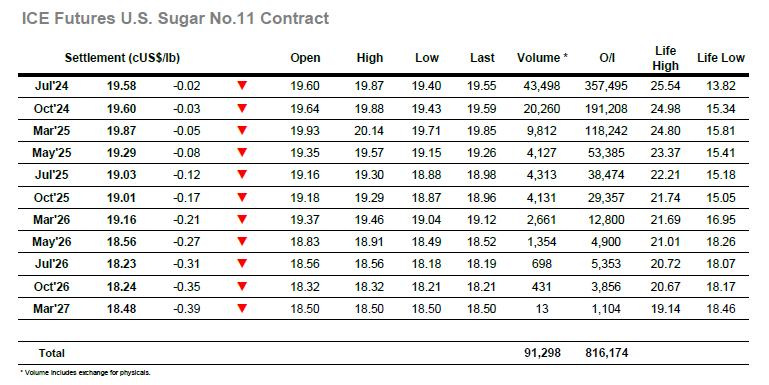

An unchanged opening garnered a small degree of support soon afterwards as stronger London whites pulled Jul’24 up to 19.72, though following yesterday’s showing there was a reluctance to push in any significant way. Volumes were paltry throughout the morning as trading settled into a tight range, and though there was a small push up to 19.75 late in the morning it had no impact upon the laborious nature of proceedings. A “1pm spike” as US traders came online saw Jul’24 touch 19.87, however the move ended more quickly than it had begun with assorted liquidation from smaller traders triggered on a retreat through the range. Consolidation followed through to mid afternoon but with day traders remaining persistent in the efforts to generate movement we then saw a spike lower to the 19.40 area though this also was unsuccessful in gathering other selling / significant algo interest. By the final hour short covering had moved Jul’24 back to the mid 19.50’s, and here it remained with a calm closing period seeing Jul’24 end the day at 19.58 and remain rangebound for another day.

London whites rattled out of the traps as if yesterday had never happened with surging gains which saw Aug’24 range between $576.00 and $579.90 across the opening stages. The gains were relatively uniform which meant an uplift for the arbs down the board, with early trades at $145.00 for Aug/Jul’24 and $120.50 for Oct/Oct’24. Following a period of consolidation there was a drop back from the highs as smaller traders flipped back out of early longs, but that was the only feature as prices otherwise drifted along on minimal volumes. Early afternoon saw a short but sharp push back upward to new daily highs of $582.00, but buying interest was not being seen from consumers and so this latest effort proved to be fruitless, and the market cooled yet again, this time retreating to new daily lows and filling the overnight gap on the intra-day charts as the market attempted to dig in. Confidence amongst day traders was rattled a push down to $571.20 followed as they investigated the underlying support, though as with the spike higher this failed to gather interest with a covering rally taking process back to a small credit. There was some gloss being added through the front month spreads with Aug/Oct’24 trading out to $25 late in the session, but otherwise it remained the status quo as the market ensured an inside day. Ayg’24 settled a few dollars higher at $575.60, with more of the same expected tomorrow.