Insight Focus

- European carbon market declines more than 7% after March options expiry.

- Attention moves to annual compliance by end-April.

- EU emissions probably rose in 2022 thanks to higher use of coal to generate power.

European carbon allowance prices experienced a volatile week ending March 24, after plunging more than 15% in early March, as options traders fought to keep price bets in the money ahead of the contract’s expiry.

The benchmark December 2023 futures contract moved between €84.75 and €93.34 last week, with a violent €7 decline on Friday after the options contract had expired.

Now, with the March derivatives contracts out of the way, the market has shifted its focus to the culmination of the annual compliance cycle at the end of April.

Analysts predict that overall emissions will have risen by between 1%-2% in 2022, reflecting the EU’s switch away from expensive natural gas to cheaper, but more carbon-intensive coal to generate electricity.

The increase in emissions from the power sector is likely to have offset any decline in greenhouse gas pollution from industrial plants, many of which reduced or even suspended production in 2022 after natural gas prices soared after Russia’s invasion of Ukraine.

More than 11,000 industrial installations across Europe must submit independently-verified reports detailing their CO2 emissions by the end of March, and have another month to surrender EU emission Allowances (EUAs) matching their emissions.

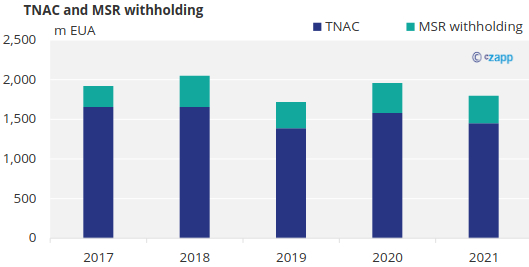

The compliance season, which broadly corresponds to the first four months of the year, will be followed by the European Commission’s calculation of the market supply – the Total Number of Allowances in Circulation (TNAC) – which will determine how much supply is to be withheld from the market in the year starting September.

If the TNAC reports a total market supply of more than 833 million EUAs in any calendar year, the Market Stability Reserve (MSR) takes away 24% of any excess. The subtraction is applied to auction volumes sold in the year starting from the following September.

While this withholding does not affect the allocation of free EUAs given to non-power sector industrials, it does tighten the overall supply in the market and raises prices. Indeed the European Union’s mere approval of the MSR in 2018 led to a quadrupling of prices in 2017-2018 as investors rushed into the market.

However, the supply outlook in 2023 is somewhat clouded by the European Union’s decision last year to create a fund to assist in the bloc’s pivot away from Russian energy supplies.

The REPowerEU initiative will invest €210 billion until 2027 in renewable energy, energy efficiency and switching industrial users away from coal and gas.

The EU decided that some €20 billion of this total should come from the bloc’s carbon market, sourced by selling roughly 250 million EUAs from member state auction reserves and other sources between 2023 and 2026.

These sales are expected to begin by September, and represent an advance on supply that had not been scheduled to come to market until the period from 2027.

Consequently, prices are likely to slip in the near term as these EUAs are sold into the market, but may rise even faster after 2027 when the market will tighten faster than originally planned.

Market participants also point out that the increase in supply due to the REPowerEU sales will lead the MSR to withdraw larger tranches of EUAs from the market in the coming years, since annual supply as calculated by the TNAC will increase.

As a result, some say, the net price effect of the REPowerEU initiative may be rather less than expected, and that the tighter overall supply after 2027 may lead to even higher EUA prices. Already some analysts are predicting prices of more than €130 in the second half of the decade.