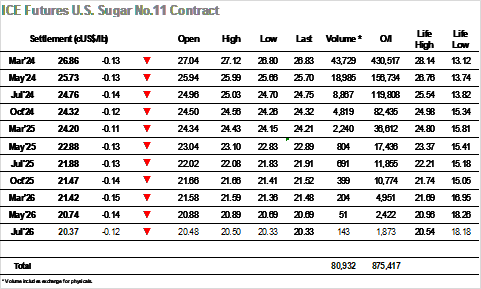

There was very little to get interested about this morning as a low volume environment saw March’24 continue to track the recent range with some light movement either side of 27.00. Hopes still rest upon the US specs to generate movement but there was no sign of any significant interest here as the market continued sideways during the early afternoon, the current picture seeming to cause more and more traders to distance themselves from the environment. It was only during the final three hours that any interest was generated, and in keeping with the week it was the lower end that was being tested again by specs as the look to try and break below 26.80 in hope that a break could draw additional selling. Lows were initially recorded at 26.82, and though the final stages saw 26.80 print, it was the third successive day that this level has provided the low (with last Friday having been at 26.81). Settlement was made just above this level at 26.86, with more of the same likely tomorrow.

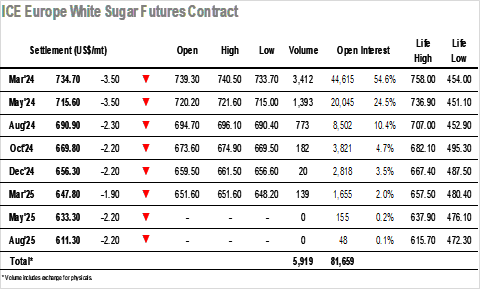

The day began with March’24 slipping back to the mid $730’s where values remained for a short period before being supported back up to $740.00. With the activity taking place within recent parameters there was no substance to any of the movements, low volume continuing to be a factor and going some way to explaining the difficultly the market is having in escaping the current malaise. Moving into the afternoon the price began to slip lower, initially slowly but accelerating down towards yesterdays weakest levels as March’24 traded to $733.70. This fall saw the March/May’24 spread trading down to $17.70, though with some larger sized buy orders starting to be seen there was a short covering rally to boost the outright and spread values. The final hours saw prices calmly return to the lower end of the range and there remains an element of near-term vulnerability, though with today representing a low volume inside day which ended at $734.70 the signs point to a continuation of the broadly sideways pattern.