463 words / 2 minute reading time

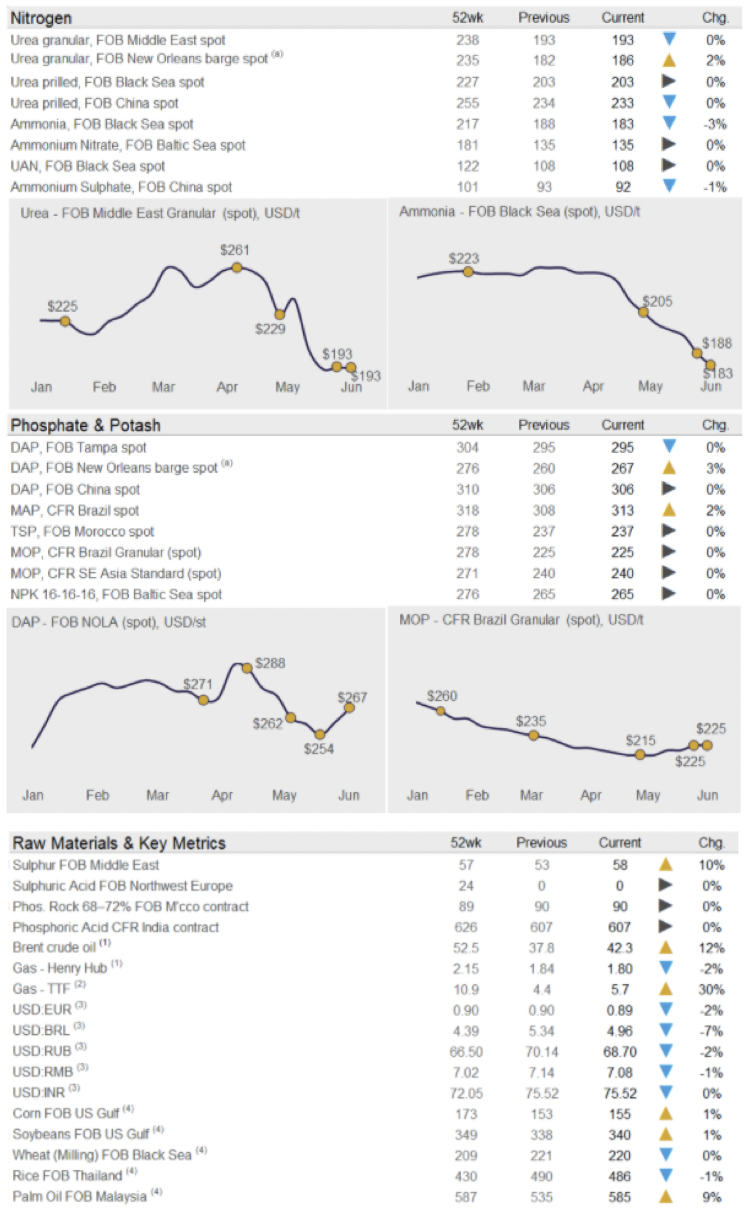

Some Useful Acronyms: Urea and Ammonium Nitrate (UAN), Ammonium Sulfate (AS), Monoammonium Phosphate (MAP), Diammonium Phosphate (DAP), New Orleans, Louisiana (NOLA), Overseas Citizenship of India (OCI).

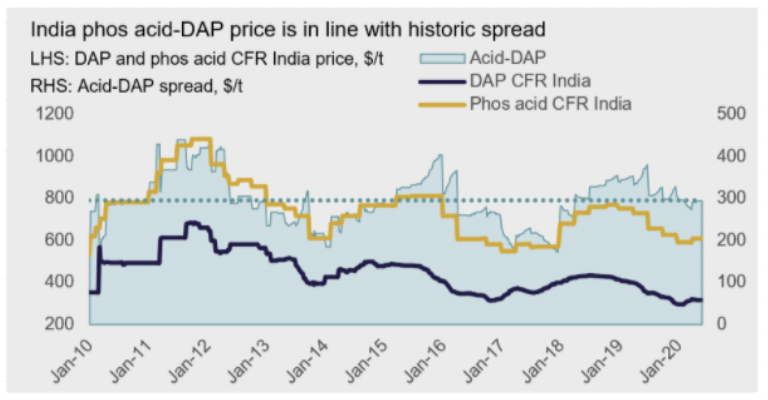

India’s Phosphoric Acid and DAP Price in Line with Historic Spread

Urea

The firmer undertone in the urea market is expected to prevail supported by expectations of an Indian import tender which is expected to be floated this week.

Nitrates and Sulphates

Ammonium nitrate is unlikely to see any significant price development this week while UAN activity at Rouen is expected to remain subdued as French farmers gear up for an early harvest. Ammonium sulphate export activity ex-China is likely to find relief in the Incofe tender closing June 9.

Ammonia

The spread between prices east and west of Suez is set to prevail. Suppliers may seek to take advantage of low priced tonnage in the west and move it east.

Phosphates

Gradually improving demand and limited near-term availability continue to support DAP/MAP prices in the Americas this week with OCP targeting $320/t CFR for MAP in Brazil. Supply/demand balance remains in India as domestic players attempt to push up the DAP Maximum Retail Price.

Potash

Some potash producers are anticipating Indonesia’s Petrokimia Gresik to float a tender for roughly 200-250,000 t MOP this week. Producers are also likely to continue to focus on forward sales to Brazil amid strong demand.

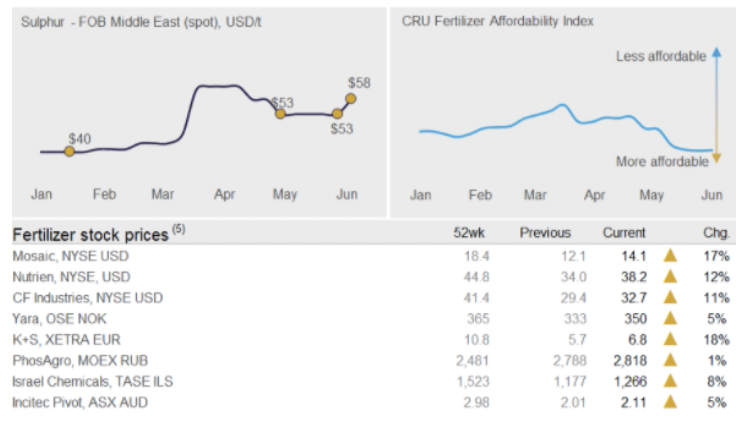

Sulphur

Middle East producers posted slight increases in their official monthly prices for June, last week. The new prices are roughly in line with global delivered prices, even after sentiment in China softened slightly last week after some firming in mid-to-late May. Foskor’s tender for 100,000 t, closing this week, should also be supportive of prices.

Sulphuric Acid

After recovering from their April lows, sulphuric acid prices appear to have hit a wall due to a lack of demand. In most regions, acid prices remain exceptionally attractive when compared with sulphur prices, which should allow for some further price increases. Still, as long as demand from Chile in particular remains effectively non-existent, it will be difficult to push prices up.

About the Data – Current Price Assessment Data (9th June 2020)

52wk = average of past 52 weeks. (a) – US short tonnes. Sources: All fertilizer prices from CRU Fertlizer Week. Energy, stock price and FX rate metrics from the closing Friday of each week, all physical prices on a USD basis. Grain prices as of the Wednesday of each week. CRU Affordability Index calculated based on ratio of CRU fertilizer price index and grain price index. (1) EIA, (2) Powernext, (3) Haver, (4) International Grains Council, (5) company reporting/websites.