Insight Focus

- Investor selling of risky assets hits EU carbon market.

- Prices fall 15% in one week.

- Traded volume was the highest since Russia invaded Ukraine.

EU carbon prices plunge amid macro concerns as compliance season hits high gear

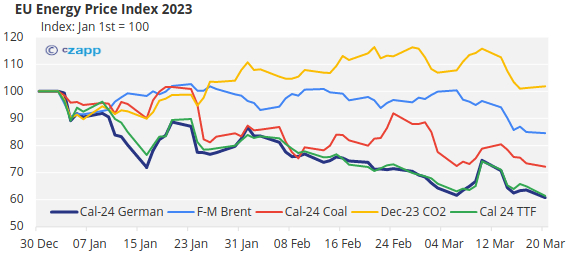

European carbon prices have plunged as much as 15% in the last week as growing concerns over the resilience of the banking sector developed into a fully-fledged crisis and prompted widespread selling of risky assets by investors.

December 2023 EU Emission Allowance (EUA) futures have fallen from a March 13 high of €100.16 to a low on March 20 of €84.75, a drop of more than 15%, as speculative traders fled to safe haven investments.

Last week was also the busiest week’s trading in the carbon market since Russia began its invasion of Ukraine a year ago: more than 160 million December 2023 EUA futures changed hands on ICE Endex in the five days to March 17.

The volatility in carbon prices at the moment is driven not only by wider macroeconomic concerns, but also by the imminent expiry of March EUA options. Traders hedging their exposure to the price of the underlying futures contract is exaggerating the market’s volatility.

There are more than 36 million tonnes of positions in call options at up to €120/tonne, and almost 26 million tonnes of put options at strike prices between €75 and €100.

Support for prices is seen coming primarily from compliance demand. Installations covered by the EU ETS must submit verified emissions accounting for 2022 by the end of March, and must surrender EUAs covering those emissions by the last working day of April.

As a result the March-April period is among the busiest in the year for industrial buying.

The first quarter of the year also sees the start of the distribution of free EUAs to trade-exposed industry. EU member states are handing out a total of 526 million EUAs to industries ranging from steel and chemicals to bricks and paper.

According to the European Commission, 19 countries have so far begun to issue their 2023 tranche of allowances. Some, including Germany, the Netherlands and Belgium, have almost finished their distribution, but others, including Finland, Poland, Spain and Portugal have yet to start.

The timing of this handout is often vital to industrials. EU ETS rules allow companies to use freshly-issued EUAs to meet their prior-year compliance, so that a company can immediately surrender newly-received EUAs for 2023 to meet its 2022 obligations.

The EU in 2021 made changes to how the annual allocation of EUAs is calculated each year, and in 2021 and 2022 a number of countries experienced difficulty in calculating how many allowances to give to each installation. This meant that many plants in Ireland and France, most notably, only received their 2022 EUAs around the end of the year.

The outlook for EUAs remains clouded and volatile through to the March options expiry this week, though even carbon is likely to remain a hostage to fortune as investors seek out safe assets.

The global financial crisis of 2007-2008 saw EUA prices tumble from €30 to less than €10 in less than two months as investors fled assets linked to macroeconomic performance. The market only reclaimed the €30 level ten years later after the European Union introduced reforms to tighten the cap on emissions.

Nevertheless, carbon remains the best-performing energy-related market in 2023. While prices have tumbled from their record high of €101.25, emissions allowances remain in positive territory for the year to date. Natural gas and benchmark German electricity prices are down nearly 40% since the start of 2023.