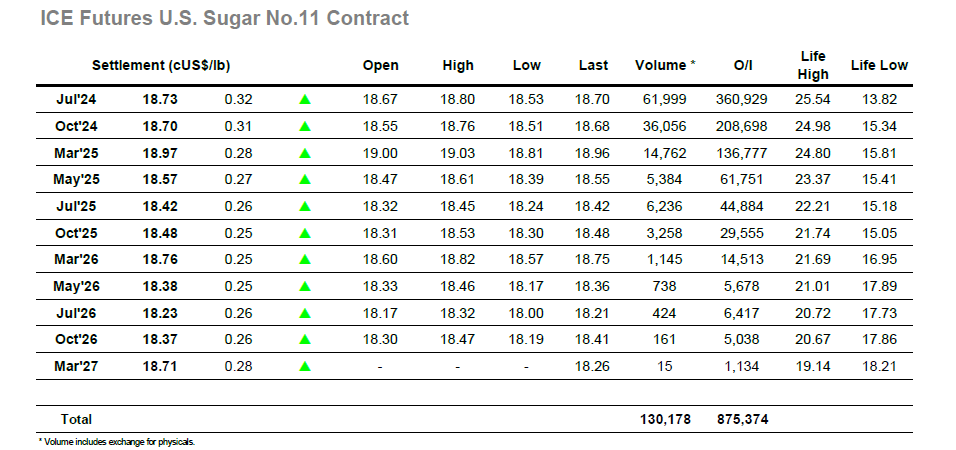

Following the 3-day break from Memorial Day weekend, the market opened around 20 points higher than last week’s close at 18.67, slightly building on this for around the next hour or so, before falling back toward 18.60 shortly after. Jul’24 futures prices then proceeded to broadly trade in a 5-point range either side of this for the majority of the day, short of a brief attempt and failure to break back to 18.70 halfway through the session. The final few hours of trading were characterised by an orderly rally as high as 18.80 before running out of steam, closing the day for 18.70, further cementing the market within the current 18-19c trading range that still shows little sign of breaking.

Following the long weekend, Aug’24 white sugar futures picked up where they left off on Friday, opening 3USD higher and stretching a further 3USD to 553USD/tonne within the first hour’s trading. Though these gains were quickly returned and more, falling back below the open to 547.3USD/tonne in the second hour. Throughout the rest of session, the market gradually tracked upwards, largely on thin volume, breaking through 554USD/tonne in the final few hours of the session before handing back a little to close the day at 553.8USD/tonne. This moves the market more firmly back toward the top of the recent range seen since the middle of May, and with a less inspiring day over on the No.11 the Aug/Jul’24 white premium has strengthened back above 141USD/tonne.