Insight Focus

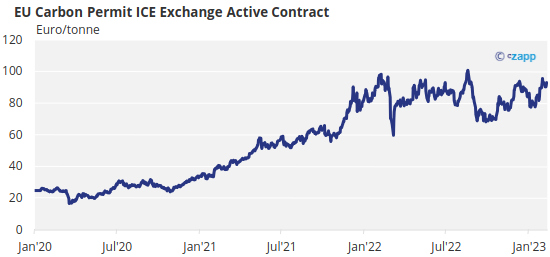

- EU carbon prices are approaching €100.

- This follows delayed issuance of 2023 permits and compliance demand.

- This comes despite wide-ranging reforms to the market.

EU carbon prices near €100 amid compliance demand, delayed supply

European carbon permit prices set a new record high on Monday as technical trading signals, together with compliance demand amid a delayed issuance of 2023 permits boosted sentiment among traders.

The rally came even after the European Union largely approved wide-ranging reforms to the market that included selling an additional 250 million allowances to the market.

Prices for front-year EU emission Allowance (EUA) futures reached a high of €99.99 early on Monday afternoon, compared to a previous record of €99.22 set in August last year. Many experts are confident the price will top €100 in the coming days.

Traders have shrugged off parliamentary approval of a plan to release in excess of €20 billion worth of EUAs from future auctions to help fund the EU’s pivot away from Russian fossil fuels.

The REPowerEU plan would bring forward €8 billion worth of EUAs from member state auctions scheduled for 2027-2030 and instead sell them to the market over 2023-2026, as well as advancing €12 billion of EUAs from auctions set aside for the bloc’s Innovation Fund.

For some trading sources the rally reflects a lack of key market data after a major data aggregator experienced an attack on its web infrastructure in January that has left carbon market participants without Commitment of Traders data for the last two weeks.

The data shows the total number of short and long futures and options positions held by various categories of trading participants, including investment funds and compliance companies.

Sources say the data is widely used as a source of insight into the market’s likely moves, and they focus closely on the holdings of investment funds, who are seen as key price drivers on a day-to-day basis.

The recent rally in EUA prices has also been interpreted as a short-term reaction to the regulatory process nearing its end, and to technical factors, rather than to the fundamental shift in supply and demand over the coming three years.

While the “Fit for 55” reform package is intended to tighten supply of EUAs over the rest of the decade, the REPowerEU initiative is expected to be more short-term in its impact.

Most analysts believe that prices will begin to come down as the additional auction volumes make their way into the market. The European Commission is expected to announce a change to the auction schedule later this spring, but before then the annual compliance cycle will be completed and this is keeping prices strong in the short term.

With member states likely to be delayed in handing out their allocation of free EUAs for 2023, industrial companies are expected to have to resort to the market to complete their purchasing for 2022 compliance.

Market experts also speculate that many industrials delayed buying EUAs in 2022 amid soaring energy costs and a burgeoning economic slowdown, and with gas and power prices now coming down companies may now have more latitude to catch up with their EU ETS compliance.