541 words / 3 minute reading time

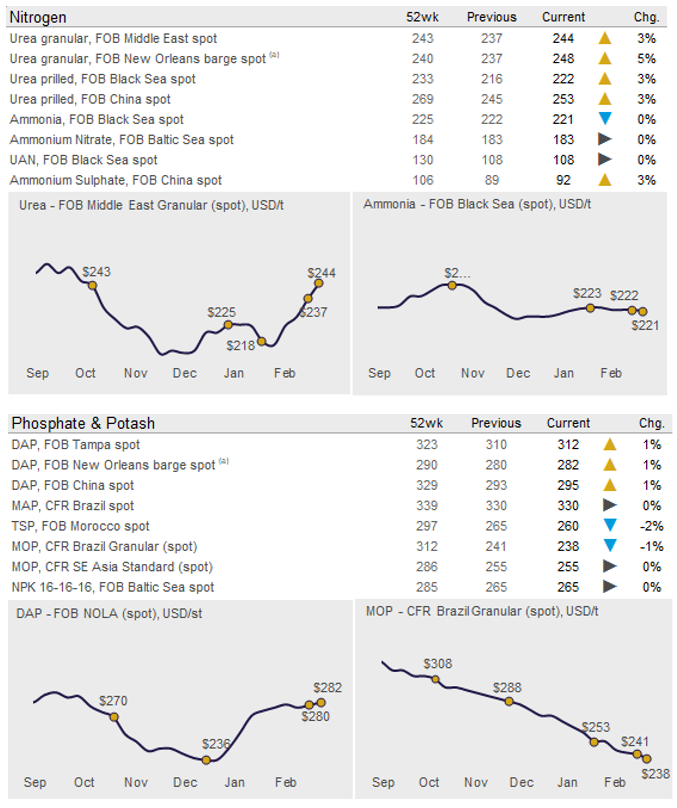

Some Useful Acronyms: Urea and Ammonium Nitrate (UAN), Ammonium Sulfate (AS), Monoammonium Phosphate (MAP), Diammonium Phosphate (DAP).

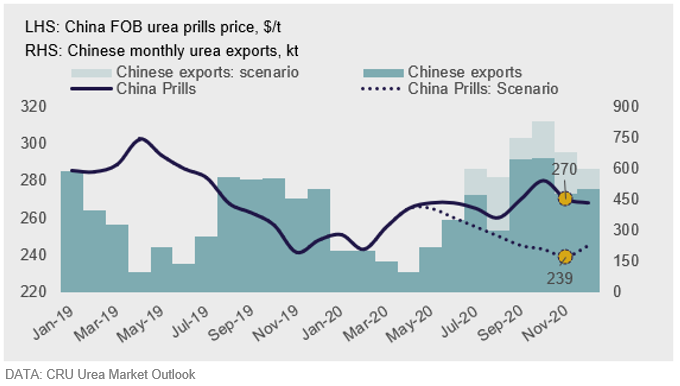

A Slowdown in China Will Raise Urea Exports and Stall Price Recovery in H2 2020

In the February edition of the Urea Market Outlook, published last week, CRU presents a scenario that considers Chinese exports and prices if the impact of Covid-19 on industrial output does not recover in H2 2020. This scenario assumes lower technical urea demand, lower nitrogen feedstock prices and ultimately, a lower marginal production cost of Chinese exports.

Urea

Further firming of granular and prills prices is on the cards with strong demand from the US and Europe, plus an India import tender on the horizon.

Nitrates and Sulphates

UAN is expected to maintain its momentum at Rouen, while European producers and traders are becoming increasingly interested in how UAN performs at NOLA given recent sharp increases in urea and ammonia prices. No significant change in capro AS export availability ex China is expected. Still, increased domestic demand may lead to further price firming.

Ammonia

The flat market will prevail until US spring direct application demand emerges in the coming weeks. Looking slightly softer in the east.

Phosphates

As Mosaic and OCP return to higher production in March, market participants are watching how much further DAP/MAP price recovery can be achieved in the coming weeks.

Potash

Downwards price pressure is expected to extend this week in global potash markets as buyers hold back from committing to spot purchases amid widespread uncertainty over the coronavirus epidemic.

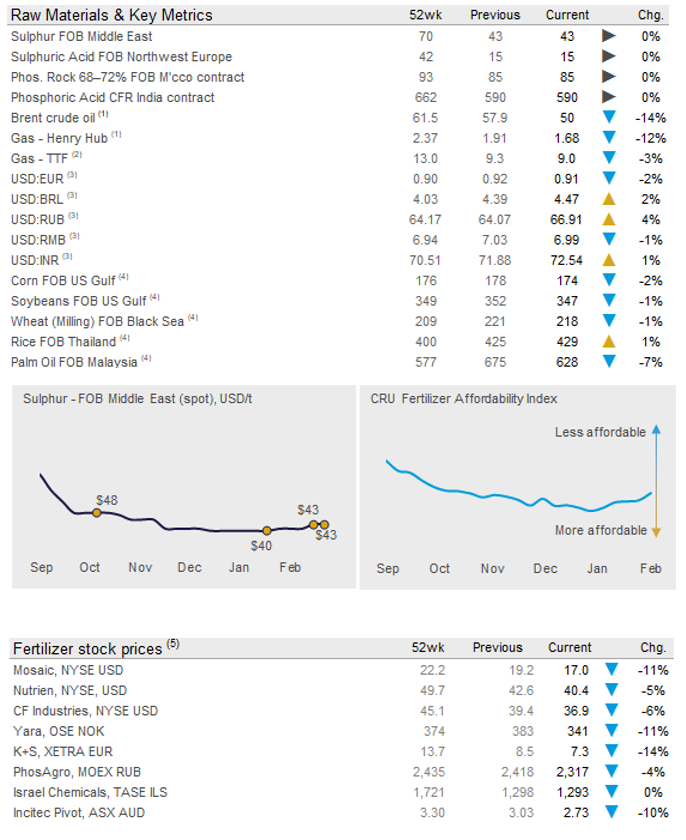

Sulphur

Muntajat’s slight increase of its QSP by $1/t for March demonstrated that producers are cautious about recent slight increases in sulphur prices given fragile fundamentals. Still, tight prompt spot availability combined with increasing fertilizer prices and production ramp-ups west of Suez should lead to firm pricing, at least in the short term. Still, low downstream production and record stock in China will limit any upside, as will impending improved availability.

Sulphuric Acid

Prices have continued falling in recent weeks, particularly in the Pacific market, and sources are waiting to see what price Timac is able to obtain for its current spot requirement to determine whether Atlantic prices are falling further. There is little potential for upside of acid in the short term, with prices more likely to be lower than higher as downstream demand remains weak and sulphur prices remain low. In addition, supply has recovered from last year’s low with a lighter planned maintenance slate and no major unplanned production issues.

About the Data – Current Price Assessment Data (27th January 2020)

52wk = average of past 52 weeks. (a) – US short tonnes. Sources: All fertilizer prices from CRU Fertlizer Week. Energy, stock price and FX rate metrics from the closing Friday of each week, all physical prices on a USD basis. Grain prices as of the Wednesday of each week. CRU Affordability Index calculated based on ratio of CRU fertilizer price index and grain price index. (1) EIA, (2) Powernext, (3) Haver, (4) International Grains Council, (5) company reporting/websites.