Insight Focus

- Dry weather in the US leads to deterioration of corn crop.

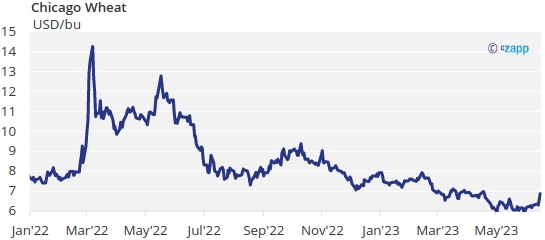

- Dry weather in EU may be hitting wheat production.

- Very slow vessel inspections in the Black Sea corridor.

Forecast

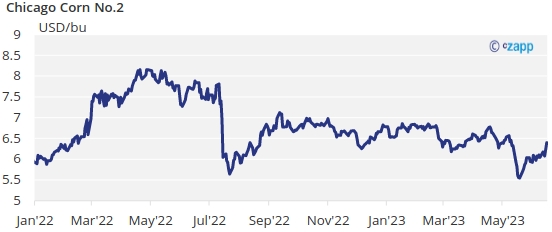

No changes to our Chicago Corn average price forecast for the 22/23 (Sep/Aug) crop in a range of 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,56 USD/bu.

Market Commentary

Spec and short covering rally in Chicago as crop condition and dry weather is signaling USDA’s Corn yield will be difficult to reach. Crop condition in France down again. Only two vessels per day is the pace of the Black Sea corridor.

It was all about weather last week and about dry weather in both sides of the Atlantic. Coceral reduced their EU Wheat production forecast and Corn condition in the US continued to deteriorate. Nothing that we had not suggested during the last few reports. And the US drought monitor showed a sizable 57% of the Corn area is experiencing drought vs. 17% last year. Is not looking good for the record yield the USDA is forecasting.

Corn and Wheat in Chicago had an expressive rally especially by the end of the week after the drought monitor was released.

US Corn is now fully planted and condition fell for a third week in a row and is just 61% good or excellent vs. 72% last year. The expectation was for 64% good or excellent and the lower reading triggered a rally.

In Brazil, Conab increased their Corn production forecast by a marginal 200k ton to 125,7 mill ton vs. 125,5 before. Safrinha Corn is 1,7% harvested slower than the 4,9% progress of last year. In Argentina Corn is 37,5% harvested and the USDA local office reduced their forecast by 2 mill ton to 35 mill ton due to the dry conditions Argentina has suffered.

In Russia, Corn planting is 87,9% complete. In France Corn condition fell 2 points and is now 86% good or excellent.

Wheat rallied too in the US on weather concerns but was also supported by uncertainty coming from the Black Sea corridor which continues to show a very slow pace as just 2 vessels per day are being inspected.

US Wheat harvesting started and is now 8% done in line with last year and the five year average.

In Europe, Coceral lowered their forecast for EU Wheat to 127,3 mill ton vs. 129,5 they had before basically flat vs. last year’s production. The reduction came mainly from northern Europe due to persistent dry weather. French Wheat condition fell another 3 points and is now 85% good or excellent and is the fourth week in a row with conditions worsening.

In the weather front, dry weather is expected in the US while in Brazil rains and cold weather are expected again this week. Europe is expected to have warm temperatures and some rains in the north.

We continue to be in a weather market, and persistent dry weather in the US has the market now with serious doubts about the USDA’s forecasted Corn yield of 181 bpa. In our opinion Corn condition is saying it already and the very aggressive yield will probably be downgraded sooner or later. The market has already priced some weather premium. If rains return in the short term, we will see a pullback, but we now think it will be difficult to see prices below 6 USD/bu again.

Spec and short covering rally in Chicago as crop condition and dry weather is signaling USDA’s Corn yield will be difficult to reach. Crop condition in France down again. Only two vessels per day is the pace of the Black Sea corridor. We continue to be in a weather market, and persistent dry weather in the US has the market now with serious doubts about the USDA’s forecasted Corn yield of 181 bpa. In our opinion Corn condition is saying it already and the very aggressive yield will probably be downgraded sooner or later. The market has already priced some weather premium. If rains return in the short term, we will see a pullback, but we now think it will be difficult to see prices below 6 USD/bu again. No changes to our average price forecast for Chicago Corn for the 22/23 (Sep/Aug) crop in a range 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,56 USD/bu.