Insight Focus

- Russia hardens negotiating position.

- Russia will need to export large grains crops.

- EU bans Ukrainian ags imports until June 5th.

Forecast

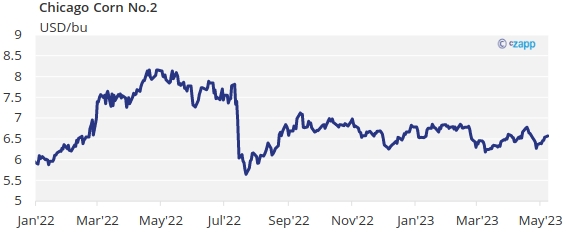

No changes to our Chicago Corn average price forecast for the 22/23 (Sep/Aug) crop in a range of 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,6 USD/bu.

Market Commentary

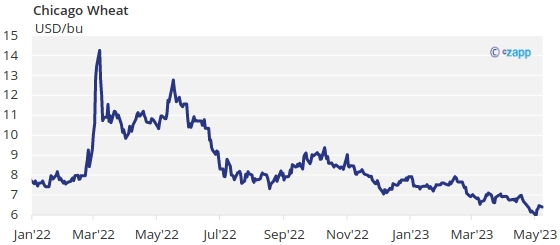

Mixed week for Grains with a strong recovery in Chicago and mild or negative in Europe. Brazilian Corn plummeted again. Doubts around the extension of the Black Sea corridor remain.

Favorable weather was again an important driver for prices last week, with a negative start on expectations of good US Wheat condition and Corn planting progress. But then fresh worries around the extension of the Black Sea corridor took the front line again and all grains turned around finally closing the week positive, except for Corn in Europe.

Indeed US Corn planting came in at 26% complete well above last year’s pace of 13% but within the five year average pace of 26%. And French Corn planting is very much delayed running at 59% planted vs. 81% last year.

The EU banned imports of Ukrainian agricultural products until June 5, among them Corn and Wheat but only to the bordering countries with Ukraine. We don’t think this will impact prices and just basis in those neighboring countries.

In Brazil, the first Corn crop is 63,6% harvested vs. 68,2% last year. In Argentina, Corn harvesting has reached 19,7% vs. 25% last year and condition is just 4% good or excellent.

In the Wheat front, US Wheat condition improved by 2 point and is now 28% good or excellent vs. 27% last year. French Wheat condition was 93% good or excellent one point lower week on week and vs. 89% last year.

In the weather front, the US is expected to have again favorable weather. Brazil is expected to receive some rains this week which will favor the recently planted safrinha crop. Europe will continue to suffer dry weather in the south while the north is having normal conditions.

The key this week will be the negotiations around the extension of the Black Sea corridor with Russia playing hard in the negotiations as they want some of the international sanctions to be lifted. We will have to wait and see, but ultimately Russia needs to export their bumper crop and should be interested in reaching an agreement. Apart from some volatility around this issue, the overall risk should continue to be to the downside.