Insight Focus

- After a poor performance in the US, a rally in soybeans and wheat on Friday pulled Chicago corn prices higher.

- With corn harvesting and wheat planting running well across all regions, we continue to see downside risk in the market.

- Only negative fundamentals, such as weather challenges and supply disruptions out of the Black Sea could push prices higher.

Forecast

There is no change to our forecast for Chicago Corn, which remains in the range of USD 3.90/bushel to USD 4.15 USD/bushel for the average of the 2023/24 crop (September – August). The average price since September 1 is running at USD 4.81 USD/bushel.

Corn Feels Pressure Before Wider Commodity Rally on Friday

Corn prices in Chicago fell again this week to a low of USD 4.69/bushel on Thursday. But a rebound in soybeans and to a lesser extent wheat pulled corn higher on Friday, limiting the week’s losses. In Europe, Matif closed slightly up, while the price of Brazilian corn continues to hover around BRL 60/bag (USD 12.24/bag).

The downside pressure throughout the week was due to very good harvest progress in the US, which remained well above the five-year average. US corn is currently 71% harvested compared with 74% last year and above the five-year average of 66%. However, it is worth noting that a comparison with last year’s harvest pace is irrelevant given the small size of last year’s crop.

Drought conditions improved again with just 36% of the area now affected, down from 49% last week. Russian corn is 53% harvested, Ukrainian corn is 60% harvested and French corn is 80% harvested compared with 99% last year. The condition of the French crop was stable on the week at 83% in a good to very good state, which is a drastic improvement on the 42% recorded last year.

In Brazil, the first corn crop is 37.2% planted, slightly behind last year’s progress at 39,8%. In Argentina, planting is 23.4% complete and 20% of the crop is in good or excellent condition.

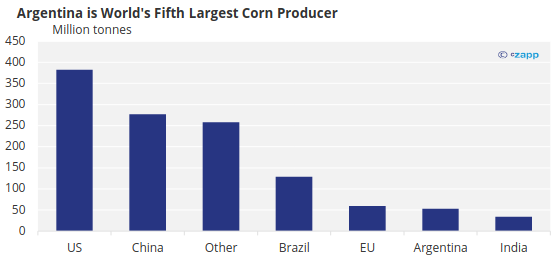

The USDA’s local office in Argentina reduced its corn production forecast for 2023/24 by 2 million tonnes to 53 million tonnes. However, this is significantly higher than the 34 million tonnes recorded for the most recently completed crop. The reduction will likely be included in the November WASDE report later this week.

Source: USDA

Dry Weather, ASF, Black Sea Progress Keep Wheat Prices Muted

Wheat started the week negatively due to the fast pace of planting in the US and very good crop conditions reported by the USDA. It reported that 47% are in good or excellent condition, which marks the best start in the last 20 years. Although prices turned around by mid-week on bargain buying, the week still closed negative.

US winter wheat is now 84% planted compared with 86% last year and the 85% five-year average. The condition was 47% good or excellent compared with 28% last year. About 42% of the wheat area is under drought conditions, which is down seven percentage points on the week.

On the weather front, dry weather at the end of last week in the US is expected to continue this week. This is positive for the corn harvesting and winter wheat planting pace. Brazil and Argentina are both expected to experience rains again.

Rain is also forecast in Europe. French wheat is 62% planted compared with 81% last year and lower than the five-year average of 72%.

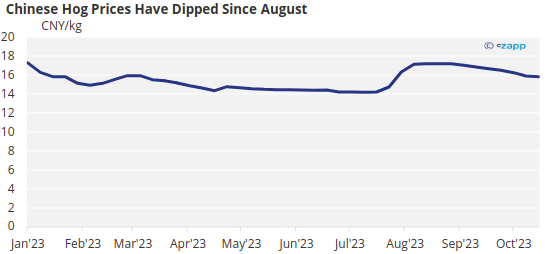

Something to watch is the African Swine Fever outbreak in China. Hog prices have already plummeted, and this could negatively impact protein demand, reducing soybean and corn imports.

Source: Pig333

No news is good news out the Black Sea with the export flow continuing and no news of Russia impeding exports in any form. Russian winter wheat planting is 55% complete, while planting in Ukraine is 85.7% complete.

With corn harvesting running well across all regions and no adverse weather issues, we continue to see downside risk in the market. Only supply disruptions out of the Black Sea may result in higher prices.