Mild opening gains were soon erased, and the market slipped back to sit in the 19.0 area for Jul’24. This was disappointing in the context of yesterday’s recovery back up through the near-term range, and clearly discouraged most participants to leave prices flatlining into the early afternoon. The arrival of Americas based traders raised a murmur of additional interest, however the sideways theme endured to leave the market experiencing its quietest session for some time. With the market seemingly sleepwalking towards the close it was with some surprise that the picture suddenly became interesting. A selling push gathered some momentum to break down beneath the morning lows and trigger small trader selling (long liquidation from yesterday?) which suddenly saw Jul’24 at lows of 19.31 before some buying kicked in to allow prices to hold into the final hour. May’24 was meanwhile heading towards expiry by playing a similar range to of late, seeing trades between 0.28 points and 0.49 points for May/Jul’24 as fine tuning took place ahead of an expected 1.5m ton plus tender. There was additional volatility around the close with new session lows recorded at 19.26 ahead of closing highs at 19.47, the upshot of which was a close at 19.41 which leave the market still cemented in the 19/20c band. May’24 expired at 19.71 with May/Jul’24 valued at 0.30 points premium. It is understood that 32,914 lots (1,672,114t) will be tendered, with details to be published by the exchange tomorrow.

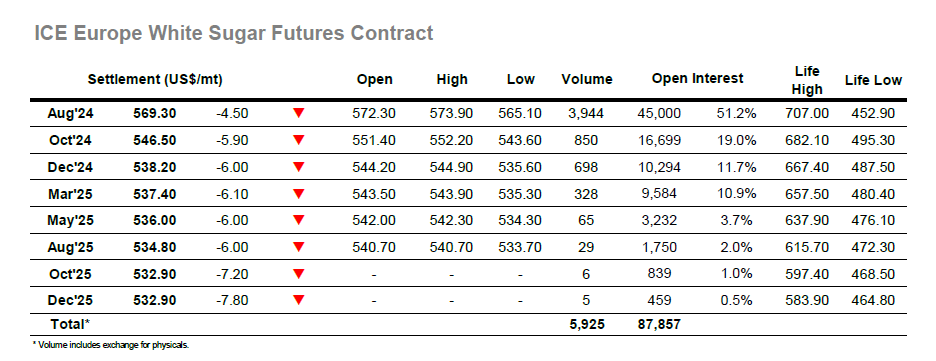

The market failed to make any move to build upon yesterday’s more positive showing, and instead the first 15-minutes saw Aug’24 fall by $5 to $568.80. The price then stabilised, though this owed more to a lack of selling than anything else, and on very light volumes the morning became a period of quiet consolidation. There was a little more noise during the early afternoon as the usual array of Americas activity emerged, although the price movement did not extend beyond the early parameters and the market then looked to calm again. With so little occurring for the flat price there was little hope for the spreads, with minimal volumes changing hands down the board. The white premiums meanwhile saw a small recovery at the top of the board with Aug/Jul’24 popping back up above $139.00 intra-day although again this was on very low volume / activity. The final 90 minutes saw unexpected movement as light selling sent the Aug’24 price tumbling down to lows at $565.10, before MOC buying emerged to reduce some of the losses with settlement at $569.30. The volatility also allowed Aug/Jul’24 to print back up to $142.00 late on, late gains which value the arb more positively into month end.