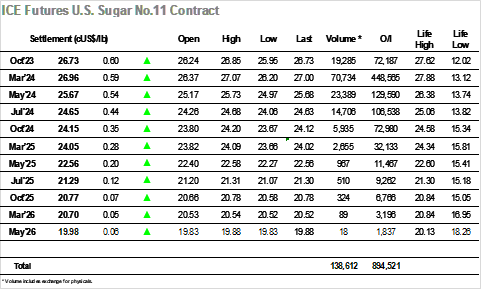

March’24 quickly slipped back again this morning to sit in the lower 26.20’s the recent apathy from the specs continuing to dictate the market direction (or lack thereof) as we drifted along sideways ahead of the lows through the morning. Unlike recent days the arrival of US based traders did not lead to selling, instead allowing the market to pull back up a little and trade back into credit, not overly significant but providing a hint that we may have ended the correction. Meanwhile a good deal of interest was being made for the Oct’23 position with spread movement being seen from both sides, as the Oct’23/March’24 ranged between -0.24 point and -0.31 points. By mid-afternoon, a little more support was being seen from specs to bring the price back above 26.50, and unlike yesterday there was no immediate panic to liquidate longs allowing the price to hold the upper end of what was still a narrow trading band. What then followed was still unexpected though as another spec push triggered both algo interest and buy stops which sent the market soaring, with March’24 reaching a high at 27.07 before encountering some profit taking. Still the market proved resilient with the final stages played out just beneath 27.00, leading to a March’24 settlement at 26.96 that the specs will likely look to build upon tomorrow. Oct’23 open interest remains huge at 72,187 lots as we head towards tomorrows expiry. Today’s volume was 18,695 lots which will reduce that figure, but a large delivery appears inevitable.

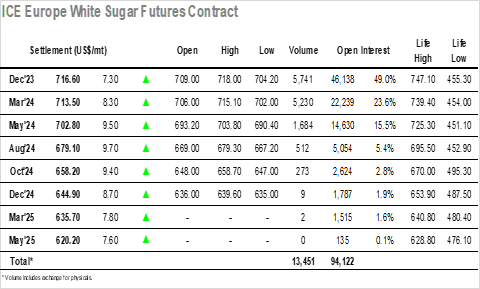

The softer trend was maintained as we got underway this morning with Dec’23 dipping to quietly drift along just ahead of $706.00 for the duration of the morning. It was only as we moved past noon that the price showed any sign of working away from the lows however having nudged above $710 the progress stalled and it was not too long before we were again looking back to the morning lows. Trading became a little choppier as the afternoon progressed, but despite some efforts to stabilise for the No.11 there was no sign that the whites wanted to follow, eventually falling to lows at $704.20 while the March/March’24 white premium value slumped below $120.00. From this low there was a remarkable turnaround as a breakout in No.11 forced the whites to follow, rallying at a rapid pace into the teens for Dec’23 and March’24, despite the premium further slipping to $119.00. The gains seemed to reinvigorate the specs with the market continuing to the top of the range through the final hour and providing the first positive close in a week with Dec’23 settling at $716.60. This should provide a platform for the flat price to climb further back through the range, however with the white premiums struggling a move back towards contract highs feels unlikely.