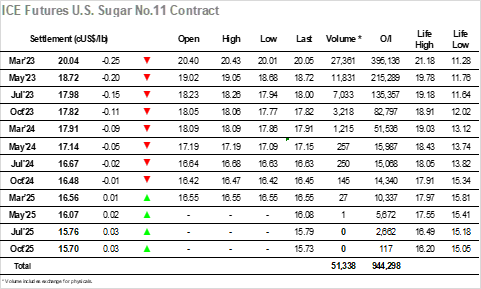

The final trading day of 2022 commenced positively with early activity seeing March’23 trade up to 20.43, though with limited volume being seen once any initial hedging had been concluded the picture settled down with the price retreating to consolidate in the 20.20 area. With the macro showing as mixed and no real sign that the funds would step in to add to/protect their long holding for year-end valuation purposes the situation showed no change for many hours, and we were well into the afternoon before breaking away from the narrow band. When we did it was a small downward extension of the range that took place, ultimately recording a session low at 20.01 during the final hour though volumes showed the movement was based on little substance with most traders simply holding station and content with their positions. Heading out we saw March’23 valued at 20.04 and March/May’23 at 1.32 points, a solid position from which to start 2023 though with questions hanging over the sustainability of the fund long should the fundamental picture not show further reduction in production.

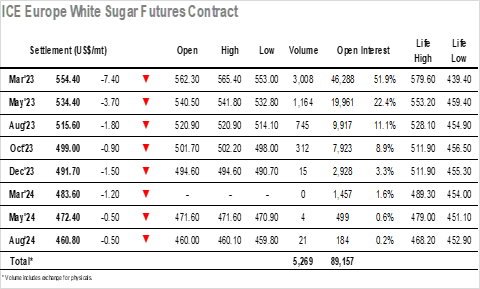

The day started positively with some light hedge lifting for March’23 taking the price up to $565.40 during the early stages, in the process widening the March/March’23 white premium beyond $116.00. The lack of any obvious spec support did impact the gains with a retreat following to $560.00 later in the morning, though by and large the picture held steady ahead of the US day getting underway. Rather than see the specs step in to defend their considerable long holding ahead of year end the afternoon became one of disappointment as nearby values withered on low volume and slipped down by several dollars to trade through the $550’s. In doing so we saw the March/May’23 spread slip back to $20 and the March/March’23 premium down to $111.00, with the feeling that most participants had already stepped away for the New Year festivities. The close played out at the bottom of the daily range to leave March’23 at $554.40 as we head into the New Year weekend with trading to resume next Tuesday.