Insight Focus

- Russia has suggested they could limit corn exports to avoid low stocks.

- But otherwise corn and wheat feel well-supplied.

- Russia has also harvested an all-time record amount of wheat.

Forecast

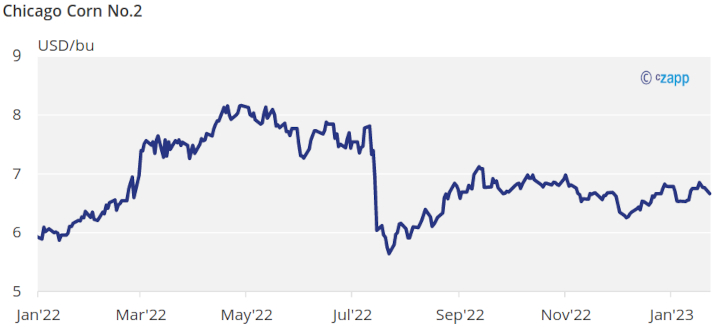

No changes to our Chicago Corn average price forecast for the 22/23 (Sep/Aug) crop in a range of 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,7 USD/bu.

Market Commentary

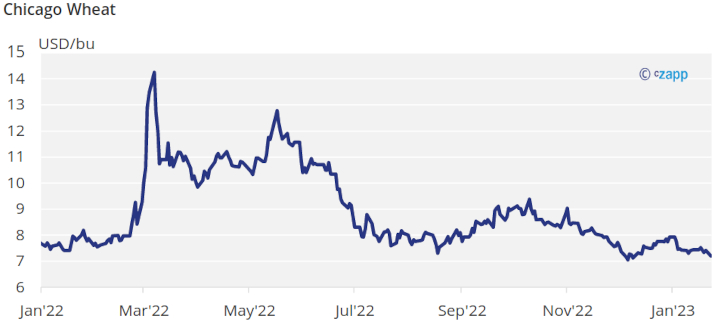

Flat week for Corn in Chicago while negative week in the rest geographies including Wheat which starts to feel a heavier supply picture.

All the gains in Chicago Corn happened last Tuesday coinciding with Russia suggesting they could limit exports aiming to avoid a low level of stocks. But the market corrected during the rest of the week on profit taking after the WASDE rally and also pressed by fear of low Chinese demand and good Wheat supply.

Corn harvesting in Ukraine is 87% complete with 24,4 mill ton harvested vs. 27 of the Jan WASDE and 42 mill ton produced last crop. Corn planting in Argentina is 88,6% complete and conditions stand at a poor 5% good or excellent falling two percentual points in the week. First Corn crop planting in Brazil is 91,9% complete vs. 93,8% last year. Russia’s Corn production was 11,78 mill ton vs. 15,2 last year. But the Wheat crop was an all-time record -see below. This took Russia to suggest they may limit exports to maintain stock levels, which fueled prices in Chicago.

BAGE in Argentina reduced their Corn production forecast to 44,5 mill ton or 7,5 mill ton lower than their previous forecast of 52 mill ton which is also the same number of the latest WASDE.

In terms of trade flow, Chinese stats showed they imported 27,3% less Corn in 2022 vs. 2021 due to lower demand. The big question now is how much Corn will China import during 2023 if the economy rebounds thanks to mobility restrictions being lifted.

On the Wheat front, European Wheat values continued to fall last week on the back of ample supply as advanced in last week’s report. But US futures had a mild weekly fall thanks to a Friday rally on the back of better than expected export data.

Russia officially published their final Wheat production number of 104,44 mill ton, an all time record. This is +27,2% year on year and vs. 91 mill ton of the last WASDE which inexplicably is not updating their production number.

Egypt announced last week they will cut wheat imports by 5% this year not helping price action last week. And France AgriMer increased their Wheat export forecast somehow suggesting a big crop is coming.

The Indian government is projecting production of 117 mill ton vs. 103 of the latest WASDE. This means the WASDE is missing a sizable volume: 14 mill ton from India and 13,4 mill ton from Russia.

In the weather front, favorable weather is expected in Argentina and Brazil with rains expected across the agricultural areas. US weather should see snow and rains in the Plains and the Corn belt, and similar weather is expected in Europe. Once more the focal point will be on potential winter killing in Europe as temperatures have fallen significantly and Wheat has not been able to develop cold protection.

Grain exports out of Ukraine rallied 25% week on week somehow lifting concerns that trade flow out of the Black Sea is restricted.

The big picture is that grain stocks are flat year on year but with a combination of a Corn stock draw of some 9,5 mill ton vs. a Wheat stock build of some 28 mill ton, with the rest of the draw coming from other grains. The bulk of the stock draw in Corn is coming from lower US production, which should be supportive prices in Chicago. EU production is also lower, but prices were also reflecting limited supply out of Ukraine and that has been solved already. The downside pressure can come from ample Wheat supply, but a big part of it is in Russia and their export flow should be difficult due to sanctions.