Insight Focus

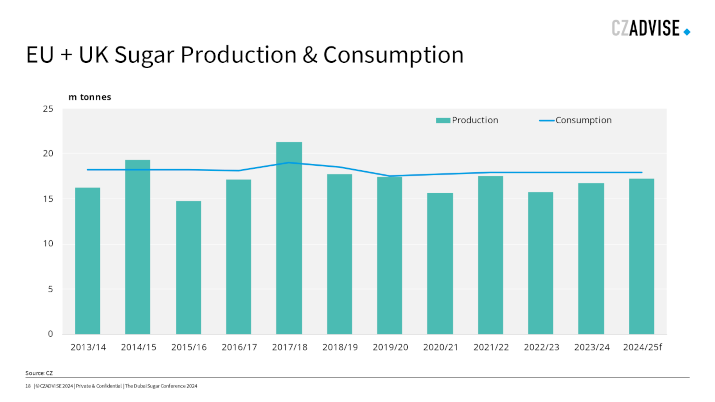

- European sugar production should increase in 2024/25.

- This means Europe is likely to have more white sugar to export.

- European spot sugar prices have started to weaken.

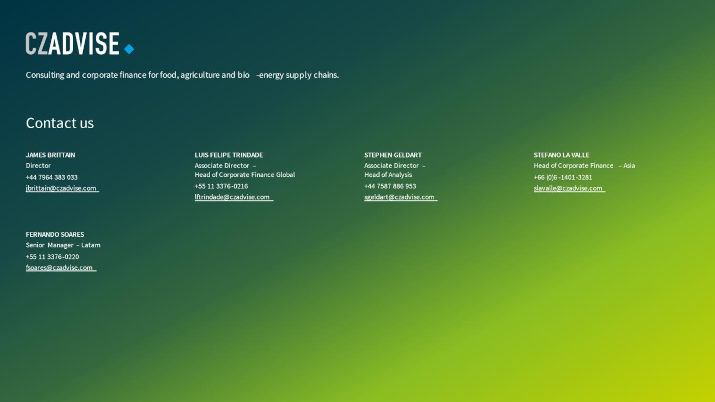

Hi everyone, it’s Stephen from CZ with an update on the sugar market. Last week I spoke at the Dubai Sugar Conference on the European sugar market.

My job was the set the scene for a panel discussion with Olivier Leducq of Tereos, Fred Zeller of the Association of South German Beet Growers and Viacheslav Chuk of Astarta, moderated by Kona Haque. This meant I had to condense everything there is to know about one of the world’s largest sugar producers and consumers into 10 minutes, while also giving a subtle introduction to CZ’s new consulting business.

I know that European sugar often fills people with dread, so I kept the talk fast-moving. I started at the back of the supply chain and then worked forwards. Here’s what I said.

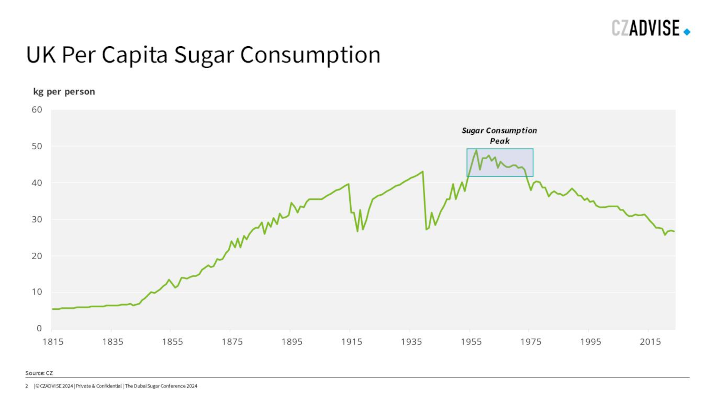

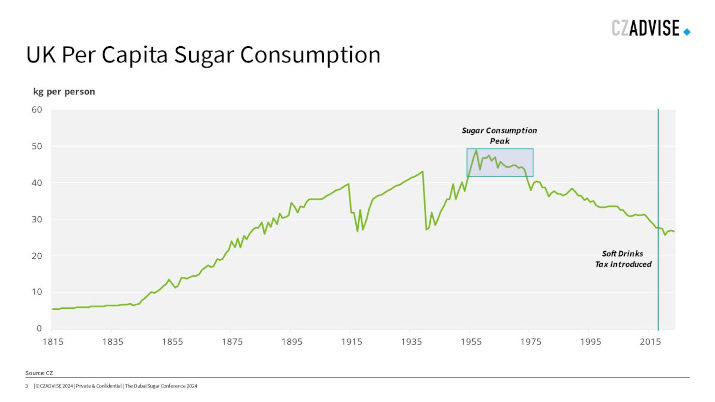

Here’s per capita sugar consumption in the UK.

I’ve chosen the UK because it’s the country for which I have the most data, but I believe that all western European countries and many other European countries will show a similar path, just with the timing differing slightly. For the UK, sugar consumption peaked in the 1950s and 1960s and has been falling ever since.

Sugar taxation doesn’t seem to have made a huge difference to sugar consumption, nor to obesity.

Overall EU sugar consumption is broadly unchanging each year, with per capita losses being made up through a growing population.

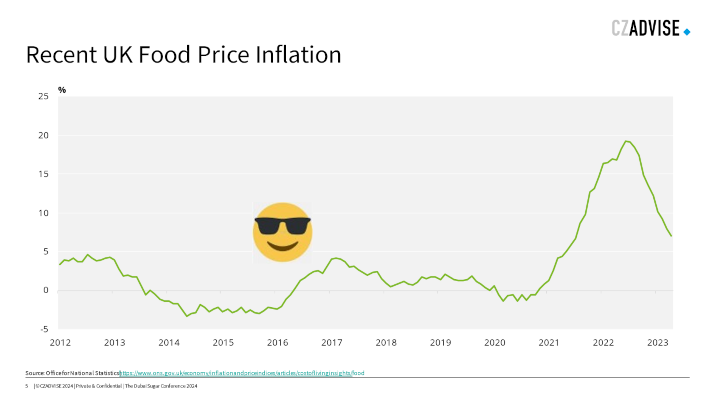

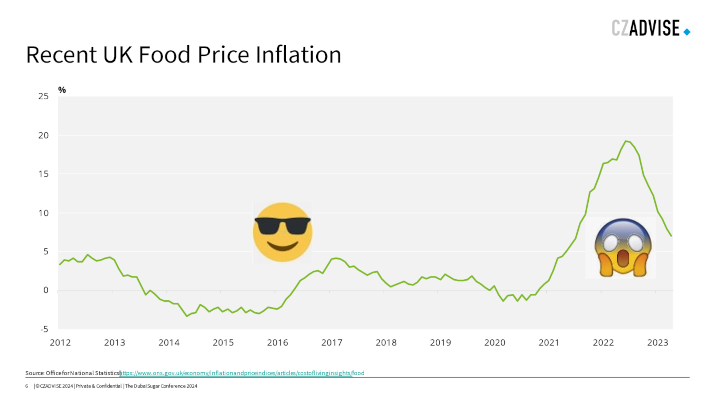

It’s also important to know that we’ve just been through a period of huge food price inflation in Europe. Again, it’s UK data, which is that most readily available to me, but I assume it’s similar across the continent. Between 2012 and 2022 food prices were effectively static and consumers had rules of thumb which worked. Pack of chicken of this size for 5 euros, block of cheese this size for 3 euros.

Now food is up 40% in several years and those rules don’t work. This has been a big shock to consumption. While all food prices have been rising, sugar was unaffected. But sugar prices have been persistently high in the EU and so now there are mutterings that sugar consumption may be getting a little weaker. This is something to watch.

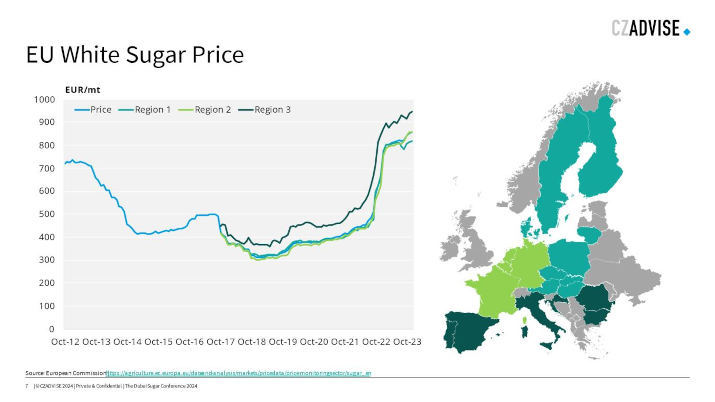

We saw in last chart food inflation peaked in middle of 2023. European sugar prices are now coming off, though the Commission data doesn’t show this yet. You can also see that the prices today are at a premium to the world market.

Commission publishes by 3 regions and I’ve marked them on a map so you can see what’s what. In general, the northern west Europe beet planting belt has lower prices than the periphery.

Now we’ve looked at the prices beet processors and refiners get for their sugar, let’s look at some of the costs. The impression I get is that neither farmers nor processors have been terribly happy in recent years despite the high sugar prices, which is unusual.

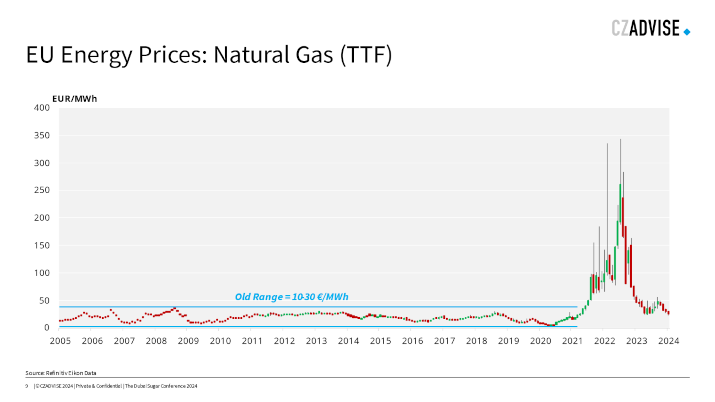

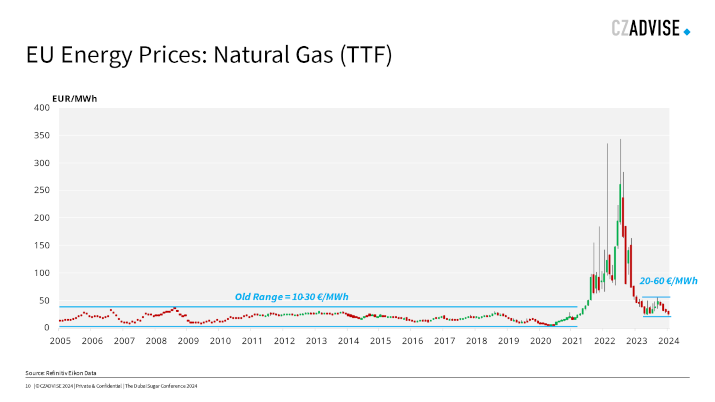

Here’s the EU natural gas price, which I will use as a proxy for energy prices. As we all know, around the time Russia invaded Ukraine prices went crazy. The EU no longer gets Russian gas and is an LNG importer from the world market, in competition with many other places. This had a major effect on European beet processing and refining. Europe used to be the world’s cheapest supplier of high quality refined sugar. No longer.

Even now natural gas prices have fallen dramatically, they remain twice what they were in the 2010s. This is a cost to the sugar industry.

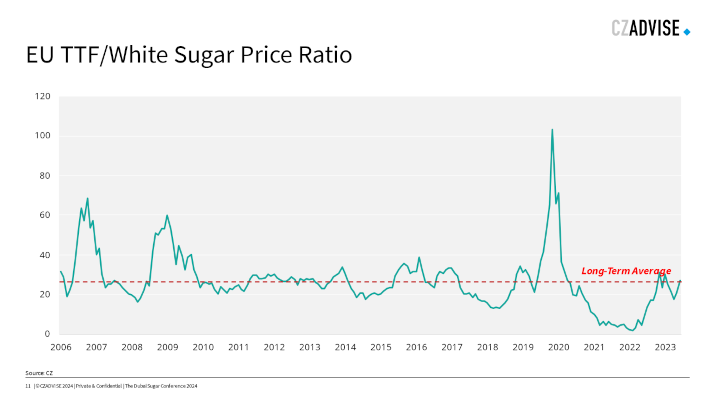

If we make a crude ratio of the EU TTF price and the White sugar price we can see the almighty producer margin squeeze in 2022. Below the line means producers energy costs hurt more than normal. Above the line means everything’s good. So high energy costs have been a big deal for the European sugar industry recently and remain a big deal today, especially if white sugar prices now do start to fall but energy prices remain elevated.

This is one reason recent beet price negotiations have been tricky in some European countries.

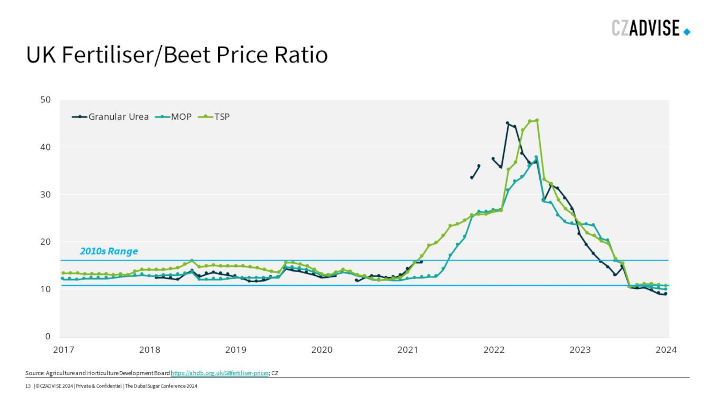

Energy is a big deal for farmers too. Obviously in the case of diesel in tractors, but also making fertilser is energy intensive. Here’s UK fertilizer prices in pounds per tonne divided by beet prices paid in the UK in pounds per tonne to make a crude farmer affordability ratio. You can see that beet farmers faced an awful problem in 2022, when urea, muriate of potash and triple superphosphate became extremely expensive relative to the beet price.

Happily, at the current time prices are back at the long term normal level; slightly cheaper, actually. All other things being equal this is good for farmers, and perhaps for beet area and yields.

So we’ve looked at the high EU sugar prices and we’ve also seen that costs have become more manageable than they were in 2022 and 2023. Beet prices are up too, so let’s go back up the chain and see what this means for sugar production in the EU. I’m not looking at what the raw sugar refineries make here, but at beet processing.

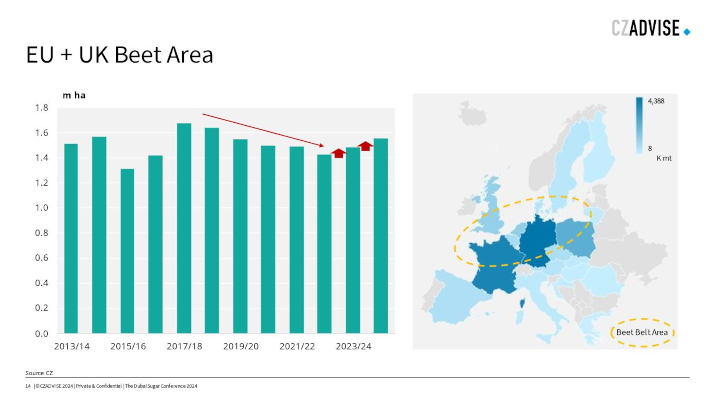

As you can see, I think Europe’s beet area will increase this season by around 5%. We’re starting to reverse the previous 5 seasons of decline, though we’re not back to where we were in 2017.

The map shows you where most beet is grown in the EU. What happens in France and Germany is by far the most important factor, as Olivier and Fred will confirm.

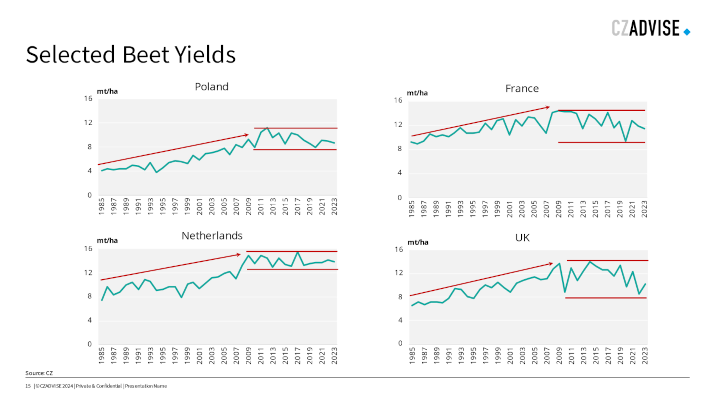

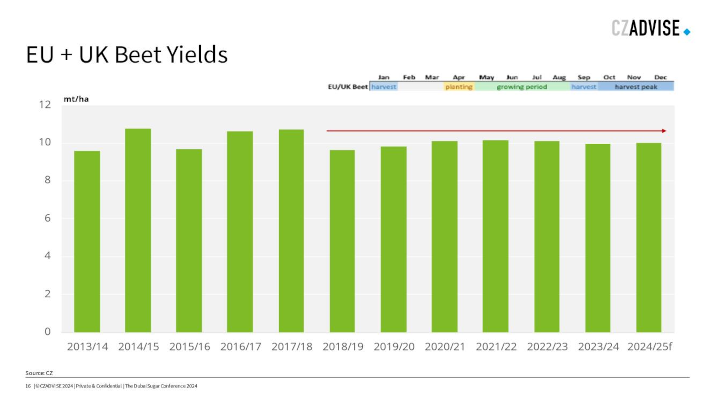

Now we arrive at a problem. European beet yields are not getting better. We had decades of improvements in farming practice, seed technology, fertilizer application, beet processing technology, but in the 2010s yields have gone sideways.

This is a major problem for the industry and we’re waiting for the next step up in tech, wherever it comes from. This means I think the EU+UK will make 17.3m tonnes sugar in 24/25. This is a first estimate and is middle of the range for recent years. Weather will have a major impact on yields and whether we can exceed this number or not.

This would mean that once again the EU is in slight deficit.

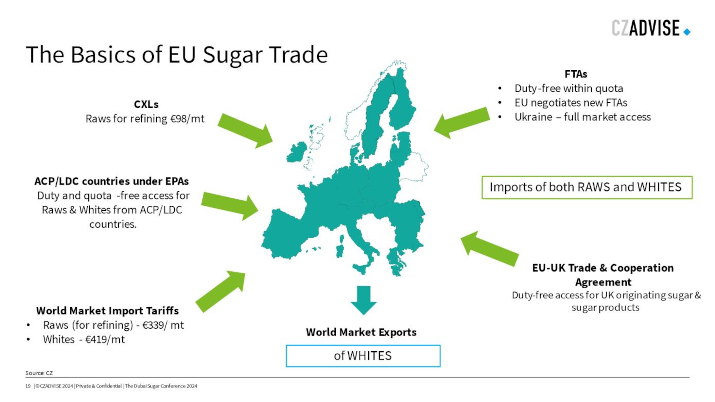

Are you all with me so far? Because I’m about to leap quickly into European trade. So far we’ve only looked at beet production, but the continents refiners need raw sugar to process, and Europe also exports white sugar. Let’s go.

Here’s a brief explanation of Europe’s sugar trade.

If you want to bring sugar into the EU, you can do it in whatever form you like duty free for unlimited volume if you’re an ACP/LDC country.

You can pay a reduced duty for raws for refining if you’re a CXL country.

There are various free trade agreements in place. The UK recently got a cargo of Australian raw sugar, for example.

Or you pay full duty which is expensive. Whites are exported out.

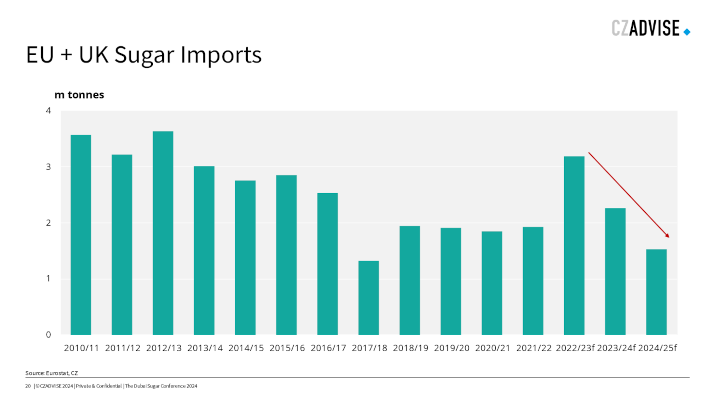

Imports today tend to be between 1-2m tonnes a year, unless there’s a bad crop and/or high prices as we saw in 2022/23.

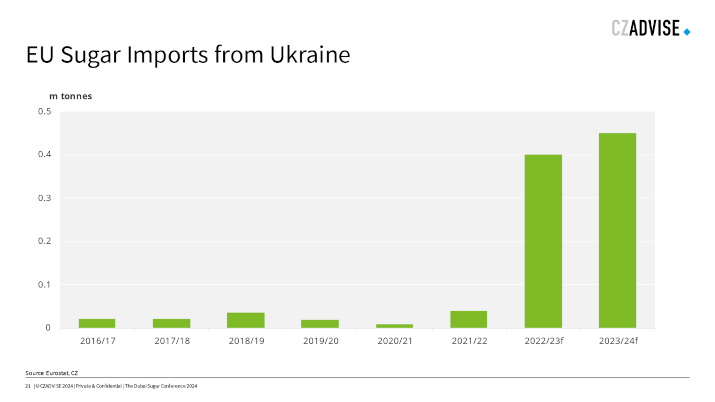

One major recent change has been that Ukraine has started to account for a large share of these imports after the EU allowed duty-free access after Russia’s invasion. This access was eventually restricted last season thanks to the huge flow of arrivals. The same may happen this season too; a decision is imminent.

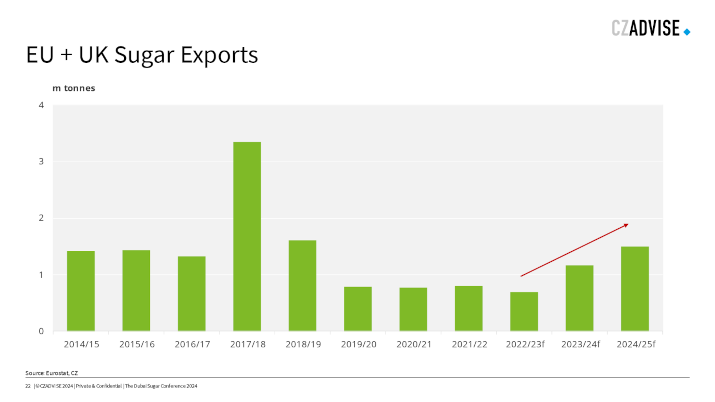

Exports are the safety valve to balance the market and happen when we have large crops. EU exports tend to go to nearby neighbours: UK, Israel, Switzerland, etc. We think they could grow if EU prices continue to fall in the coming months.

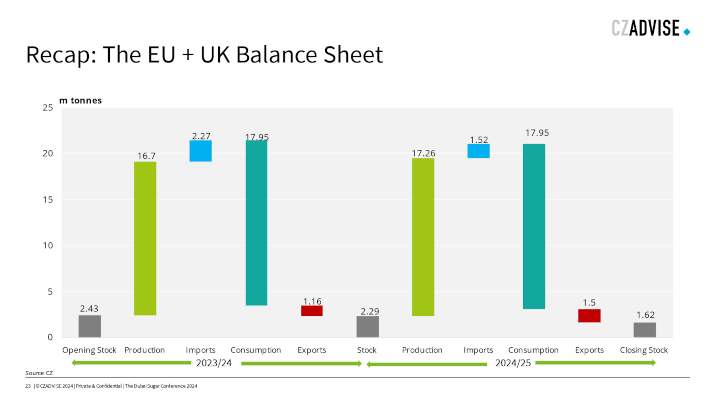

So….to keep in mind ahead of our discussion, here’s a balance sheet to show what we think is happening today.

If European prices fall, imports in 24/25 will decrease and exports will increase, bringing stocks to around 1.6m tonnes. This is a 9% STU, which is at the lower end of normal for Europe.

One final thing to bear in mind when thinking about Europe. Sugar is and always has been a heavily regulated market. Don’t make the mistake of thinking regs have reduced. It’s the opposite. Sector more regulated than ever.

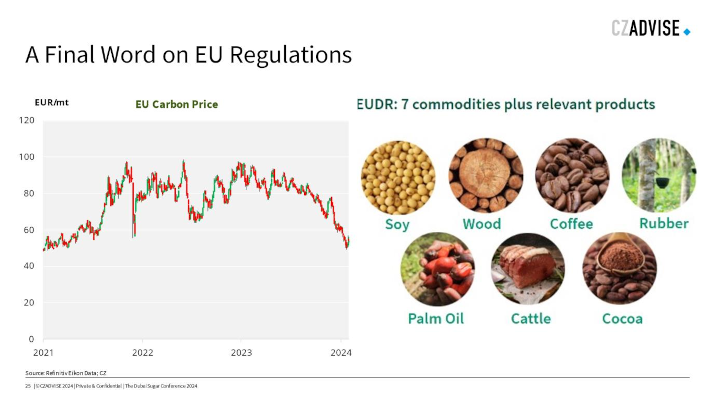

2 quick examples to show the scope of European regulations. They affect everyone in this room. Europe has a cost of carbon. This is applied to major carbon dioxide emitters like the power or steel sectors. That price is around 60 euros per tonne today. One way or another that price will be applied to agriculture and food processing as Europe moves to net zero in the coming decades.

To try to protect its local industries, the EU is applying a carbon border adjustment mechanism to imports. If those imports come from countries with no carbon price then it will be applied through import duty from 2026. It starts with a few sectors like cement and steel, but also including fertilisers. But by 2030 it will cover all products included in the EU Emissions trading scheme.

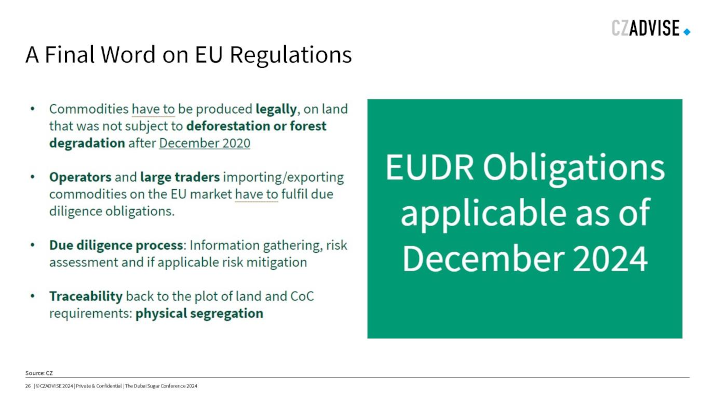

The other regulation you need to know is the EU Deforestation-free Regulation. This is huge – it’s got massive scope and shows the EU is serious about reaching net zero. I think it could be the biggest change for commodities in our generation. It starts next year; importers will need to prove that these 7 commodities, and their derivatives like leather from cattle, come from land that is deforestation-free.

Imports will need to be segregated and the land it was produced on will need to be identified by satellite or drone imagery down to an individual plot. The reporting requirements are huge. Failure to report could lead to a fine of 4% of EU turnover, a 2-year ban on imports and confiscation of goods. Sugar could be added to this as early as 2026.

If you’d like help on how your business can respond to any of these regs, please talk to me, my team can help.

But that’s enough from me. I’ve hit my 10 minutes so thank you for your time and attention.