- After a decade of falling prices, many commodities have strengthened in 2021.

- With this, we’ve seen staple food prices surge in some countries.

- This has hit poorer countries the hardest, but Governments are taking action.

Food Prices Rising with Commodity Boom?

- After a decade of falling prices, many commodities have strengthened in the past year.

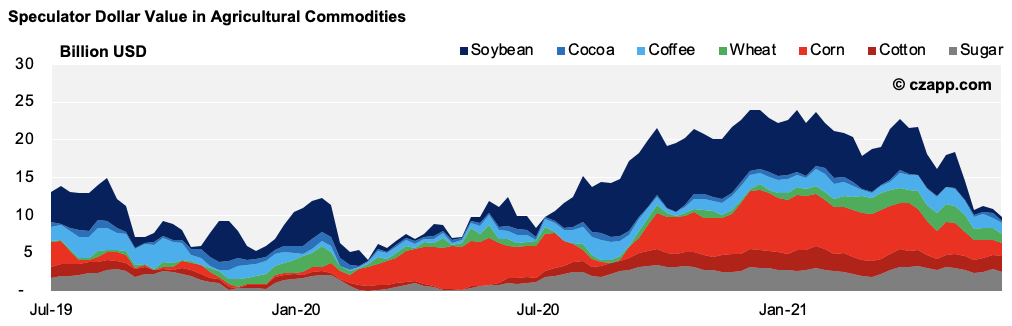

- Widespread reports of a “commodity boom” have driven food prices higher as speculators quickly enter commodities.

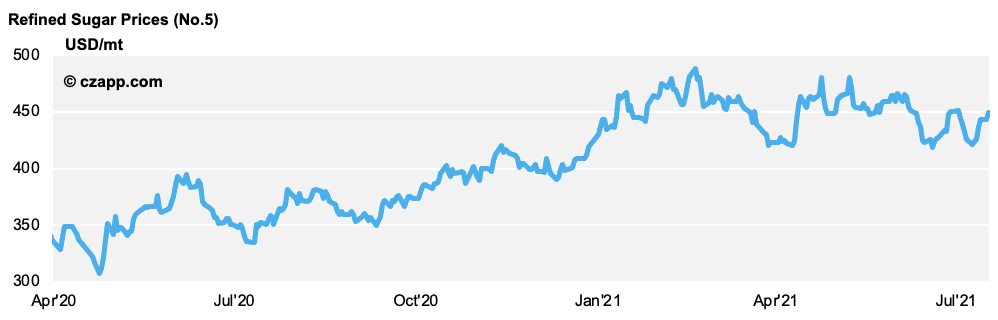

- As it stands, corn and soybean are up 70% year-on-year, and refined sugar prices have increased from 300 USD/mt to 450 USD/mt since Apr’20.

- These price hikes have been exacerbated by the global container shortage and high freight costs.

- Many are now worried that food is becoming more expensive.

Where’s Been Hit the Hardest?

- Developing countries have felt the brunt of this as they tend to spend a high proportion of income on staple foods.

- Sugar is a key food source, especially in poorer areas, meaning price increases here can have serious social consequences.

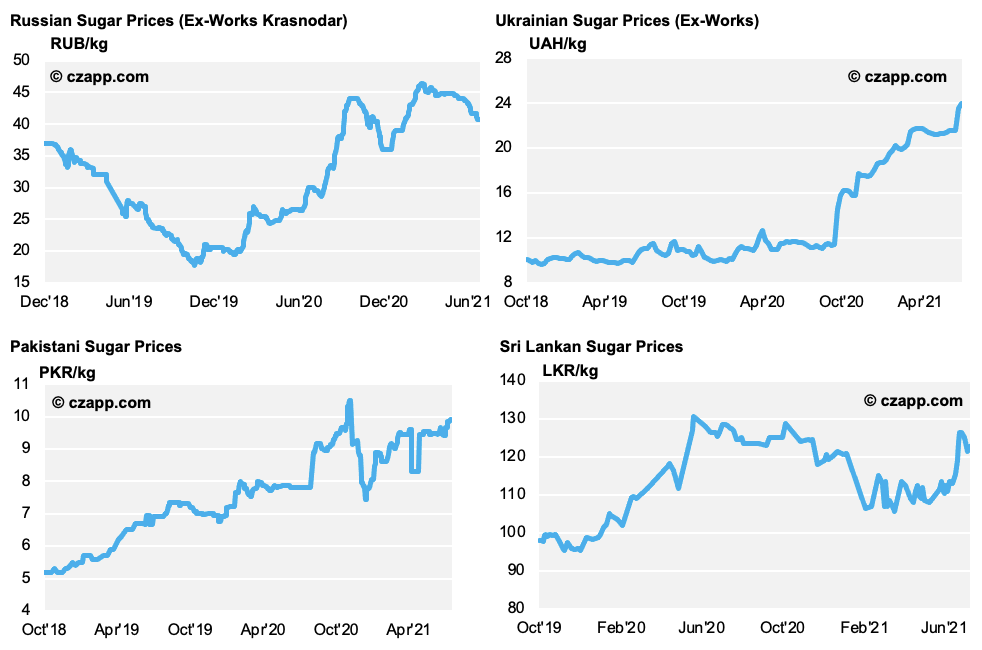

- This is concerning as Russian, Ukrainian, Pakistani and Sri Lankan sugar prices have risen dramatically in the last year.

- In many cases, imports have been challenging and expensive due to the logistical disruption seen around the world which has made matters worse.

- Some governments have also been reluctant to waive large import duties designed to protect the domestic sugar industry.

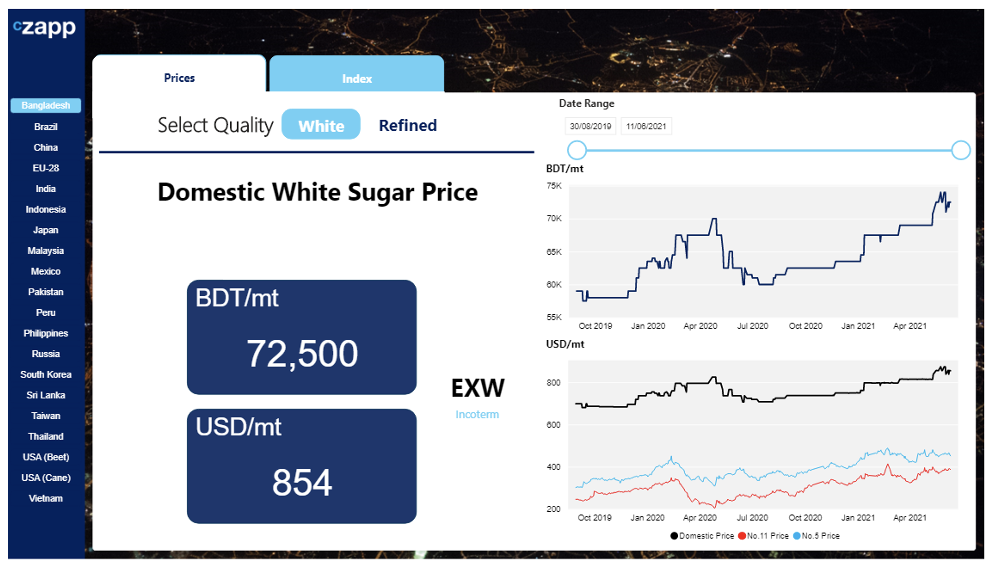

- But it’s not just these countries that have been affected: we’ve heard reports that Ivory Coast’s sugar prices have jumped 52% this year, and prices in Bangladesh have also been on the rise.

You Can Monitor Domestic Sugar Prices in the Interactive Data Section

How Are These Countries Responding?

- Back in December, the Government and producers agreed to freeze sugar prices at 36 RUB/kg (496 USD/mt) wholesale and 46 RUB/kg (634 USD/mt) retail.

- The Government’s also looking to set up a sugar buffer stock system to stockpile up to 500k tonnes of sugar.

- Prices are now under control and the Government’s running a duty-free white sugar import programme between 5th May and 30th September to keep it this way (they normally incur a 340 USD/mt duty).

- White sugar imports were chosen as they can quickly ease supply shortages.

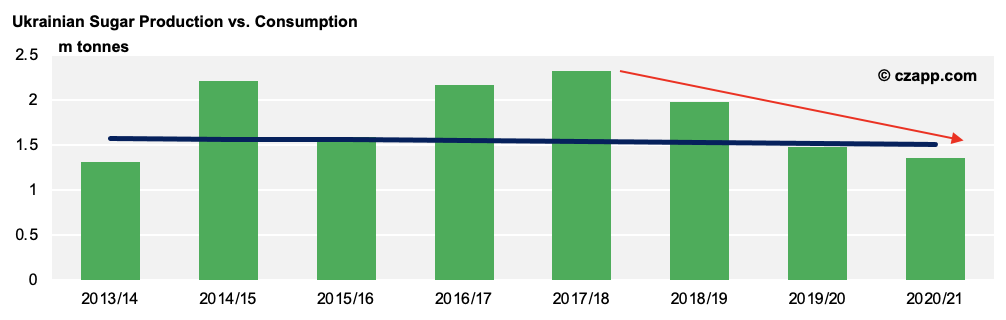

- Ukrainian sugar stocks have been declining for the past two seasons.

- Low world and domestic sugar prices left little incentive for farmers to grow beet, meaning its area declined quite significantly.

- Ukraine can import up to 260k tonnes of raw sugar each season, incurring just 2% duty.

- However, it’s a slow process as there are just two factories capable of refining raw sugar.

- Even so, the Government recently rejected a 60k tonne duty-free white sugar import proposal, leaving the 50% duty in place.

- It’s instead encouraging producers and consumers to agree on prices ahead of the next crop.

- In Pakistan, the mills and traders have been accused of stockpiling to try to take advantage of higher prices.

- The Government’s therefore introduced measures to better monitor the mills’ production and sales to prevent hoarding.

- Sugar smuggling from Pakistan into Afghanistan has further reduced stocks of sugar within Pakistan.

- Earlier in the year, the Government approved a 500k tonne duty-free white sugar import programme, but it’s been very difficult to secure this sugar (several tenders have failed, most likely because the price offered was too high).

- Lastly, in Sri Lanka, the Government’s introducing measures to curb rising prices and prevent living costs from climbing too high.

- These measures include setting maximum prices and rationing some essential food products.

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…