was a calm start to the day with May’24 initially edging along sideways, but while there was low volume and limited appetite to push some spec interest did emerge during the morning to take May’24 up through yesterday’s high and reach $637.10. In contrast to yesterday’s afternoon when No.11 was diving the movements there was no such momentum to be found today, and so progress stalled with the May’24 white premium value having widened out to $135.00 but without the sustained buying that would have been necessary to continue. The situation developed into several hours of tedium with prices slowly creeping back down the range to unchanged levels on apathy, and even when some buying did reappear during the afternoon it simply served to ensure an intra-day double top with the buying ending abruptly when the morning high held firm. There was some additional buying appearing during late afternoon which extended the range a small way further to $637.80 however in keeping with the day there was position squaring to follow which set us back into the range ahead of the close. May’24 settlement was reached at $635.00 and March/May’24 ended at $14.60, bringing a neutral day to a welcome conclusion.