Insight Focus

- Dairy farmer margins are under pressure despite rising milk prices.

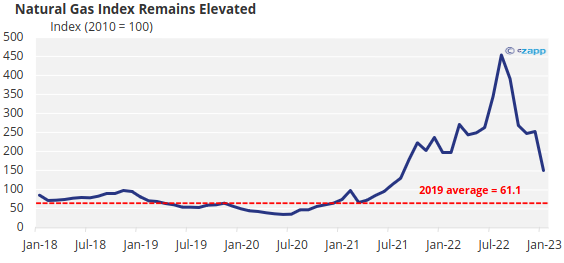

- Rising input costs have been exacerbated by energy inflation.

- Dairy alternatives are eating into market share, making the situation even worse.

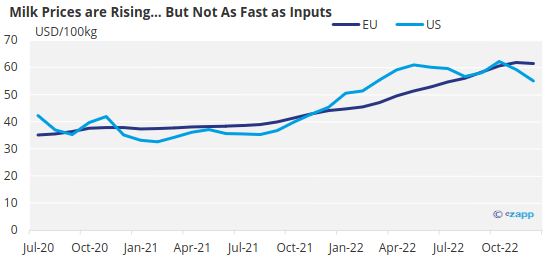

Dairy farmers in regions of the developed world such as the UK, Europe and the US are being pressured on all sides by slowing demand and rising costs. Although the price of milk has risen in recent years, it has been nowhere near as fast as input costs. And demand erosion is gaining pace as plant-based products gain a stronger foothold in the market.

Dairy Farmers Struggle

Farmers have been under pressure due to low margins for quite some time. But although the price of milk is now rising, more problems are piling up under the surface.

Source: European Commission, CLAL

Between August 2021 and August 2022 for example, the price of natural gas rose by about 250%, while the cost of milk was up by about 50%.

Source: World Bank

The labour market also remains extremely tight. Farmers are struggling to find affordable staff that will be prepared to face the tough conditions on farms.

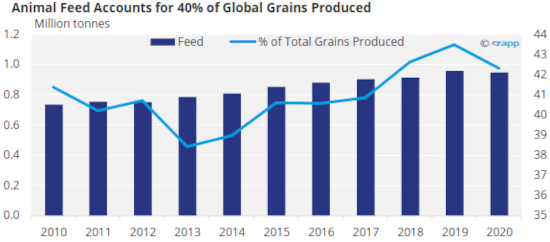

But one of the biggest impacts putting pressure on incomes comes from feed. Grains provide an important source of nutrients for animals and almost half of grains produced globally is used for animal feed.

Source: FAO

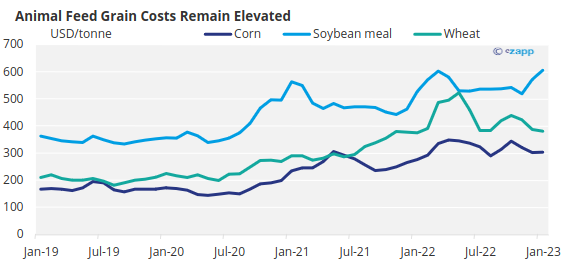

And although it has normalized slightly since a grain corridor was established, the price of grains has not returned to the levels seen before the Russian invasion of Ukraine.

Source: World Bank

Alternative Dairy Gnaws Away Demand

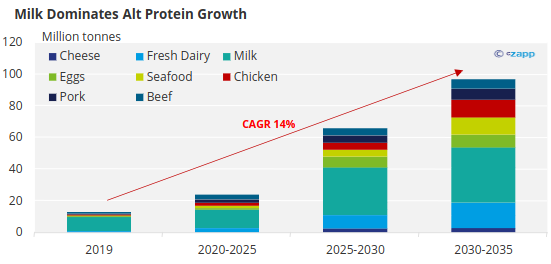

Now, another burden for the dairy industry is the rise of alternative milk. This is the fastest growing sector across all alternative proteins.

Data Source: BCG

In the UK, about a third of consumers now drink plant-based milk, with the largest consumer segment made up of younger generations aged 25-44, according to Mintel. And in the US, Good Food Institute says that plant-based milk has a penetration within 42% of households

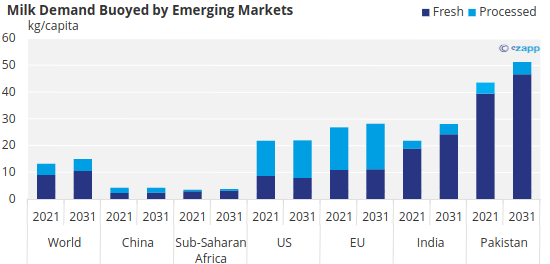

According to the OECD-FAO Agricultural Outlook, overall per capita demand for fresh dairy products in Europe and North America is “stable to declining”.

Source: OECD-FAO Agricultural Outlook

There is growing demand in developing countries such as India and Pakistan, but milk is difficult to trade due to its perishability. This means there is likely to be higher demand for milk powders over fresh milk.

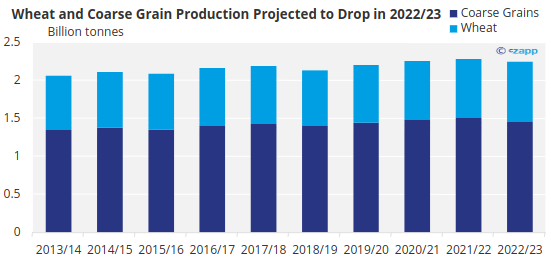

Global Grain Production Drops

Global grains production is expected to drop in 2022/23, exacerbating the situation.

Source: FAO

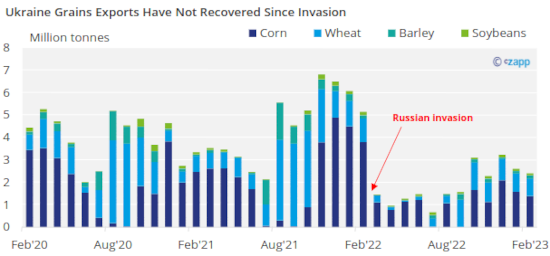

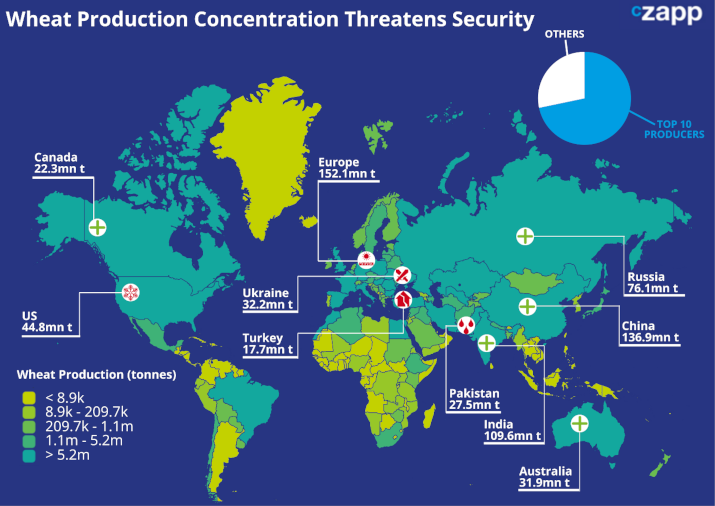

There are several reasons why production is dropping. One of these is Ukraine. Between them, Russia and Ukraine produce about 11% of the world’s wheat and normally both are major exporters. But trade flows have been disrupted by the war.

Source: UN Black Sea Grain Initiative, UN Comtrade

There are ongoing talks on extending the grain corridor but will need to be renewed in March. However, Russia has signaled that it is unhappy with some of the terms of the deal, jeopardizing a potential agreement.

And even despite the grain corridor, there is reason to believe the next few harvests will be severely disrupted. Farmers have been unable to tend crops and much of the fighting is taking place in the east of Ukraine – where there is a high concentration of farmland.

In addition to the war, extreme weather events have contributed to a production drop in several wheat producing countries. This is significant as a large proportion of production is concentrated in just a few countries.

Concluding Thoughts

- Dairy farmers are being hit on all sides, by high input costs and shrinking demand.

- The war in Ukraine and adverse weather events are both responsible for persistently high animal feed prices.

- Growing demand for alternative milk is adding to dairy farmers’ woes.

- Not only does this tighten the supply of grains, but it also eats into farmers’ target market.

- As food inflation remains high in many countries, there is no sign that the situation will improve.