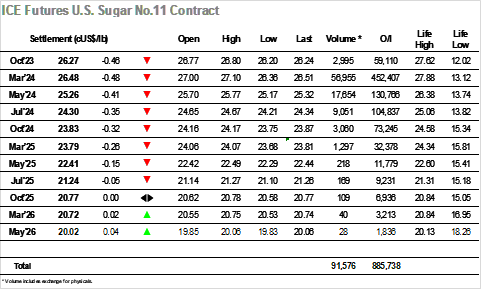

The day began positively with early buying taking March’24 up to 27.10 as traders looked to build upon yesterdays recovery, however the efforts soon receded with the market pulling back to sit in the 26.80’s for most of the morning. This consolidation still appeared to have potential given that today represented the end of the week, month, and quarter, however there was no significant interest arising from the US and so despite movements which saw the price kick back up to 26.96 the market did not convince of any sustained upward potential. By mid afternoon March’24 was trading down to new daily lows as some specs cleared down positions obtained in the past 24 hours, while focus increasingly turned to the Oct’23 expiry. Here we started the day with a still huge open interest of 59,110 lots, and though the Oct’23/March’24 spread swung between -0.30 points and -0.10 points the volumes were small meaning that most of that position was heading to tender. The market made efforts to minimise the losses but by the final hour the scale of pre-weekend position squaring saw March’24 slump to 26.36. Some closing buying ensured a settlement away from this mark at 26.48 though it remained a disheartening close for the specs. Oct’23 expired at 26.27 with the Oct’23/March’24 spread valued at -0.21 points discount. Talk is that 56,470 lots (2,868,818t) will be tendered, with full details to be published by the exchange on Monday.

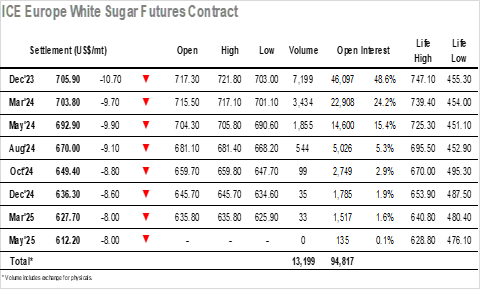

A higher opening was quickly extinguished with selling coming into the market to erase some of yesterday’s gains and leave Dec’23 drifting along near to $710.00. There was little volume coming to the market from either side as the market held sideways into the early afternoon, at which point the upside started to receive fresh impetus from another wave of spec support. Their efforts went some way to redressing weakness in the white premium with the market soaring to $721.80, a far more rapid rally than that seen for No.11 that took March/March’24 back towards $122.00 having earlier been trading down around $116.00. Unfortunately for the specs there was no continuation interest and so prices fell back soon afterwards, erasing gains and leaving us back where we started by mid-afternoon. This created a new problem for the market with day trader interest now turning to the lower end following such a conclusive failure, and so the final period was sent exploring downward. There were no such wild moves as seen earlier, however the pressure at the front of the board did send Dec’23/March’24 to a $1.30 low while March/May’24 slipped to $9.60. Having dipped to $%703.00 late in the afternoon there was a late flat price bounce to settle at $705.90 on short covering, though overall it was a disappointing end to the week.