Insight Focus

- Brazilian soybean harvest slow at 15.4% done vs 25% last year.

- Brazil first corn crop at 11% vs 17.5% last year.

- Argentine rains not sufficient for good corn development.

Forecast

No changes to our Chicago Corn average price forecast for the 22/23 (Sep/Aug) crop in a range of 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,7 USD/bu.

Market Commentary

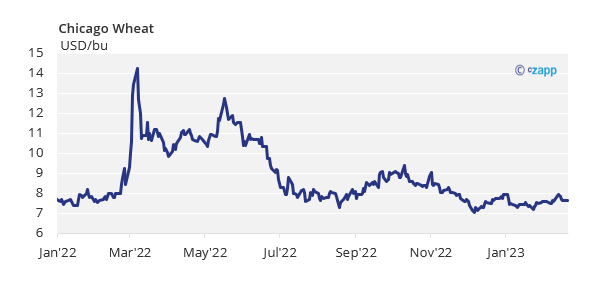

Further consolidation of the range with a negative week for Wheat on some profit taking after the rally of the previous week. The focus is on south American weather.

Last week started with a rally and then a pullback through the end of the week. There was good progress in Brazil’s planting pace which even still below last year’s, the weekly progress caught up with part of the delay and we think was part of the downward pressure in Chicago.

The strength at the beginning of the weeks could have been attributable to uncertainties around the grains corridor out of Ukraine, but the reality is that flow continues to work.

Argentinian production was lowered by 2 mill ton to 45 mill ton by the local office of the USDA just a week after the WASDE. This is more in line with estimates in a range of 42,5 and 44 mill ton but BCR said last week conditions may deteriorate as rains have not been sufficient. BAGE lowered Corn condition by a massive 9% last week to just 11%.

In Brazil, the Soybean harvest continues to run slow with just 15,4% complete vs. 25% last year. The second corn crop is 20,4% planted vs. 35,1% last year. First Corn crop is 11% harvested vs. 17,5% last year.

In the Wheat front, Russian exports have slowed down due to bad weather as published last Friday sending European prices higher, but still making a negative week.

Weather is expected to dry up in southern Europe, with northern Europe expected to be colder and rainy. The risk comes to the dry conditions in the south of France. Argentina is also expected to dry up which will not help to improve Corn condition, but rains in Brazil are forecast to continue which may continue to delay Soybean harvesting operations and safrinha Corn planting. US Weather, both Wheat and Corn areas are expected to receive stormy weather.

The IGC reduced its global grain production forecast by 8 mill ton for the 22/23 crop and most of it due to lower Corn production in the US and Argentina, nothing that the WASDE had not already considered and the market has priced in.

The export flow out of Ukraine may improve thanks to an increase in the depth of a canal that links the Danube with the Black Sea. This is seen as an alternative to a potential no extension of the actual grain corridor agreement between Ukraine, Russia, Turkey and the UN.

The market continues to consolidate and trade in a range of 6,5 to 6,9 USD/bu for Chicago Corn with some more volatility in European grains mostly due to the impact of the war in Ukraine.

We expect further consolidation of the actual range with the focus continuing to be south American weather which would be an upside risk: Corn condition in Argentina could worsen given dry weather is back, and Corn planting in Brazil could be further delayed as it continues to rain. We don’t see any major downside risk.