Insight Focus

Germany cancelled 12.3 million EUAs from the 2025-2030 auction reserve due to the closure of two coal plants. While cancellation is voluntary for EU member states, further removals could add to market tightness after 2027.

Germany Cancels EUAs

Germany will voluntarily cancel 12.3 million EU carbon allowances between 2025 and 2030 to reflect the permanent closure of two coal-fired power plants, the European Commission reported last week.

The cancellations are the first such reduction in EU Allowance supply under a new regime that allows EU member states to reduce EUA supply as more coal units are closed and demand falls. According to one estimate, as many as 2 billion surplus EUAs could be generated through these closures.

The process is entirely voluntary. The EU regulation “provides the possibility for, and strongly encourages Member States to cancel allowances from their auction volumes in the event of closure of electricity generation capacity in their territory.”

Equally, countries that choose not to cancel EUAs after the plant closures are required to notify the Commission of their reasons.

Closures Account for 25 Million Tonnes

According to the Commission document, the cancellations have been made after RWE shut one unit representing about 13% of capacity at its Neurath plant in April 2022, followed by its Frechen unit in December 2022. The entire Neurath facility reported emissions of more than 24 million tonnes in 2022 while Frechen reported just under 1 million tonnes.

The cancelled allowances have already been transferred into the Market Stability Reserve, so no adjustments will be needed to future supply, but other countries are expected to make similar adjustments as more coal plants are shut.

The power sector receives no allowances free of charge under the EU ETS, and utilities are required to buy the necessary EUAs either in daily auctions or in the secondary market.

The total number of EUAs sold at auction each year is calibrated to reflect the likely demand from power generators and those industrials that receive less than 100% of their emissions in freely allocated allowances.

Coal Phases Out

According to analysis by the Beyond Fossil Fuels project, 23 European states (including the UK) have committed to phase out coal by the end of this decade, while 10 have never generated power using coal. Bulgaria, Romania, Croatia, Czechia and Slovenia have all set deadlines for after 2030, while neighbouring countries Kosovo and Turkey have not set any end date for the use of coal.

A study by the Carbon Market Watch group in 2019 found that coal plant closures between 2021 and 2030 could generate more than 2 billion surplus EUAs in the market unless member states cancel these EUAs from their auction reserves.

Electricity generated by burning fossil fuels fell by 21% in 2023, after two years of single digit increases amid the energy supply crisis triggered by Russia’s invasion of Ukraine. Over the same three-year period renewable energy output has climbed by more than 10%.

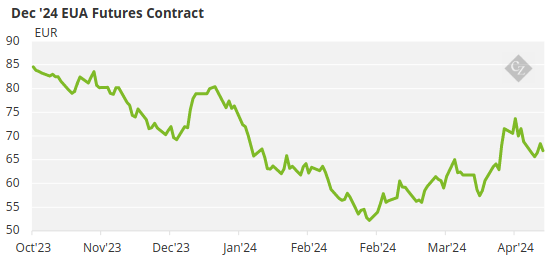

Market participants say that the speed at which fossil electricity has shrunk has taken the market by surprise and was a key factor in the nearly 50% slump in allowance prices, along with a drop in industrial demand for power.

MSR Removes Excess Supply

The rapid drop in fossil demand means the Market Stability Reserve will continue to operate through to 2030, analysts predict, as it continues to soak up excess supply.

This year’s MSR withdrawal is likely to be a little more than 200 million tonnes, the smallest cut since the mechanism launched in 2019, but it will be larger in future years as the system eats into the additional supply generated by the REPowerEU initiative.

But further voluntary EUA cancellations could help drain the oversupply over time – although it’s a question of both if, and when, national governments make the commitment to cut supply.

Conversely, they might choose to wait until late in the decade, to ensure that there has been sufficient supply for industry in the run-up to 2030, yet potentially draining the market of auction supply when it’s most needed.

Analysts expect supply to tighten significantly from 2027 as the REPowerEU programme comes to an end. Member states have brought forward auction volumes that were scheduled for sale in 2027-2030, slashing supply by more than 250 million EUAs in the last four years of the current phase.