Insight Focus

- The first-ever shipment of corn from Brazil to China is underway.

- China had allowed Brazilian shipments after phytosanitary requirements were met.

- This was negative for US Corn as FOB Gulf prices are not competitive.

Forecast

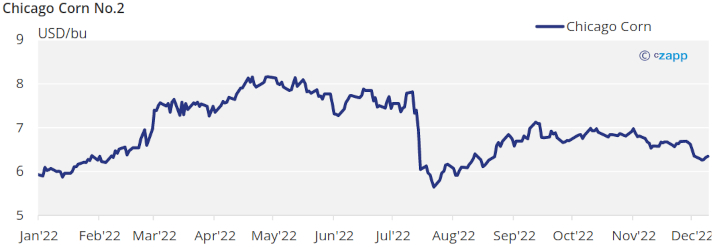

No changes to our Chicago Corn average price forecast for the 22/23 (Sep/Aug) crop in a range of 5,8 to 6,3 USD/bu with an upside bias depending on Ukraine’s harvest and Argentinian conditions. The average price since Sep 1 is running at 6,74 USD/bu.

Market Commentary

Another negative week for all grains in all geographies after a neutral to bearish WASDE and good weather conditions.

Before the publication of the WASDE last Friday, there was finally confirmation of Brazilian Corn being loaded for China which was negative for US Corn as FOB Gulf prices are not competitive for international markets.

The December WASDE left unchanged global Wheat stocks for 22/23 and reduced global Corn stocks by 2,4 mill ton.

On the Corn side, US stocks were revised 75 mill bu higher all coming from lower exports as production and consumption figures were left unchanged within expectations.

Russian production was lowered by 1 mill ton to 14 mill ton, Ukrainian production was lowered by a sizable 4,5 mill ton to 27 mill ton, and EU production was marginally lowered by 600kton to 54,2 mill ton. Overall production fell by 6,53 mill ton partially offset by 4,75 mill ton off less consumption, resulting in 2,36 mill ton of lower global stocks.

Conab in Brazil forecasted Corn production in 22/23 at 125,8 mill ton slightly below their previous forecast of 126,4 mill ton and vs. the WASDE estimate of 126 mill ton. This is vs. 112,8 mill ton produced last year.

On the Wheat front, US figures were left unchanged. Global production was reduced in Argentina by 3 mill ton to 12,5 mill ton, increased in Australia by 2,1 mill ton to 36,6 mill ton and reduced in Canada by 1,2 mill ton to 33,8 mill ton. Global production was reduced by 2 mill ton which was offset by lower consumption of 1,64 mill ton leaving ending stocks virtually unchanged. Interesting once more is that the WASDE continued stubborn with Russian production of 91 mill ton vs. the 105 mill ton officially published by Russian authorities which we think is what is priced in.

Corn harvesting in Ukraine is 66% complete and yield continues low showing 6,2 ton/ha or -17% year on year. Corn harvesting in Russia is 70% complete and yields are up by 7,4% yoy. Corn planting in Argentina made good progress and is now 32,7% complete but still below 38% planted last year while condition has also improved four percentual points to 18% good or excellent condition. First Corn crop planting in Brazil was 71,2% complete vs. 77,9% last year.

In the Wheat front, Australia revised their production forecast higher again to 36,6 mill ton due to better yields, very close to their all time high. This put pressure on Wheat prices at the beginning of last week.

In Russia, Wheat is going into the dormant phase due to freezing temperatures. French Wheat is fully planted and is 97% in good or excellent condition.

In the weather front, rains are expected in the US and also in Brazil. Europe is also expected to receive rains and snow.

The trade flow out of Ukraine has slowed down a bit but simply due to weather difficulties and not due to the conflict.

The WASDE was somehow a non-event and despite the downward revision to Ukrainian Corn production, that number was already priced in we think. Also the absence of a real Wheat production number in Russia somehow invalidates the global Wheat S&D projection of the December WASDE.

We think the risks are around Corn harvesting pace in Ukraine and Wheat quality in Europe. Ukraine’s Corn harvest is running very slow and freezing temperatures will make it difficult to complete. European Wheat is inperfect condition but has not developed frost tolerance due to a mild autumn and freezing temperatures arriving could result in some winter killing.

We think the price correction seen in the last two weeks have already reflected the new supply picture and the focus turns to Ukraine and European Wheat. Expect prices to remain rangebound.