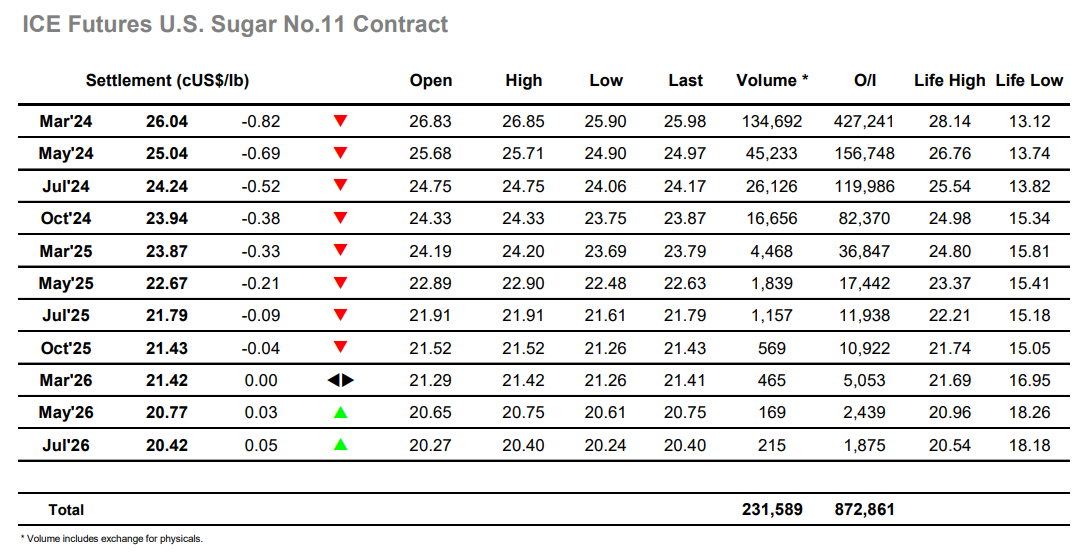

Having held robustly at 26.80 for the last four sessions there was an immediate crack as opening selling sent March’24 through this level and plunging to 26.63, filling in some good scale buying along the way as sell stops meant a 5-minute volume in excess of 7,000 lots to kick things off. There was no immediate continuation of the move however with prices then levelling out in the 26.60’s, and as the picture calmed so a morning of sideways trading ensued ahead of the lows. Eyes increasingly turned towards the US to see whether the morning weakness may invoke a bigger reaction from the US specs and funds, and the signs were that it would with a small nudge down to 26.50 testing the size of underlying scale interest. Following a pause the decline gathered pace, though unlike the opening things were done in an orderly manner with few aggressive stops. Funds were further reducing their positions into the consumer buying, the news that Opec+ was reducing production by 1m barrels per day having no effect, leading to the largest percentage fall since the summer as March’24 reached 25.92. It was not just the flat price which was taking a pounding as the spreads also absorbed significant damage due to the nature of the nearby liquidation, With March/May’24 drop[ping to 0.99 points, May/Jul’24 to 0.80 points and Jul/Oct’24 to 0.29 points. From the lows there was a small push back up to 26.16 on short covering however the damage was such that few traders were interested in buying and values were left languishing at the lower levels through to the close. Settlement was made at 26.04 for March’24, ending the month on a weak note with the market showing the potential for further near-term losses.

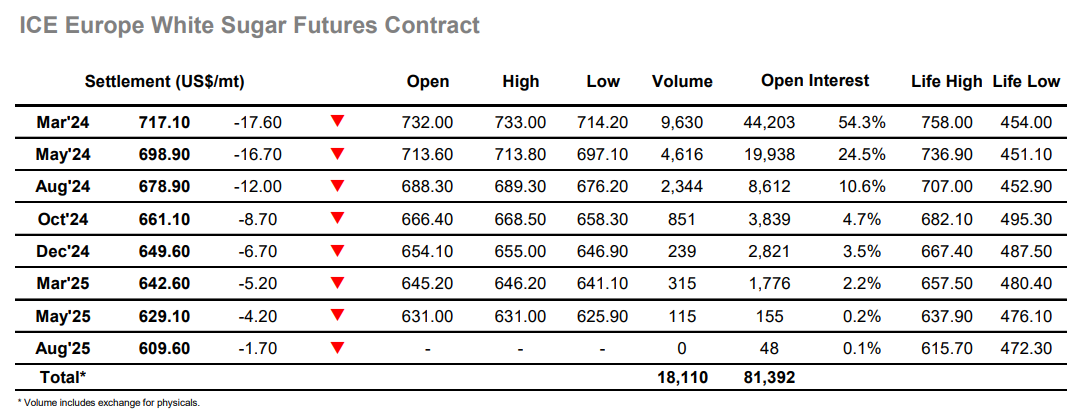

Losses for No.11 led March’24 to gap lower as we began, the day began with trades down to $730.50. Attempts to stabilise proved to be brief and additional losses were incurred through the morning to a low at $725.90 with all short-term technical support having been broken. Despite this weakness the market continued to try and cling on for a few hours, though into the afternoon the pressures being exerted upon No.11 by the specs and funds rippled through to our own market with the same sector adding to the liquidation. Consumer scales were being filled in to bring some joy to that sector, but for the specs it was a case of being forced to liquidate longs with the lower levels drawing the next orders with the decline extending all the way to $714.20, the lowest level since 23rd October. Through the weakness there was not significant movement for the white premiums, the scale buying meaning some order was maintained to the decline despite its sizable range. From the lows there was very little appetite to try and mount a recovery, and so the month drew to a conclusion on a negative note as March’24 settled at $717.10. This may draw out some physical interest and resultant support, though should the specs continue to liquidate that in itself will not stand in the way of further potential downward movement.