It was a subdued start to the day saw Jul’24 dipping back into the 19.80’s, and while the price then flatlined for a couple of hours the lack of any desire to continue yesterday’s push higher was surprising. When the market did break from its narrow band the movement was again lower, with shorts protecting their holdings and pushing prices back down easily with recent levels continuing to see only few resting orders. By late morning Jul’24 had returned to the 19.50’s, and it proved to be a tough area to escape from with smaller traders now unwilling to pursue the long side again. This left the market again following a sideways path, ranging across the 19.50’s/19.60’s through the afternoon on diminishing volumes. The weakness was mostly confined to the top of the board, and so spread gains recorded yesterday were being reversed with May/Jul’24 falling back to a small discount at -0.04 points and Oct’24/March’25 down to -0.30 points. Having recorded lows at 19.51 the final hours proved slow and tedious with prices continuing to track sideways and finally concluding the day at 19.60 to remain wedged firmly in the 19/20c band.

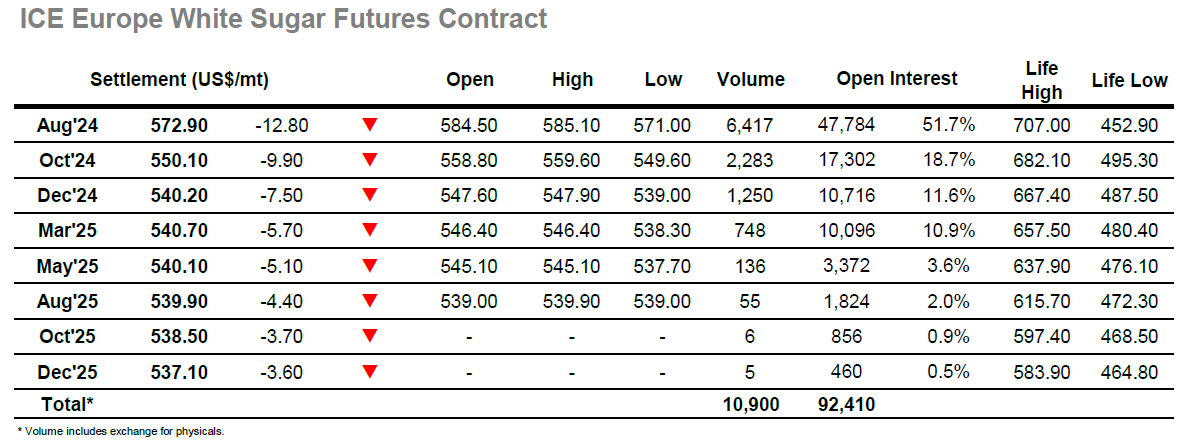

· The day began with Aug’24 setting back a little to consolidate following yesterday’s sweeping gains, and the first two hours were mostly spent in the $583.00 area. This still maintained the positive gloss on the near-term charts however the buying which had pushed the market so impressively was not to be seen and instead the market encountered liquidation from the faster moving traders which sent the price tumbling back to $575.00 before the morning was through. Assorted consumer interest started to emerge following the dip to arrest the decline, though there remained a negative bias to proceedings moving through the afternoon. Alongside the flat price weakness there was a correction seen for the spreads with Aug/Oct’24 dropping back to $21.40 during the afternoon as the spot month drew the bulk of the selling. With Aug’24 under pressure from all sides the white premium also contracted without seeing much volume, and by late afternoon it was valued near to $140.00. Session lows were registered at $571.00 during the last hour, and while there was some position squaring / defensive buying late on as Aug’24 settled at $572.90 an otherwise disappointing day petered out with the market still struggling to break free from recent parameters.