Insight Focus

- Low Mississippi water levels are putting pressure on Chicago Corn.

- September’s WASDE should clarify any changes to corn yields.

- Brazil rains expected to delay harvesting pace.

Forecast

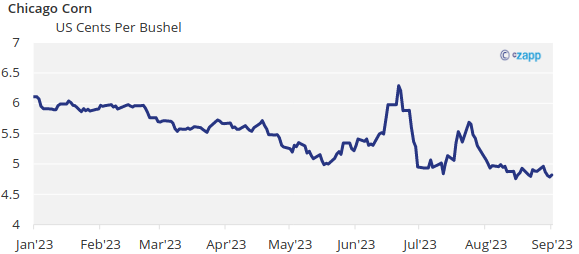

No changes to our Chicago Corn average price forecast for the 2022-2023 September and August crop in a range of 6 to 6.5 USD/bu. The average price since 1 September is running at 6.28 USD/bu.

Market Commentary

Ample supply around the corner weighs in the market and grains had a negative week across all geographies. Low water levels in the Mississippi also put pressure in Chicago Corn.

Despite some production downgrades announced last week, the big production growth across most regions (except for Argentina) leaves the market well supplied and pressuring prices lower.

The Pro Farmer crop tour in the US projected Corn production of 14,96 billion bu below the USDA estimate of 15,11 billion bu. They are projecting yield of 172 bpa vs. 175.1 of the USDA.

The European Commission reduced their Corn production forecast by 1.3 million tonnes to 61.9 million tonnes due to lower yields in Eastern Europe caused by hot and dry weather. Production is still well above the 52.3 million tonnes produced last year.

Water levels in the Mississippi are historically low which could impact Corn exports and freight rates have rallied. This will cause FOB Gulf prices to be less competitive and put pressure on Chicago to offset the logistical costs and be competitive for export markets.

US Corn condition worsened 2 points to 56% good or excellent vs. 54% last year. Corn area under drought increased by 2 points and is now 45% somehow expected given two weeks of very hot and dry weather. French Corn is 82% in good or excellent condition flat week on week and vs. 46% last year. The harvest has started and is now 1% complete.

In Brazil, Safrinha Corn is 84% harvested vs. 93,8% last year. Argentina has finished their harvest with no official data yet but should be around 34 million tonnes much lower than the 52 million tonnes harvested last year being the only important producer with a decrease in production.

Wheat is felling harvest pressure with northern hemisphere crops almost fully harvested. US winter Wheat is now fully harvested. Spring Wheat condition fell 1 point and is now 37% good or excellent vs. 68% last year. Spring Wheat is 54% harvested vs. 48% last year. The area of US winter Wheat under drought was 46% up from 44% the previous week. French spring Wheat is fully harvested. Russian Wheat is 65% harvested. Ukrainian Wheat is fully harvested.

The European Commission reduced soft Wheat production by a marginal 352k tonnes to 127,1 million tonnes slightly above last year’s production of 126,7 million tonnes.

But the most important news on the Wheat front was Russia saying the Black Sea grain deal would be discussed in a meeting with Turkey during last Thursday and Friday. By the time of writing there were no news about any progress made.

In the weather front, average temperatures and average rainfall is expected for this week in the US but crop condition reading could still reflect the impact of two consecutive weeks of very hot and dry weather, in any case net drying is expected which is not good. In Brazil rains are expected during the whole week probably delaying the second crop harvesting pace. In Europe higher temperatures are expected in France and Germany with little rain.

Expect the market to remain under pressure with some volatility coming from weather still impacting Corn yields in the US and Europe. But we are in the final stages of Corn maturation before harvesting starts and only some extreme weather could cause significant changes to production estimates. The September WASDE next week should give some more clarity but we don’t expect significant changes.