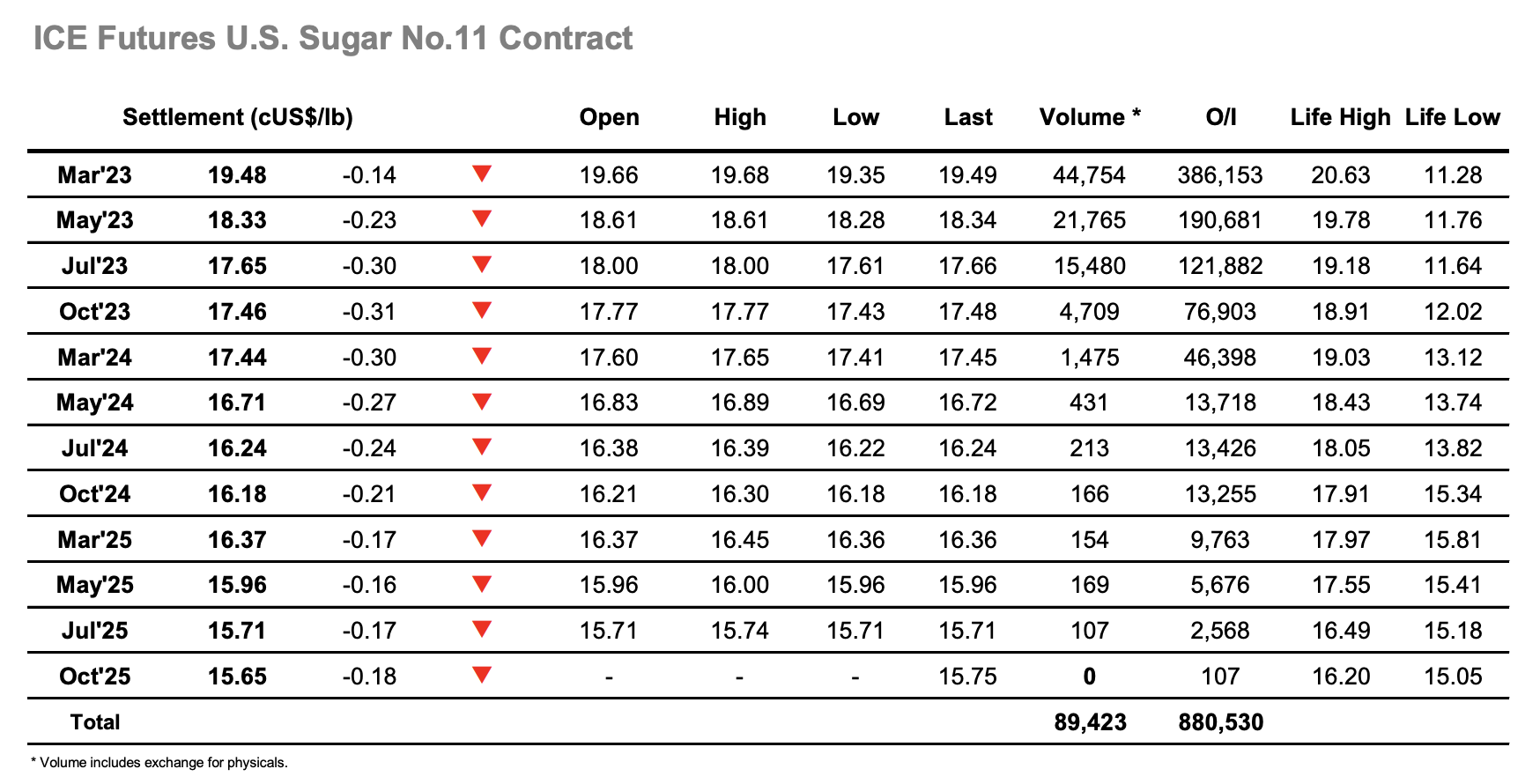

There was familiarity about the early activity as again we saw initial higher prints quickly erode and the market slip back to 19.41 before finding a degree of support. On low volume the market then proceeded to drift along within the confines of this week’s range, a couple of dips down to 19.35 providing the only flash of interest in an otherwise dull environment. If the morning activity had had an element of familiarity about it then so did the afternoon as light but persistent spec buying re-appeared to pull prices away from the lows and eventually bring March’23 back into a small credit. Though the rally stalled March’23 remained near to unchanged well into the final hour, only starting to slip as some pre-weekend selling/position squaring emerged ahead of the call. The call itself proved to be far more dramatic though with far more aggressive liquidation sending the price all the way back to 19.44 and resulting in a lower settlement value at 19.48. In contrast to the flat price liquidation the March’23 spreads remained buoyant with March/May’23 going out at 1.15 points and March/Jul’23 at 1.83 points, a positive showing which will continue to provide encouragement to longs. Attention now turns to the COT report which based on market movement over the period would be expected to show a modest reduction in the net long, though after last weeks unexpected increase nothing can be assumed.

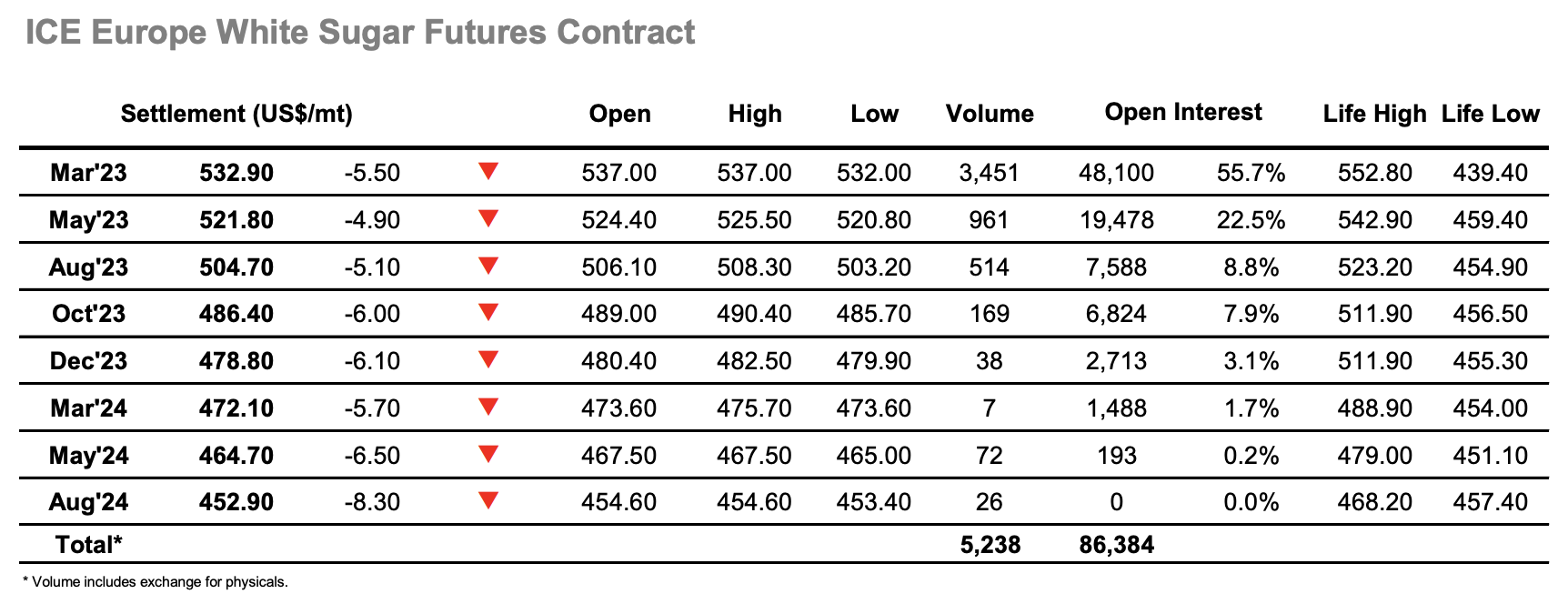

Despite being relatively quiet, the week to date has seen March’23 swing within a decent sized range between $522.20 and $545.30, though initial signs were that today would see no extension of this as the market quickly dropped down beneath $535 to sit to the centre of this band. With the initial selling done the market moved broadly sideways on very light volume, what limited interest there was being mostly confined to March’23 as illustrated by the limited depth across the rest of the board. Generally, the afternoon has brought greater interest to proceedings but not so today as March’23 continued to be as flat as they come in the $535.00 area, disregarding the recovery that was being made in nearby No.11 values to narrow the white premiums, March/March’23 slipping back to $102.00 and May/May’23 towards $116.00. These premiums recovered a little during the final stages as No.11 fell back, and while whites also showed some late weakness the movement was more modest and simply dropped March’23 back to the lower end of the day’s range and head into the weekend at $532.90.