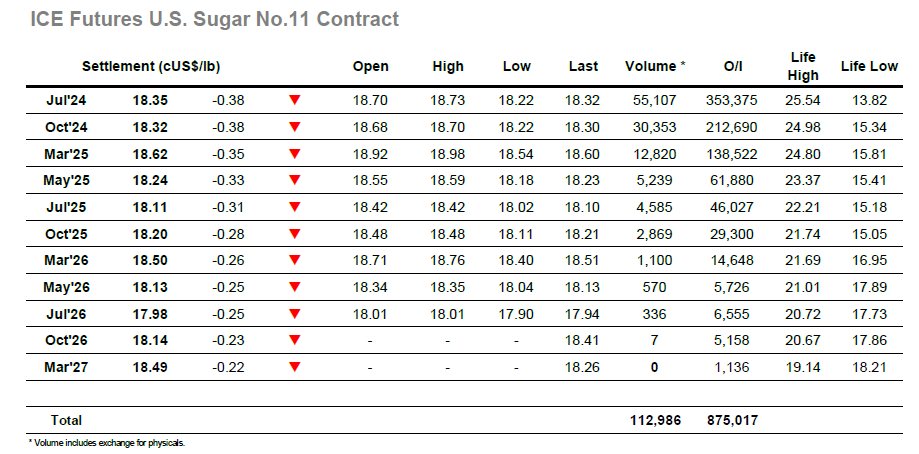

Today’s session initially picked up where yesterday’s left off, with the Jul’24 raw sugar contract trading just beneath 18.70c/lb for the first hour after open. However, this was to be short lived as selling on very thin volumes quickly moved prices down 20 points, finding temporary support at 18.50c/lb. After a quick breather here prices continued down as far as a further 30 points before stabilising around 18.3c/lb on slightly healthier volumes. The remainder of the session saw broadly rangebound trading between 18.3-18.4c/lb, closing the day at 18.32c/lb.

Similarly to the raws market, the Aug’24 white sugar futures opened positively, retesting yesterday’s high in the early stages, though this positivity turned out to be short lived. Over the next 4 hours the market lost almost 10USD before finally finding some support around 545USD/tonne, trading sideways into the second half of the session. Going into the final hours, with prices beginning to slip again, a few bursts of larger volume buying was able to maintain support around 543USD/tonne until close. Despite finishing lower, Aug’24 still appears to be moving cautiously higher, now 15USD higher than the month-low despite the Aug/Jul’24 white premium contracting slightly back below 140USD/tonne.